For the first couple weeks of February I felt like a fish out of water, flip flopping around, struggling and out of my element. I was hospitalized at the end of January so it took me a couple weeks to recover and start to feel like myself again. I tell you what – it is absolutely incredible how our bodies can heal with proper care and rest. When you’re really sick, it can be so hard to do even the simplest of things. So when your body finally manages to bounce back, it can make you feel invincible. Every second of good health and “being me” again feels incredibly precious. A reboot puts so many things in life into perspective. We must count our lucky stars and give thanks for what we have.

For the first couple weeks of February I felt like a fish out of water, flip flopping around, struggling and out of my element. I was hospitalized at the end of January so it took me a couple weeks to recover and start to feel like myself again. I tell you what – it is absolutely incredible how our bodies can heal with proper care and rest. When you’re really sick, it can be so hard to do even the simplest of things. So when your body finally manages to bounce back, it can make you feel invincible. Every second of good health and “being me” again feels incredibly precious. A reboot puts so many things in life into perspective. We must count our lucky stars and give thanks for what we have.

Even though I started the month of February on bed rest and wasn’t able to earn any freelancing income then, I needed that rest. After I started to feel better I also took some time off to be with family, which was refreshing and comforting. I spent the rest of the month getting caught up and back into the swing of things.

New Here? Welcome! Be sure to check out my about page and read how I got paid to break free from a grueling desk job earlier this year. I publish monthly income reports to track my progress and push myself forward.

2016 Goals Update

I have three main career goals for 2016 and I’m actively hustling to meet or beat them this year. In each of my income reports, I provide a quick update on my progress:

1) Goal: Invest At Least $5,000 Every Month

I invested $5,000 into a 5-year Euro Stoxx 50 barrier structured note in February. Structured notes are a type of investment that are not traded on a public stock exchange like the NYSE, meaning they are illiquid and aimed to be held until maturity. Structured notes are over the counter (OTC) derivatives that are basically the a hybrid of a bond, intended to protect your principal, and a derivative. The terms generally range between 1.5 – 6 years in length – the one I just purchased is a 5-year note.

At maturity, my investment will provide 175% of the actual return of SX5E uncapped with a downside barrier of 90% of the initial level at maturity. Essentially, some of the benefits for investing in structured notes are diversification, principal protection, not having to invest “naked” in the underlying investment, and being able to “set it and forget it” until maturity date.

The market has been on an upward rally since the lows in early February so I’m wishing I had invested more. But I generally think it’s better to invest than not at all, especially with a long term horizon, so I’ll find a time to leg in some more money in March. I just haven’t decided what I want to buy yet. I’ll report back on my next purchase in my March income report.

2) Goal: Grow My Net Worth By $75,000

I am on a quest to become a multi-millionaire! It’s a long journey, but an exciting and fulfilling one. If I can grow my net worth by $75,000 this year I’ll pass a net worth of $1 million and will be in good shape to hit some financial goals I want to reach before I turn 40. How do I plan to accomplish this goal? I plan to save a lot of money continue doing as much as I can freelancing.

I’m surprised on the upside with the stock market’s climb in recent weeks. So it’s really hard to say where things will go the rest of the year. Tracking the election and the Fed may help predict which way the markets could go.

As for more money related matters, I’m working on finalizing my tax returns this week. Looks like I overestimated my estimated taxes last year so I should be getting a nice chunk of money back. I’m hoping to improve my calculations on my estimated payments this year to come out closer to flat when I file next year. For those of you who own a business, don’t forget the filing deadline for corporations is March 15 and the first 2016 install of estimated taxes are due April 15th.

On the flip side, I had a large outflow from my savings in February because my mother continues to have financial issues. She was in the underwriting process for a mortgage/debt consolidation and wasn’t going to qualify based on the principal amount she wanted and her total debt outstanding. In order to help her qualify, I paid off one of her large credit card balances in full – $8,336 to be exact – to improve her debt to income ratio.

Although she wants to be able to pay me back, the reality is that’s highly unlikely. She simply grew her debt for decades too long despite my many attempts over the years to get her to change her live within her means. The good news is that her loan was approved this week and she is trying to change for the better.

It’s very frustrating but also fortunate that I can help her. I just have to work harder to make more money. She’s likely going to continue to need more money in the future and I don’t want my own future to be derailed because of her financial problems. I’m also going to try and be more diligent about monitoring her finances – even though she hates that – for everyone’s benefit. I’m also keeping my sister as involved as possible (they don’t really get along) since this is a family matter and not my burden to bear alone.

3) Goal: Grow More Traffic

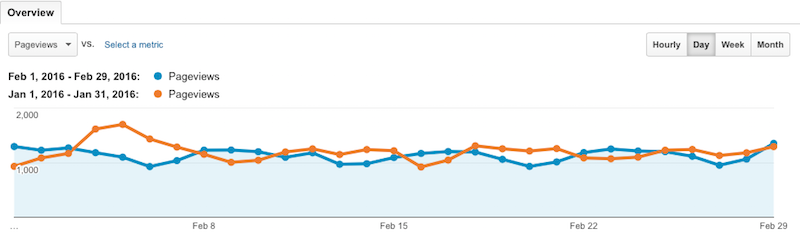

Growing traffic is easier said than done, but I keep reminding myself its possible as I’ve witnessed by many other sites. Unfortunately traffic for Untemplater was down in February even if I adjust the prior period comparison to 29 days.

