I don’t consider myself a big spender. I only shop for myself once or twice a year and I like to take my time searching for sales and reading reviews before I buy things. I like to save and use more of my disposable income on experiences and travel instead of on trendy clothes, accessories, gadgets, and stuff that ends up becoming clutter. When I first graduated college though I was the complete opposite! Not only did I make less money then, I was rather careless with my money and often went into debt buying things I didn’t need.

Hole In My Pocket

About a week ago when I was cleaning my closet, I realized it’d been a while since I bought new clothes for myself. I discovered the lining in my winter coat had completely ripped through all the repairs I had sewn in it last year and the fabric was falling to pieces. One of the pockets even had a huge hole in it, so I decided it was time to start searching for a new one.

Some people are happier paying more money to have top quality items, but I’ve got a bargain shopper mentality engrained in me now that I can’t seem to shake. I’d rather pay $50 for a coat that does the job and has 2-3 years in it, versus pay $300 for a top of the line parka that has 5-10 years in it. Spending less just feels better.

Using Sales To Get Stuff You Actually Need

After deciding to spend some money on myself on Black Friday this year, I was determined to find the best bargains. It felt weird shopping for myself since I normally put my extra money in my travel fund or retirement savings, but I did well finding some good sales. I got a hooded winter coat for $45, two collared work shirts for $15 each, and black knee high socks for $2. Nothing exciting, but it feels good to get practical stuff, especially when it’s cheap!

Where Does All My Money Go?

Thinking past what I bought, I got to wondering: where does all my money go? Even though I knew I hadn’t spent much money on myself this year I wanted to see what my spending habits really looked like on paper. Normally I request an annual summary from my credit card company in January, which shows a breakdown of what I charged for the year. But feeling too impatient to wait another month and a half for that report, I started digging around my online banking account for some insights.

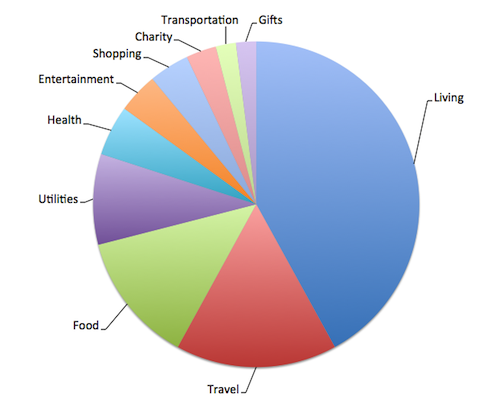

To my delight, I discovered my bank has automated reports now that show how my spending breaks down by category across all my accounts. Being able to see transactions from my checking, savings, and credit card accounts together was the type of data I was seeking to answer my question, where does all my money go? However I noticed that the auto generated reports didn’t classify any of my check payments, and some of the category percentages looked off, so I found a way to export the raw data into Excel. Then I corrected the entries the bank had blank or classified wrong, and created my own pie chart.

This is what my results look like year to date:

Easy to understand and pretty cool to see as a pie chart right? Even though I use spreadsheets to put together my budget every year, this was the first time I’d ever seen how my spending breaks down visually. Like most folks, I spend the most on living expenses. Travel is my second largest, which I’m not too surprised by since I took several trips this year including my recent adventure to Istanbul. I have to save a lot of money in order to take trips, but it’s what I love to do and I want to travel while I’m still young and without kids.

Food is a big expense but an important one, and utilities are a pain but a necessity. I’m thankful that I’ve been healthy this year, and that most of my spending there has been for preventative and personal care. I didn’t spend much on concert tickets and such this year so my entertainment portion is pretty small and I’m glad to see my personal shopping spending is low too. I think my charitable giving seems reasonable and I save a lot by using public transportation year round which feels great. And since I got an early start on my holiday shopping buying presents in Istanbul, I don’t anticipate the gifts category to increase by much in December. Overall, I think my spending chart looks pretty good!

Make The Most Of Your Break Down

If you make the effort to analyze your own spending, you’ll easily be able to answer the question, where does all my money go? You could be quite surprised by your own data. I plan on going through this exercise at least once a year to help keep my budget and goals in check and encourage you to do the same. Remember you’re never too young to start taking a proactive approach to personal finance! Get curious about your spending and set some financial goals right now while it’s fresh in your mind.

