With the holidays over, I’ve got taxes and budgeting at the forefront of my mind for 2016. All I want to do is save, save, save and find ways to declutter and simplify.

I really should do a better job at cleaning my house each week since I’m too frugal to pay someone to do that for me. But if I have to choose between cleaning and working or petting my cat, cleaning usually loses. 🙂

My new cat has happily settled in and has made herself a bed in my lap right now as I write this post. She’s proven to be quite the picky eater with a sensitive stomach, but her gentle nature and love of snuggling makes up for it.

New Here? Welcome! Be sure to check out my about page and read how I got paid to break free from a grueling desk job earlier this year. I publish monthly income reports to track my progress and push myself forward.

2015 Goals Final Results

I had three main career goals for 2015. In each of my 2015 income reports, I provide a quick update on my progress. Here’s a recap of how I ended the year 2015:

1) Goal: Grow More Traffic

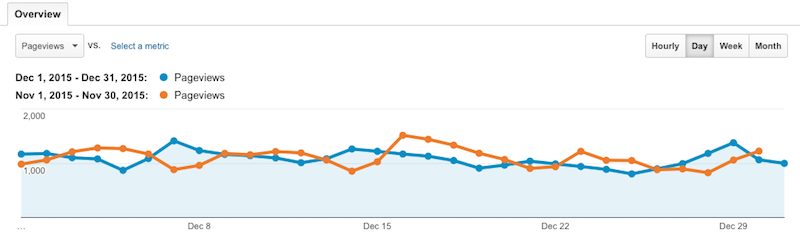

December vs. November:

Considering that most people are busy traveling and shopping during December, I’m happy with how Untemplater’s traffic came out. December was up about 1.25% over November, which isn’t phenomenal, but I’d rather be up to flat than down! Now that I’ve finished a year of monitoring my analytics, I have a decent idea of seasonality and how 2016 could pan out.

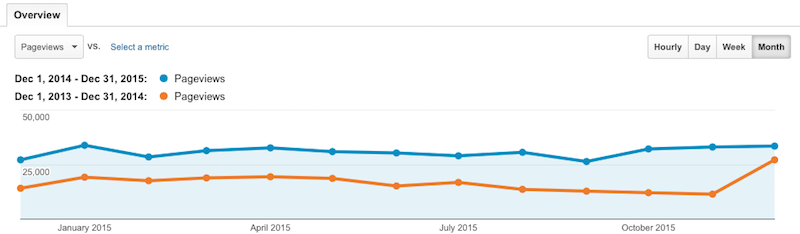

Year over Year:

I had a big spike up at the end of 2014 that didn’t recur in 2015 – dang. No huge growth in 2015, but things stayed steady and did end up, which is what I’m always aiming for. I’ll be curious to see if the Google Penguin updates that are supposed to be coming soon will help or not.

Overall, I give myself a “push” on this goal. I ended the year up, but didn’t experience anything amazing in terms of traffic like I was hoping for.

2) Goal: Land More Freelancing Gigs

I feel good about my freelancing accomplishments in 2015. I started the year off slow, but picked things up in the summer and a lot more in Q4. I wasn’t able to invoice as much in December but that’s because I took some time off and worked extra hours in November to make up for it.

I finally got my first assignment from a client I thought had dropped off the face of the earth. That was a nice surprise, although I don’t expect the assignments to be regular from here on out by any means. At least I’m in their system, so if an opportunity comes up in the coming months I can jump on it quickly.

I reached out to another client who gives me work from time to time and continue to develop that relationship. I’m hopeful I can become more active with them this year.

3) Goal: Build More Affiliate Income

My experiment with Amazon totally failed, but that’s okay. Most sites don’t do that great with Amazon Associates unless they are a niche product review type of website. I continue to build relationships with various affiliates and plan to keep that up this year too.

Just like with my freelancing clients, I keep a close eye on my invoices and payments. It’s amazing how so many companies are horrendous at paying unless you continuously follow up.

