Tax deadlines are creeping up, especially if you have your own business. Corporate tax returns are due by March 17, 2014 (Forms 1120, 1120A, 1120S). Hopefully you’ve already reconciled and closed your books for 2013 and are headed into the final stages of reviewing your federal and state returns. I like to file both my corporate and individual tax returns at the same time by the corporate deadline to get everything done and done.

I tend to get stressed in tax season every year, mostly because there’s so much to do, and I always get tense when money and paperwork is involved. But tax time is also a fantastic opportunity to learn new things and take a closer look at your financial situation for the remainder of the year.

Simple Business Tax Tips

Here are some simple and easy business tax tips to get you through the next few weeks and have smoother sailing on your future filings too. Don’t let all the different government forms and rate tables scare you into a panic. And don’t feel overwhelmed with the size of this list. These tips are pretty easy to implement if you’re motivated to make improvements.

Give yourself a chance to understand the basics, and the rest will start to click into place. Be patient with yourself. I’m still no tax expert, but even a regular Jane like me who’s terrible at accounting can go from zero business tax knowledge to a comfortable understanding of all the various numbers in my returns.

- Understand your business entity – In order to make sense of what taxes and forms you are required to file, you must know what the legal structure is of your business. Is it a partnership, C corporation, S corporation, LLC? Or are you simply a sole proprietor filing a schedule C?

- Review your Balance Sheet and Profit & Loss statement – Every good business owner knows the importance of keeping good books and records. You should be reviewing the financial health of your company throughout the year so there are no surprises when it comes time to file your returns. Take an extra close eye at your year end Balance Sheet and Profit & Loss statements.

- Compile a list of questions – Every year before I file my returns, I put together a big list of questions. I try to find answers to as many of them as possible on my own, and take the rest to my accountant. I keep all of my notes on my computer so I can easily reference them later.

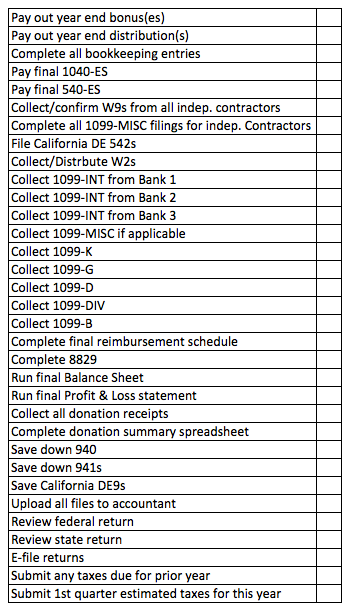

- Keep a year end/tax checklist and update it every year – I used to get so stressed about trying to remember what I needed to do at year end and gather for filing taxes that I suffered from debilitating back pain. There’s a LOT to keep track of when you have to file corporate returns on top of your own individual returns. My solution was creating a checklist, which takes the thinking and confusion out of it. I also update it each year as my situation changes. Take a look at this snapshot to get an idea of some of the things you may need to do:

- Go as paperless as possible – It’s so much more convenient to have digital copies of all your forms, receipts, and filings. I use separate folders for my corporate versus individual documents to stay organized. The easier you make it to find files, the less stressed you’ll be!

- Understand the various tax rates that you pay – Pay attention to the tax rates that you’re paying! Some of these rates can change every year like your unemployment tax rate. If your business is in a state like California, you’ll start to realize the incredible appeal of more business and tax friendly states. California isn’t one of them!

- Never assume your accountant didn’t make any mistakes – Most corporations will use the help of an accountant to complete and file tax returns. Whether you use someone in-house or externally, never ever assume they did everything correctly. Although my accountant is very knowledgeable, I still caught multiple mistakes that he made. Nobody knows your business as well as you, so you really need to check everything.

- Stay on top of your estimated taxes – Having to pay estimated taxes is a PITA, but paying penalties and fees is much worse! Earnings can vary from one quarter to another, but avoid skipping a payment all together. If you don’t follow the safe harbor rule, at least do your best to pay equal or close to equal amounts in each quarter.

- Have a meeting with your accountant before he/she starts on your returns – A lot of the mistakes I caught that my accountant missed would have been avoided if we sat down together before he started working on my returns. As a result, we’re going to meet both before and after he works on the returns next year. This will help avoid double counting or missing entries.

- Stay organized throughout the year – I can never emphasize enough how important it is to stay organized. Keeping good records makes tax time so much smoother. And it will also save yourself a lot of headaches during the other months too.