Untemplaters, when was the last time you analyzed your spending in categories? So where does all your money go?

I’m glad that banks are offering that tracking now. I use Mint and have used Quicken, and both track spending very well! I’m with you, in that the bulk of my money goes to living expenses.

My biggest discretionary item comes from eating at restaurants. That’s one area in which I could easily cut more. I’m cutting back a bit for health reasons, really. Much easier to eat a balanced, nutritious, healthy diet cooking at home. That said, we all have our entertainment and splurges, so the financial part isn’t a huge deal.

Generally speaking, tracking one’s expenses and knowing where money goes helps keep the focus on needs first and wants second. Some wants are ok 🙂

Eating at home saves a lot so that’s good you’re looking to do more of that. I try to cook at least once on the weekends but weekdays are hard for me. I order take out a lot to save time from all the prep and cleaning involved with cooking so I try to stick to healthy menus when I order. It can be hard to resist the less healthy but super delicious choices though!

Holes in your jacket pockets can have a silver lining… literally. I’ve found quarters and dimes that dropped through, and ended up between the lining and the outer layer.

It would have been nice to find some $20 bills in there but no luck this time for me. I did find a twenty in the pocket of a coat I seldom wear earlier this year though, that was sweet!! 🙂

Nice pie chart. Images make blow-outs really pop. I would be looking for ways to shrink the utilities portion, and throw it all into travel!

Yeah the cost of utilities bites. I’m better at turning the water off while I scrub dishes now though and use the scheduler on the thermostat so I don’t forget to turn it off at night or when I go to work. I should try lowering the temperature by a degree or two and see if that helps the gas bill go down a little. Even little savings add up!

“I’d rather pay $50 for a coat that does the job and has 2-3 years in it, versus pay $300 for a top of the line parka that has 5-10 years in it.”

That is exactly my buying philosophy. I know people who use the “quality” rational to buy expensive clothes, but do they really wear it for 10 years? I doubt it.

My spending is all over the place. It’s very difficult to keep track of, but I think I’ll try breaking it down into category like you did for 2012.

I know! I hope I’m the same size in 5-10 years but who knows right? Doesn’t feel right spending double or tripple the price when the probability of wearing something that far out in the future is so uncertain. Maybe I’ll be living in the tropics in 10 years and not even need a winter coat! 🙂

Yes, I’m a big pie chart fan myself! It’s a good way to see where it all goes.

I have to admit, when you started talking about the holes in your pockets I thought you were going to say that a bunch of change went into the liner…

Haha I keep coins inside my wallet almost all the time so no jingle in the liner for me. My keys did fall in there though and gave me a good scare though!

I’ve had holes in my jackets where I found money fall out! Glad you found a new one before that happened!

Cool looking chart. I like the Travel pie slice. What is your ideal percentage for living, travel, food and entertainment you think?

Thanks, I am really loving my new coat! I think my ideal chart would prolly have 10% less in living and utilities costs each with 15% of that added to my existing travel spending and the other 5% to entertainment. I save a lot on utilities in the summer since there’s no need for AC in SF but it’s hard to cut heating costs in winter though. I’m always freezing at the office so I like to be warm at home!

My credit card statement too provides this nice pie chart on where the money goes. I was quite surprised actually!

Small purchases quickly add up.

They really do add up. I’m starting to track how much cash I go through a week on lunches and such now too because cash esp can disappear quick!

When I first got married I tracked every expense in an excel spreadsheet that I put together. It provided both high-level and detailed views. Very helpful, if time-consuming. This provided a base knowledge that I was able to build on and know when I started spending more than I should in various categories.

It’s been a few months since I’ve looked in detail at my spending, though, so it is definitely time to take a look. I hadn’t thought about looking at the bank’s site to see if they have any sort of break-down. I certainly hope so, as that will save me some time.

Thanks for the reminder!

I’ll continue to use my spreadsheets but charts are so much cooler! 🙂 If your bank doesn’t have reports now keep checking back every few months because with more banks advertising these free services the rest will have to follow suit to stay competitive.