Unless Congress passes legislation to extend federal unemployment benefits in 2013, no unemployed person will be eligible for more than 26 weeks of state maximum unemployment benefits. Gone will be the days of 99 weeks of unemployment benefits or even the proposed “Shock & Awe Yeah” program that provides five years of insurance.

Once January 1, 2013 hits, millions who receive federal unemployment benefits are on their own. There may be some serious financial consequences for people who rely on unemployment insurance to survive, especially those who are older or who have been out of the work force the longest.

Suddenly, there is a daunting fear that maybe being “funemployed” is not that attractive a proposition anymore as state unemployment rates dip below crisis levels. Those who used their time off to start a business, travel the world, or be extremely picky about the jobs they take will have to make some tough choices. National unemployment after all, is now 7.8% and improving.

SHOULD FEDERAL UNEMPLOYMENT BENEFITS BE EXTENDED?

Yes They Should

In some countries such as France, the unemployed get roughly 70% of their last year’s salary for an indefinite period of time. In the United States, the maximum unemployment, no matter how much you make is only about $24,000 a year. To achieve the maximum in unemployment benefits, you need to earn about $45,000 for one year.

Let’s say you were making $150,000 a year and lost your job in France. You’d be able to earn a healthy $105,000 a year as you look for work. But in the US, the most you will get is $24,000, depending on which state you live in. Given this comparison, you can see how the US provides woefully less unemployment benefits vs. France and other socialist countries such as Denmark, Holland, Norway, and Sweden.

$24,000 a year isn’t exactly a lot of money to live off, especially given employees have paid into the system for likely more than 26 weeks. $24,000 can barely get you a one bedroom apartment in San Francisco. Then you’ve got food, clothing, transportation, and other job hunting expenses to pay.

To simply shutoff all unemployment assistance come January 1, 2013 would be a travesty.

No They Should Not

The Dow Jones Industrial average is up over 100% since the crisis lows and sits at roughly 13,500. Rents and property prices are recovering in major cities such as San Francisco, Los Angeles, and New York City signifying rising demand and income. Restaurants are packed and roads are traffic jammed again. Meanwhile, people are more mobile than ever to go where the jobs are.

By any stretch of the imagination, the recovery is in full swing. If you’ve received 26 weeks of state unemployment benefits and still haven’t found a job, perhaps there might be something off with your job search strategy or intent. There are plenty of minimum wage jobs that pay $10 an hour that go unfulfilled. The problem is by receiving $1,800-$2,000 in maximum unemployment benefits a month, it’s better to just do nothing.

Meanwhile, entrepreneurship is brutally difficult compared to a day job. Not many people are going to dedicate all their time and effort to start a business if they continue to receive unemployment benefits. Hopefully, Untemplater readers don’t see entrepreneurship this way and are actively looking to create their own lifestyle businesses.

At some point, the country needs to gradually cut off the amount of unemployment benefits so that it no longer becomes a crutch. When we make benefits “temporary” for years, we risk expectations shifting towards permanency. I have friends who play tennis all day and don’t work because of government assistance. They aren’t rich, but they do lead pretty great lifestyles. However, one definition of rich is not having to work for money!

THE FOUR FEDERAL UNEMPLOYMENT TIERS AT RISK

After you exhaust your 26 weeks of State unemployment benefits, you used to get the following from the Federal government at the height of the crisis:

1) Emergency Unemployment Compensation Tier I is for up to 20 additional weeks

2) Emergency Unemployment Compensation Tier II is for up to 14 additional weeks

3) Emergency Unemployment Compensation Tier III is for up to 13 additional weeks

4) Emergency Unemployment Compensation Tier IV is for up to six additional weeks

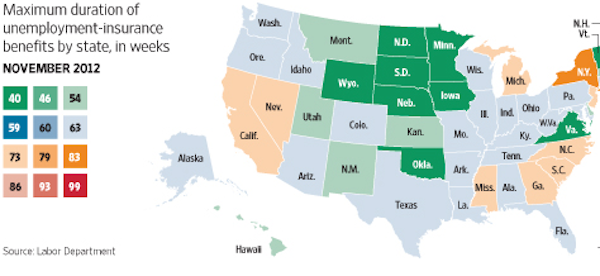

According to the chart below, you can see a tremendous decrease in the total amount of weeks given due to the improving unemployment rates in various states as of November, 2012.

TOTAL AMOUNT OF EMPLOYMENT DECREASING FROM 99 WEEKS

CONCLUSION

There will be no fiscal cliff, nor will Congress not pass legislation to extend Federal unemployment benefits in 2013. Although the government has given everyone on benefits a warning this past summer, there are new people who are unemployed every single day who need the money.

Nobody should judge others without walking in their shoes first. If you believe the government should cut off all federal assistance in the New Year, just want out because one day you might need a helping hand.

Update 1/9/13: Washington DC passes a new budget and extends unemployment benefits for another one year through 2013. The clock is ticking.