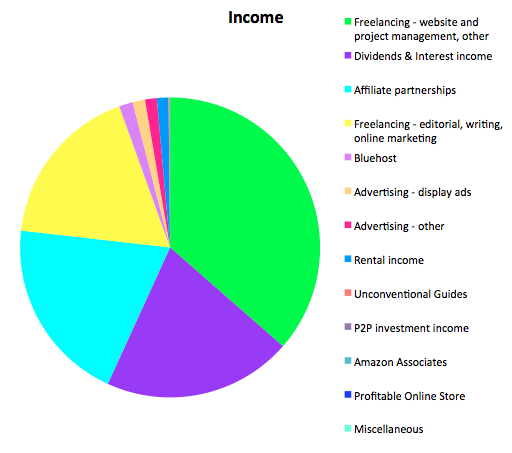

Income Report December 2015

Onwards to the December Income report…

Total Revenue Streams = $18,086

FREELANCING: $9,790

- Project consulting $6,500

- Editorial, writing, online marketing $3,200

- Teaching music $90

INVESTMENTS: $3,922

- Dividends & Interest income $3,687

- Rental income $225

- Prosper P2P investment income $10

ADVERTISING & AFFILIATE: $4,374

- Affiliate Partnerships: $3,612

- Bluehost: $270

- Contextual Advertising (Adsense): $241

- Advertising other: $230

- Unconventional Guides: $20

- Amazon Associates: $1

- Genesis $0

- Profitable Online Store: $0

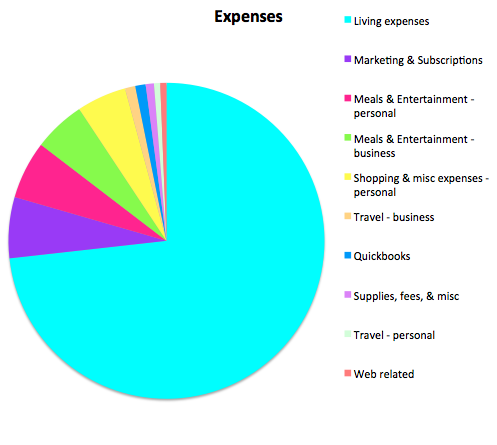

Expenses = $(4,725)

BUSINESS: $(730)

- Aweber, Marketing, Subscriptions, Fees: $(295)

- Meals & Entertainment – business: $(250)

- Travel – business: $(50)

- Quickbooks: $(50)

- Hosting, web related: $(30)

- Supplies & misc: $(40)

- Outsourcing: $(0)

PERSONAL: $(3,995)

- Living expenses: $(3,460)

- Shopping & misc expenses – personal $(240)

- Meals & Entertainment – personal: $(280)

- Travel – personal: $(30)

PROFITS: $18,086 (Income) – $4,725 (Expenses) = $13,361

December Takeaways

I feel good about how I ended 2015. It was certainly a big year of transition for me. When I left my job of 10 years at the beginning of 2015, I did not expect to be back there consulting with them before the year was up. I’m very thankful for the extra income (especially with the stock market imploding) and having a flexible schedule.

On a personal level, I feel good about how the year went as well. I’m glad I decided to publish my net worth and this has me super motivated to reach the $1 million mark as soon as I can. I want to work and earn as much as I can while I still feel young because goodness knows one day my body isn’t going to be able to keep up.

Adopting a cat has been a lot more work that I anticipated since she got sick and needed a lot of extra care, but now that I pretty much have a rhythm down things are going much better. It’s expensive to bring a pet home and I wouldn’t have taken her in if I didn’t feel financially capable. I must say having a cat around the house does reduce stress and increases happiness, especially now that she’s feeling better.

Recommendations

Start Your Own Website – Want to make more money and be more free? Work on building your brand by creating your own website the easy way with a WordPress site like mine through Bluehost for super cheap. You can register your domain for under $20/year and get hosting for only $3.49/month. Whatever your interests are, focus on building your skills and developing your own unique niche.

I’ve been blogging since 2010 and it has allowed me to break free from the corporate grind to travel, work from home, and do so many more things I’ve always wanted to do but couldn’t. The income is relatively passive as posts I’ve written years ago are still being found through Google and generating income. There’s not a week that goes by where I’m not thankful for starting this site!