- Create a 100% deductible meals category – One thing you may not have done if you have employees is create an expense category separate from meals and entertainment (only 50% deductible) that’s 100% deductible. For example, if you order lunch at work for your employees for business purposes, that’s 100% deductible versus taking a client out to lunch.

- Set calendar reminders for filing deadlines – We all get swamped, and it’s easy to forget a deadline until after it’s past. Avoid penalties and fees as much as possible. Don’t let your hard earned dollars go to waste!

- Save records and receipts of all payments that you make – Make sure to keep track of what you’ve paid and when. For example, it makes a difference on your tax returns if you paid your 4th quarter estimated taxes in Dec 2013 versus Jan 2014.

- Aim for a refund/taxes due amount within +/- $1,000 – If you stay on top of your estimated tax payments and monitor your books, you should be able to avoid any big surprises when you go to file your returns. You’ll also know if something looks fishy if your accountant fat fingered some numbers.

- Maximize your deductions every year – There are a lot of business related expenses that you should be deducting on your tax returns each year. Once a new year starts, it’s too late to bump up your expenses for the prior year! Here’s a helpful list of common business expense tax deductions.

- Pay out reimbursements monthly – Make a solid effort to file and pay out expense reports on a monthly basis. Do it quarterly at a minimum because they impact your bottom line.

- Take and track distributions – If your business is performing well, consider taking distributions. Just don’t take out so much that you screw up your cash flow.

- Track your stock basis from year 1 – If you’re a shareholder in an S-Corp, start tracking your stock basis now! Otherwise the longer you wait, the harder and harder it becomes to go back in time to figure out. It’s important to track your stock basis so you won’t get caught unawares owing capital gains due to taking too much in distributions.

Further reading: Tax Tips for Entrepreneurs Part 1, and Tax Tips for Entrepreneurs Part 2.

START YOUR PROFITABLE WEBSITE TODAY

Want to make more money and be more free? Work on building your brand by creating your own website the easy way with a WordPress site like mine through Bluehost for super cheap. You can register your domain for under $20/year and get hosting for only $3.49/month. Whatever your interests are, focus on building your skills and developing your own unique niche.

I’ve been blogging since 2010 and it has allowed me to break free from the corporate grind to travel, work from home, consult for companies that I like, and do so many more things I’ve always wanted to do but couldn’t. The income is relatively passive as posts I’ve written years ago are still being found through Google and generating income. What’s better than making passive income and creating a valuable asset you can one day sell for a multiple of annual income?

I’ve conquered my biggest fears by going off on my own thanks to this website and it feels wonderful. Not a week goes by where I’m not thankful for starting this website to live the life I want to live!

Updated for 2016 and beyond

You make a great point that keeping good records makes tax time so much smoother, and it can be really beneficial to stay organized throughout the entire year. I imagine that taxes can be a really big source of stress for business owners, and they probably don’t want to be so worried about it when they’ve got so many other things to be thinking about. It must be really helpful to have an accountant or a tax service to help relieve some of that stress.

Thank you for pointing out that it is very important to stay organized throughout the year to make tax season easier. Businesses have so many documents they need to keep track of for their taxes. I would imagine they would want to hire someone to help make the process as smooth and simple as possible. Hopefully, they would look into the best companies to get them through tax season.

Hey Sydney, very well done checklists and insights.

Great tips Sydney! As usual I am waiting till the last minute… I do have all my pertinent paperwork gathered. That checklist is pretty lengthy and great reminder to track your stock moves right away. A few years ago I was busy in the market and it took forever retracing all my steps. Since you are pretty tax savvy, would you ever consider doing your taxes yourself? Finally, for someone like yourself in side hustle mode, which one is more advantageous, sole proprietorship or LLC? Thanks!

Hmmmm, that list you’ve highlighted shows why tax laws need to be simplified. That’s ridiculous!

Can your account do all that? Or is that what a bookkeeper is hired for AND a tax accountant?

Yeah it’s a lot of stuff for both Federal and State. It’s not that hard to do, it’s just time consuming. Most of the list is gathering docs that my accountant uses to put together my returns. Some tax accountants do the bookkeeping for businesses, but they charge extra for that. Bookkeeping gets easier over time, but it takes time to stay organized and get it done.

Are you doing your business taxes for your online “side hustle” or do you have your own company that does something completely different? It sure sounds like you do the bulk of the work – what are you paying your accountant to do? What type of entity are you (sounds like maybe a C or S Corp)?

Sorry for the bombardment of questions (and don’t answer them if they’re too intrusive)…just curious.