Before I started a business, I’d never heard about estimated taxes. Oh how I miss those days. Now, every time I’m writing checks to the IRS and Franchise Tax Board, I have a scowl on my face. But trust me on this –> if you want to be an entrepreneur – innocence about taxes isn’t bliss; it’s costly!

Before I started a business, I’d never heard about estimated taxes. Oh how I miss those days. Now, every time I’m writing checks to the IRS and Franchise Tax Board, I have a scowl on my face. But trust me on this –> if you want to be an entrepreneur – innocence about taxes isn’t bliss; it’s costly!

Now before I get into the basics of estimated taxes, I’ll tell you right off the bat that I’m not an accountant, nor am I a tax expert. And like most of you, I have always dreaded filing tax returns.

Besides cringing at how much I have to pay in taxes, I get so frustrated at how complicated the tax system is in the US. And each year it seems to get worse, not better. I was even doubled over with back pain from stress one year over filing taxes and was almost ready to shut down my small business, but I pushed through.

Knowledge really is power. If you’re thinking about becoming an entrepreneur and starting your own business, understanding your responsibilities as a tax payer is vital. Avoiding unnecessary penalties and fees can make a big difference on your bottom line. So what are estimated taxes anyway? Let’s dive in.

What Are Estimated Taxes?

Estimated taxes are required quarterly federal tax payments for certain individuals and businesses, ex. independent contractors and sole proprietors, who are earning income that isn’t subject to withholding. Certain states like California also require estimated taxes to be paid throughout the year. In California they are due three times a year.

Examples of income not subject to withholding:

- Self employment

- Stock dividends

- Investment income

- Interest payments

- Rental income

- Capital gains

- Prize money

- Royalties

- Alimony

The very basic rules for who has to file estimated taxes are:

–> C Corporations who expect to owe $500 or more in taxes for the year

–> Sole proprietors, S Corp shareholders, partners, and self-employed individuals who expect to owe $1,000 or more in taxes for the year

Estimated Taxes…Say Whaaaat?

If after reading the above you’re thinking to yourself, say whaaaat, don’t panic. I was totally confused when I first tried to understand what estimated taxes are too. It’s really not as complicated as you may think.

Let’s break things down. First of all you need to understand what is tax withholding? Withholding refers to those nasty taxes that are automatically deducted from your paycheck before any cash hits your bank account.

If you look at a typical W2 employee pay stub, you’ll notice debited line items for federal income tax, social security tax, and medicare tax.

If you work in California, you’ll also see state income tax as well as unemployment and disability taxes coming out. All of these payments that are being made and taken out of your gross salary are withholding taxes – they are being withheld from your paycheck.

Trust Issues And The Bottomless Pit

You see, the government doesn’t trust us to save enough money to pay all of these required taxes at the end of the year. Thus, these tax payments are withheld from each paycheck and delivered to the government’s bottomless pit bank accounts every time we get paid by an employer.

The government has its own obligations after all, and they need money coming in throughout the year to keep their programs running.

Since there are many types of income that are not subject to withholding (see above examples), the government makes sure it will get its greedy little hands on the taxes you’ll owe from those types of income streams via quarterly estimated tax payments.

If you’ll owe zero taxes for a fiscal year, however, you’re off the hook for estimated taxes! Same goes if you expect your federal withholding to cover 90% or more of the total taxes you will owe for the active year (if you’re a fisherman or farmer this drops down to roughly 67%.)

Or, if this year you anticipate you will withhold 100% of the tax you paid last year, you also don’t have to worry about paying estimated taxes. Yippee for you!

Note: You have the ability to adjust the amount of tax withholding up or down on your paychecks by giving HR an updated W-4 form. If you work for yourself, adjust your withholding rate in your payroll software. It’s a good idea to regularly update your withholding allowance if you’ve had a change in personal exemptions such as marital status or number of dependents.

Yikes, I Have To Pay! When Are Estimated Taxes Due?