Strong Recommendations To Improve Your Finances

* Manage Your Finances In One Place: Get a handle on your finances by signing up with Personal Capital. They are a free online platform which aggregates all your financial accounts in one place so you can see where you can optimize. With your finances at risk, now is more important than ever to track where your money is going! Before Personal Capital, I had to log into eight different systems to track 25+ difference accounts (brokerage, multiple banks, 401K, etc) to manage my finances. Now, I can just log into Personal Capital to see how my stock accounts are doing and when my CDs are expiring. I can also see how much I’m spending every month. Personal Capital takes less than one minute to sign up!

* Never Quit, Get Laid Off Instead. Learn how to negotiate a great severance for yourself inHow to Engineer Your Layoff! By getting laid off from a job you wanted to leave anyway, you can collect a severance, health care insurance, deferred compensation, unused vacation days, and be eligible for unemployment. The book provides helpful case studies and a framework for you to have a strategic conversation with your manager on how to profitably quit your job.

Regards,

Sam

I’m seriously scared about the possibility of losing my husband’s unemployment. I work full time and he’s been unemployed since the summer. His regular claim is up and he started an extension, but I have no clue if that extension will stop after the first of the year. (can’t seem to find reliable info to go by). He has a specialized degree and would love to go where the work is, but with 3 kids, my job and other financial and health issues, that’s not feasible. So here we are wondering if we’ll make it if he gets cut off. We will literally be choosing between eating, paying the rent or electric, getting required medicines for at least 2 of us and staving off the wolf of student loans. So if someone has a viable option for me, let me know. We are both hard working individuals who don’t like having to be on some type of assistance, but at this point have no choice. By the way, we’ve cut out a good chunk of extras with a few small exceptions. There still isn’t enough money to go around.

You may want to look into consolidating your student loans and seeing if you qualify for an extension due to hardship. It’s good you have already started cutting out extras and are watching what you spend. If you get in a bind and need to take out an emergency loan, P2P is an option that may work for you, just don’t take out more than you need as rates can be high for borrowing. Read more here Hang in there.

People don’t get it, the so called lazy people receiving the help are also the ones helping to stimulate the economy. what do you think they do with the money they get, hoard it? no ,they spend it on things they need and (not so smart) want. if the benefits are cut off then so is the spending, we are dealing with a viscious cycle. Those benefits are going right to businesses large and small once it stops they have no choice but lay off more people flooding the market even more and causing an even worse situation. I imagine there are people that are taking advantage of the benefits (as with any situation) but I bet there are alot more who aren’t and are trying anything and everything to secure employment. the unemployment rate is pretty high all around, i dont think it should be cut off until it drops more and new regulations should be in effect to make sure people aren’t taking advantage of it. If they don’t approve this extension the economy will suffer even more and those with jobs now saying they shouldn’t approve it will be in for a rude awakening when they get laid off and won’t have the help at all. the benefits aren’t really going to the unemployed they are going right back into the economy.

You are correct. The $30 billion in federal unemployment assistance is probably mostly spent on necessities that goes right into the economy. Unfortunately, it looks like Congress can’t agree on anything.

I agree unemployment could become a crutch, but it has been dialed back slowly from 99 weeks to a max of 72 week and in most states only 63.

The problem here is, that unemployment isnt really improving.

the economy each month is not generating enough jobs for the new workers entering the workforce, let alone the ones that are out of work.While the frontline unemployment number is 7.9 percent, the U6 number which is the real unemployment, is just under 15 percent. So to say Federal unemployment benefits shouldnt be extended because unemployment has improved so much, is a flawed argument.

And when would it stop? 150 weeks, 200 weeks? 5 years?

The fact is that there are jobs available but they pay less than the unemployment check or involve work that they don’t want to do, so many people refuse to take them (and they lie on the response questionnaire for the state unemployment dept).

They would prefer to sit around, mooch off relatives rent-free, and dream that their old job will come back and refuse to re-train for another career.

Or people refuse to move to a different town or state where job prospects are better.

That’s what people did during the Great Depression…there were no UE benefits, so they quickly learned to move to where there was work.

Unemployment rates are below 7% in 22 other states. Go to http://www.bls.gov/lau and look at the list on the right-hand side. It’s not 12.4% EVERYWHERE.

We need to cut off these benefits before they become just another welfare check. Personal responsibility !! After 99 weeks of free checks, the problem is you, not the economy.

My Shock & Awe YEAH program stops at 5 years. Why not? We’ve got Obama.

Easy to argue to cut benefits if you are not receiving benefits. There are millions of people who need these benefits to survive! Not everybody can work at McDonald’s.

It will probably be a big debate and lots of soundbites, and then passed at the last minute. That seems to be the new normal for financial issues.

I like your point about jobs going unfilled that people are unwilling to take. I’ve heard people mention that their unemployment benefits paid more than minimum wage jobs did, so they wouldn’t even bother. I guess I’m for keeping extended benefits, but having more accountability built in to try to make sure people are actually applying for jobs.