I just hope I won’t be on a continued decline for March and into the spring because I already anticipate a slowdown in summer due to seasonality. In any case, I plan to keep on going. Ideally I would like to publish two posts a week versus just one, but I’ve been focused on putting more hours toward my other writing projects and freelancing. I’ve got to improve my efficiency first or reshuffle my work priorities if I plan to publish more frequently in the future.

February vs January:

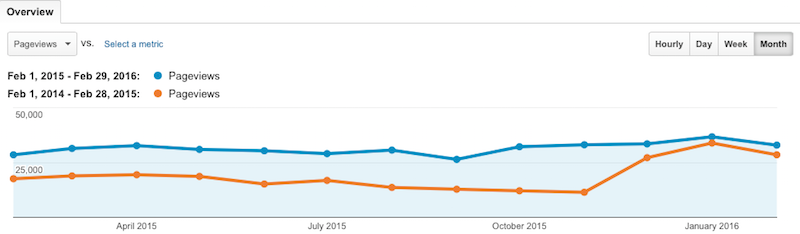

Looking at year over year numbers, I’m still hovering above. The gap has widened since January although my month over month traffic declined. Come on March – show me some love!

Year over Year:

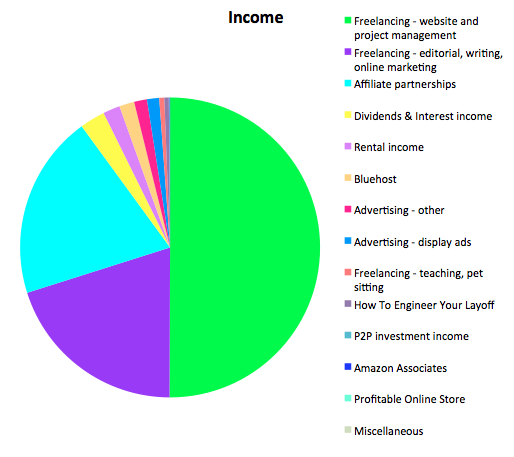

Income Report February 2016

Onwards to my February Income report…

Total Revenue Streams = $16,620

FREELANCING: $11,743

- Project consulting $8,320

- Editorial, writing, online marketing $3,333

- Teaching music $90

INVESTMENTS: $771

- Rental income $452

- Dividends & Interest income $304

- Prosper P2P investment income $15

ADVERTISING & AFFILIATE: $4,106

- Affiliate Partnerships: $3,300

- Bluehost: $270

- Advertising other: $230

- Contextual Advertising (Adsense): $218

- How To Engineer Your Layoff $80

- Amazon Associates: $8

- Profitable Online Store: $0

- Unconventional Guides: $0

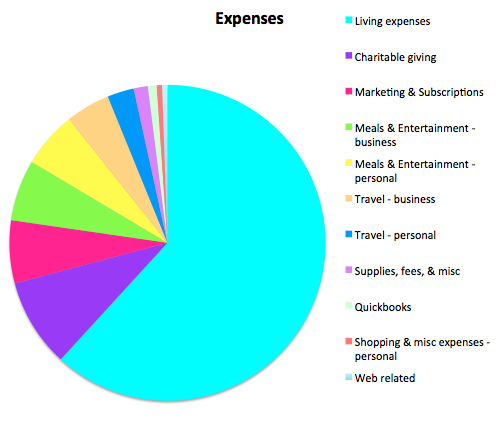

Expenses = $(5,518)

BUSINESS: $(1,110)

- Aweber, Marketing, Subscriptions, Fees: $(355)

- Meals & Entertainment – business: $(345)

- Travel – business: $(250)

- Supplies & misc: $(80)

- Quickbooks: $(50)

- Hosting, web related: $(30)

PERSONAL: $(4,408)

- Living expenses: $(3,410)

- Charitable giving $(500)

- Meals & Entertainment – personal: $(318)

- Travel – personal: $(150)

- Shopping & misc expenses – personal $(30)

$16,620 (Income) – $5,518 (Expenses) = $11,102 PROFITS

February Takeaways

What I learned in February is how incredible it feels to be out of recovery from being sick. I also had to deal with my mother’s finances which was a mixed bag of emotions. But it’s my filial responsibility to take care of her and I’m grateful for everything she’s done to care for me over the years. I hope my financial frugality will finally start to rub off on her.

My income was down mostly due to my time out of work and my expenses were up largely due to travel and donating to charity. Even though I miss having paid work day benefits, I’m glad I took the time off that I did.

February flew by in a flash and March is quickly doing the same. I’m loving the longer days now. Fortunately I’ve been feeling healthy again and have been able to work some extra hours recently. I’m a bit low on sleep but a few power naps have been a great recharge and I’m continuing to press forward. My phrase to sum up February is flip flop, ya don’t stop!