Federal estimated taxes are due:

- April 15th

- June 15th

- September 15th

- January 15th

There may be slight deviations by a day or two in some years if the 15th falls on a weekend. Any additional Federal taxes owed will be due when you file your annual tax return by the following April 15th.

Don’t forget to check your state for its specific estimated tax deadlines if required.

I know this can be confusing so here’s a simple example:

For the tax year 2019 you will submit 4 estimated tax payments by 4/15/19, 6/17/19, 9/16/19, and 1/15/20.

Then, in 1st Quarter of 2020 when you complete your return for the tax year 2019, you’ll find out if the 4 estimated tax payments you made plus any withholding you paid in 2019 sufficiently covered your total tax liability for the tax year 2019 or not.

If it turns out you owe more money than you paid during the 2019 year, you’ll need to pay that difference by 4/15/20.

Corporations that have a fiscal year end other than 12/31 have to pay by the fifteenth day of their 4th, 6th, 9th, and 12th month.

So How Do I Pay Estimated Taxes?

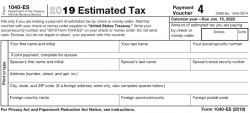

Federal estimated taxes should be submitted with Form 1040-ES. You can send the form along with your payment in the mail or pay using the EFTPS (Electronic Federal Tax Payment System). I highly recommend using EFTPS.

Corporations are required to pay using EFTPS or through a qualified 3rd party.

Note – if this is the first time you’re using EFTPS, don’t wait until the last minute! It takes at least a week to get a PIN in the mail after you register with EFTPS online and you won’t be able to use the system until you get this PIN in the mail. I found this out the hard way.

And I know how annoying it is, but don’t forget that states which require estimated taxes will have their own separate forms. In California it’s Form 540-ES for Individuals and 100-ES for Corporations.

Figuring Out How Much To Pay

One of the most annoying and frustrating things about estimated taxes is there is no perfect way to figure out exactly how much you should pay.

After all we don’t know what income we’ll be making in the future right?! But the government doesn’t take “I don’t know how much income I’ll make” as an excuse to get out of paying estimated taxes. And we all know nothing is certain but death and taxes!

If you overpay, you’ll get a refund when you file your tax return so don’t worry – your money won’t be lost. If you under pay, you’ll make up the difference when you file your tax return and there will may be some interest and fees tacked on. I’ve underpaid and overpaid in different years and fortunately wasn’t hit with any major penalties in the years I underpaid.

What Is The Safe Harbor Rule?

The easiest and safest way to figure out how much to pay, which my accountant suggested to me, is to use the safe harbor rule. The safe harbor rule protects you from underpayment penalties if you pay 100% or greater of your total taxes from your prior year tax return.

But if your adjusted gross income was $150,000 or greater last year ($75k for married and filing separate), this jumps to 110%. I know, it’s lame. But you are also protected by the safe harbor rule if you pay 90% or more of the actual tax liability of the current year, but that can be a lot harder to get right, especially if your income stream fluctuates.

If you pay more than you need to in estimated taxes, you’ll get a refund when you file your return but you will have also taken a hit in cash flow and given the government a “free loan.” Most accountants will advise you to estimate your tax liabilities as close as you can or just follow the safe harbor rule to avoid having to pay penalties.

Avoid Paying Penalties!

I’m not going to go into detail on how the government calculates late and underpayment penalties as the language makes me go cross-eyed. My accountant couldn’t even explain all the rules to me.

What you need to know is the government will typically penalize you if you don’t send in an estimated tax payment at all, if you file late, or if you paid less than you should have. The penalties will vary based on how much you owe and how long you were overdue.

If you don’t want to use the safe harbor rule to calculate your estimated tax payments, I suggest you use the worksheet on Form 1040-ES (Form 1120-W for corporations), and ask your accountant for their suggestions.

Untemplaters, do you have to pay estimated taxes? Did you ever have to pay tax penalties? Are estimated taxes required by your state? What is the most frustrating part about taxes for you?