Track Your Net Worth For Free – Utilize free technology to track your own finances and net worth with Personal Capital. You can quickly link all of your accounts in one place. The best features are their Portfolio Fee Analyzer tool and their Retirement Planner. I was able to save over $1,000 a year in fees by using their free tools. The Retirement Planner is also great because it uses your own inputs to calculate your future cash flows. Take advantage of Personal Capital’s free financial tools to maximize your net worth today.

Get A Free Personalized Investment Plan – Wealthfront is an excellent choice for personal wealth management for those who want the lowest fees and can’t be bothered with actively managing their money themselves. In the long run, it is very hard to outperform any index, therefore, the key is to pay the lowest fees possible while investing your money in the market. Get a free personalized investment plan from Wealthfront in just a couple minutes by answering a free six step questionnaire. You don’t have to transfer a single penny to see Wealthfront’s recommendations for your investments, but it’s easy to fund an account if you choose to do so.

Break free! If you’re burnt out of your day job, believe that you have options and can turn your career around. I didn’t believe I could escape for the longest time, but fortunately I wised up before I destroyed my relationships with family and my health. I never would have thought I could negotiate a severance package and get paid to leave a job I grew to hate, but I did! Learn how you too can get paid to leave your job like I did and open your eyes to new opportunities.

Untemplaters, are you satisfied with how you did last year? Are you making any significant changes to your finances this year? Are you trying to earn more passive income and pick up some side hustles in 2016?

Copyright 2016. Original content and photography authorized to appear solely on Untemplater.com. Thank you for reading!

Congrats Sydney! Watching that passive and semi-passive income come rolling in has got to be a nice feeling.

After a year of blogging I’m starting to see some nice Adsense income and have just started exploring affiliate opportunities. I’ve had no luck with Amazon either…

Keep up the excellent work!

nice site, I am going to try to get affiliate income online. I have been finding investors discounted properties to invest in and now I want to write about it. I think I can add value on what to look for and how to minimize risk. I have seen the good times in real estate investing and I have gone though the bad times in 2008. My new site should be up and running next week.

good luck in the future

Hey Sydney!

Really nice month, almost $20,000 income, and around $10,000 from passive income sources and affiliates. This a great job, amused with it =)

I just updated your income in the list of favourite best bloggers at http://passiveincomewise.com/favourite-bloggers/

It has been a little bit late this month (sorry about that) but I have been busy this January!

Best regards,

Francisco

Congrat, you make more money than other bloggers on the same niche,I need to work hard to make such money this year.

You’re absolutely right about Amazon Associates being hit or miss depending on the type of website. But, you’re doing really well in other areas (consulting, dividends, and affiliate partnership). Can’t wait until you hit $1 million!

Yeah Amazon is so finicky that way. Thanks for your kind words and I hope you reach your goals this year too.

Wow, that’s amazing. Keep up the good work!

Just discovered the blog and I am looking forward to reading more.

Thanks Laura! Welcome and glad to have you here!

Wow, great income report… very inspiring! You’re killing it with the dividends/interest and affiliate income alone. You’ll pass the $1M mark very soon with this kind of momentum. Congrats.

Thanks Michael. December was an unusually high div/interest month so I was happily surprised when I ran those numbers. I hope the volatility in the stock market doesn’t set me back too much this year. I still plan to save and invest since there are opportunities to buy in low.

That is one nice dividend income payment! Gotta love it when dividends are paid mid year and end of year.

I love how diversified your income stream is with both active, semi-passive, and passive. You essentially saved 74% of your gross income. Nice.

Negotiating a severance in early 2015 from a job you no longer enjoyed was such a no brainer!

Sam

Thanks! Yeah I was surprised how big my div income was too! The largest month I had prior to that was around $700 I think off the top of my head. It definitely makes me want to continue investing in dividend stocks!

Okay-this is so inspiring-you are killing it with all that affiliate and advertising income. I want to be you when I grow up 🙂

Aw thanks Kate! Takes a lot of hard work and hustle but so far it’s been worth it.

Great post Sydney! You are killing it with affiliate partnerships. Thanks for the motivation and good luck in 2016!

Thanks Preston! Best of luck to you too this year!