Recommendations

Start Your Own Website – Want to make more money? Work on building your brand by creating your own website the easy way with Bluehost for super cheap. You can register your domain for under $20/year and get hosting for only $3.49/month. Whatever your interests are, focus on building your skills and developing your own unique niche! I’ve been blogging since 2010 and it has allowed me to break free from the corporate grind to travel, work from home, and do so many more things I’ve always wanted to do but couldn’t. There’s not a week that goes by where I’m not thankful for starting this site!

Track Your Net Worth For Free – Utilize free technology to track your own finances and net worth with Personal Capital. You can quickly link all of your accounts in one place. The best features are their Portfolio Fee Analyzer tool and their Retirement Planner. I was able to save over $1,000 a year in fees by using their free tools. The Retirement Planner is also great because it uses your own inputs to calculate your future cash flows. Take advantage of Personal Capital’s free financial tools to maximize your net worth today.

Get A Free Personalized Investment Plan – Wealthfront is an excellent choice for personal wealth management for those who want the lowest fees and can’t be bothered with actively managing their money themselves. In the long run, it is very hard to outperform any index, therefore, the key is to pay the lowest fees possible while investing your money in the market. Get a free personalized investment plan from Wealthfront in just a couple minutes by answering a free six step questionnaire. You don’t have to transfer a single penny to see Wealthfront’s recommendations for your investments, but it’s easy to fund an account if you choose to do so.

Break free! If you’re burnt out of your day job, believe that you have options and can turn your career around. I didn’t believe I could escape for the longest time, but fortunately I wised up before I destroyed my relationships with family and my health. I never would have thought I could negotiate a severance package and get paid to leave a job I grew to hate, but I did! Learn how you too can get paid to leave your job like I did and open your eyes to new opportunities.

Untemplaters, was your February filled with snow, rain or sunshine? Have you been taking care of your health lately? Did any significant events happen to you in February?

Copyright 2016. Original content and photography authorized to appear solely on Untemplater.com. Thank you for reading!

I read your submission guidelines to include the request to comment. Being there is only so much time in a day and my business & podcast keep me insanely busy, my immediate reaction was this blog would probably not be a fit. Although I really like your mission and the tone of the pieces on here.

And then I bumped into this article. LOL

It reminds me of a BCorp type of business. Here is their link, they are a great non-profit. https://www.bcorporation.net I’m not affiliated with them nor is that an affiliate link, for the record. But back to your post.

Transparency. But NOT just transparency, bold transparency. Impressive. It’s something I teach and am very passionate about, in my coaching work, and as my work as a director/producer in experimental art forms.

It’s well past Feb, so I hope your traffic issues have sorted themselves out. 😉 Great post.

I have never heard of structured notes before in all my years of investing – very interesting. Where can I go to learn more?

Also just curious what your job was before you left the daily grind? Thanks!

Thanks for sharing this info. It makes us, especially those new bloggers, believe that there are ways to earn passive income and share lessons learned to readers at the same time.

Looking forward to reading your articles.

Thanks for sharing Sydney. This is such valuable reinforcement to show people what is possible. Multiple income streams can really help smooth out the ride too. Very happy to hear you are doing better health-wise. I’m looking forward to reading more updates!

Michael

Thanks for sharing your goals and updates about where you are in reaching them. It’s so important to have reasonable goals and actionable steps in place so that you don’t get burnt out.

Aside from goals, work, and finances, I like that you seem to stress the importance of family and enjoying life, as well. Thanks for the great reminders and inspiration!

I am impressed with both your ability to generate freelance income as well as your affiliate income streams. Actually, your whole model is impressive.

I have not been successful in generating steady freelance work recently. It requires a signficant time investment and even then appears in unexpected areas – not necessarily correlated with where I’ve been spending my effort.

Also, your affiliate income appears to be a much better channel than your AdSense and Amazon streams. Out of curiosity, how much traffic did you have before you started seeing results from your affiliate stream?

I love reading your income reports and see you kick a$$!!

Glad you are feeling better. I got knocked off my game a couple weeks ago to a stomach flu… not fun.

I’m looking forward to seeing you hit 7 figures soon. 🙂

First time visitor. Thanks for writing and sharing such a detailed income update. Investing $5k a month takes serious commitment. If you can sustain it for a few years, your retirement portfolio will be well off.

Great work, sounds like a very positive month. Hope you can keep building momentum!

Congratulations on your blogging success Sydney. If you can continue savings at a rate of $5,000/month, your goal to increase net worth is more than doable.

Just as a side note, do you have your own solo 401 (k) or do you make your investments in taxable accounts?

I am mostly focused on growing my dividend income, since it requires very little maintenance time and is more scaleable. However, I am curious about those structured notes you have invested in. Is the upside only from capital gains, or does it include dividends as well?

Best Regards,

Dividend Growth Investor

Nice job helping your mom pay off her credit card bill! Hopefully she can really appreciate this gesture and work on her spending habits more.

I wish I had bought more in Feb as well. Bought some Amazon, Apple, and SPY. I don’t based off usual contribution amounts.

Glad you are better!

Sam