– Sydney

Disclaimer: I’m not an accountant or a tax specialist. Tax rules are complex and are subject to change. Consult with a tax professional for guidance on your tax filings and payments due.

Nice tip for entrepreneurs. One should have a good understanding of business terms when turning an entrepreneur.

Those taxes can be a PITA. Here’s what a Canadian corporation would have to deal with:

Sales taxes:

Unless your gross sales are over 1.5 million (and if they are, it’s so easy to just have an accountant deal with this for you), you only need to pay sales taxes at the end of the year. You don’t even have to collect sales taxes if your sales are less than $30,000.

Corporate tax:

Not payable until the end of the first year. After that, it’s payable once per quarter if your gross sales are less than $500,000.

Source deductions for employees:

Usually quarterly, depending on the amount of deductions. It will become monthly if you cross over $3,000 of total deductions per month.

A lot of stuff to keep up with, but AFAIK in the first year I don’t have to worry about most of this stuff, heck, the revenue agency is still in the process of opening my accounts. 😉 Later on I’ll probably want to get an accountant to help out here, or spend a lot of time checking and double-checking. I’m currently using GnuCash to keep track of all of this stuff for now.

I’m also curious what my overall tax burden will be. I’m going to have to pay more on my salary since I have an additional 5% for the pension, 2.5% or so for EI, and another 5% for special crap that only exists in my province. At least by paying into this stuff, I’ll be fully eligible for benefits, but it hurts a bit more to see that you’re paying it directly. As an employee, you still pay it anyways through a lower salary, but you don’t see the direct impact of having to pay it out of your own pocket, because it was taken before it even got into your pocket.

Where I can save is the fact that some of my expenses will be deductible, as they are crucial to keep the business operating: stuff like computer and phone expenses. I can now pay for this stuff with pre-tax instead of post-tax. Another area to save is making use of any grants and tax credits that the government makes available. There aren’t actually too many of these, but Canada does have some support for R&D, and a lot of what I do is R&D. After tax credits are applied, money remaining in the company will be taxed at 19% which is still a bit high, but not horrible, as it’s a flat 19% until $500,000 and I’m still a long ways away from that.

Actually, N/M on the EI — if you own more than 40% shares of a company you’re not eligible for it. At least we don’t have to pay it in that case. 😉

Very insightful Kevin, thanks! Yeah we get the first year in business without having to worry about estimated taxes in the US too unless of course the person was already owing money the year before.

I feel ya on the pain of having to pay all these taxes out of the business versus when working for someone else we don’t really feel and notice them as much.

What really dings us here in the US is essentially having to pay double for being an employee of your own company. There’s all sorts of different business entities of course, but in simple terms a corporation has to pay its share of employment taxes plus the employee also has to pay his/her own share. In other words when a person is both the employER and the employEE, they have to pay taxes on both sides. It took me several months to fully understand that last year and once I did I was so mad lol!

Is there a charge for EFTPS? When I went to pay my income tax this year (first time ever, no refund), I was shocked to find out it would cost between $4 and 3% of what I owed to pay electronically! I mailed them a check instead. 45 cents and done.

No, EFTPS doesn’t charge to use it’s services. But I think if you use EFTPS through a bank instead of directly or use the same day payment feature, then that bank will probably charge a service/handling fee. I didn’t get to try EFTPS out yet myself as I’m still waiting for my PIN to come in the mail, but I’ll be using it in September.

I mailed mine for June earlier this week for around $5 because I sent it certified mail return receipt. I was able to do my California one online through their system for free without having to wait for a PIN though and actually already saw the funds debit from my checking account.

Yep… It’s been a year since I wrapped up freelancing (joined that company fulltime) and now am getting stung taxwise. I have no clue what’s going on, really – I made MUCH more in side income the year before that, yet owed about half of what I owe this time around.

That is weird. I wish I had the brain power to understand all the tax laws to help you figure that out. Since you’re in NZ I’m not sure what types of tax rules there are for self employed versus corporate employees. Maybe you were eligible for certain tax credits when you were freelancing?