In Colorado, there is a rule that you must make at least 5 job search contacts each week to maintain eligibility for unemployment benefits. Your job search can be audited, but I have yet to hear from someone to whom that actually happened.

Here in Texas they tell you what the lowest wage you have to condider is, in my case I made 15.00/hour at my last job and they say I do not have consider any job that pays under 12.50. Why would I want to take a job that pays half of what I made when it will not pay my bills.

I’ve been unemployed and did receive a few checks, but unemployment benefits should be slowly weened off. For many, this crutch removes any motivation to find a job and a possible better way to live. Amazing stat about France’s 70% assistance. You would think they would be happier, haha!

Out of curiosity Sam, what is the difference of tax rate allocated toward their unemployment over there as opposed to the $150 or so in the US.

Sorry Chris, don’t understand your question. Your tax rate on UB depends on your income. If all you earn is $24,000 a year with no other income, you’re probably paying an effective federal tax rate of around 7-8%.

The good news is the economy is improving however slowly. Unfortunately, job creation is very slow and there are still people losing their jobs. I don’t think there is any chance in renewing the federal assistance.

I think a lot of people have chosen not to return to the workforce because of the generous unemployment benefits – I actually see it quite a bit at my work. We pay a little above minimum wage, so it is not that appealing to many. As a result, the unemployed construction worker who used to make $20/hr chooses to get unemployment benefits rather than take a job at $9/hr. The reason – his unemployment benefits equate to about $12-14/hr.

I’m trying to hire 95 employees for the Christmas season, and will probably continue to employ about 30-40 even after Christmas. It’s a struggle and less benefits will boost unemployment because these jobs will start to be filled.

It’s hard to blame anybody who made $45,000-$85,000 a year not to want to work if they can get $24,000 a year in unemployment benefits.

But, if you are earning much less than $45K, you are NOT getting close to $24,000 a year in UB.

You consider 12.00 an hr generouse? What State do you live in? Definatly not Minneosota. Thats almost considered minimum wage here.

Money Beagle makes a point that when something is put in place, the longer it stays, the harder and harder it getst to take it away. I see this at work all the time. I have a feeling it will be extended but perhaps for a shorter period. Jobs are coming back but there are still people having a difficult time finding work. People are holding onto jobs longer so there’s less natural turn over.

I think they will be extended somewhat but I don’t think they should. Just because people are irresponsible and didn’t save for emergencies doesn’t mean they should get over a year of unemployment. Maybe during the top of the crisis, but you should be able to find some form of work within one year. It may not be what you want or pay what you were making but times have changed. If you can’t you aren’t trying hard enough. Looking for a job should be a full time job.

I donno Lance. Have you ever been unemployed?

I’ve spoken to many people, and I can consider myself unemployed as well. If you don’t have connections, it’s very difficult to get a similar quality job. Sure, maybe McDonald’s, but that’s not reasonable if you were making 5X that and doing something else.

I couldn’t disagree more. It really isn’t that easy to find work within one year. Maybe for a young individual who has nothing to lose by accepting any low paying job – sure. But for someone who has a specialized degree and a field in which they have worked their whole life, finding employment can be next to impossible. You may think it’s easy to just accept whatever comes first, but I’ve spoken to many of these people myself and believe me – they would love to accept ANYTHING, there’s just nothing out there for them. You have to have taken that path to know how it really is. It’s not pretty.

I have been unemployed since I was laid off in June 2012, you say if you cant find a job you are not trying hard enough. When was the last time you were unemployed? I four months I have only had 3 interviews, trust me I have tried for lower paying jobs but only get told that I am overqualified or that I would just leave when a better paying job comes along, which is the truth. I made 15.00 an hour on my last job, the unemployment people tell me I do not have to consider a job paying less than 12.50 which is a big cut in pay right there. SO TRY LIVING IN OUR SHOES BEFORE YOU MAKE IDIOTIC REMARK. Also there is only certain kinds of work I can do, due to have back surgery about a year ago, I am not abel to stand for more than about 10 minutes at a time.

Michael – Did you fail to read about 1/3rd of my entire post that argues FOR extending unemployment benefits, and even creating a 300 week unemployment program? I also discuss winding down benefits AFTER 52 weeks. Here’s a portion of the post you might have missed.

Yes They Should

In some countries such as France, the unemployed get roughly 70% of their last year’s salary for an indefinite period of time. In the United States, the maximum unemployment, no matter how much you make is only about $24,000 a year. To achieve the maximum in unemployment benefits, you need to earn about $45,000 for one year.

Let’s say you were making $150,000 a year and lost your job in France. You’d be able to earn a healthy $105,000 a year as you look for work. But in the US, the most you will get is $24,000, depending on which state you live in. Given this comparison, you can see how the US provides woefully less unemployment benefits vs. France and other socialist countries such as Denmark, Holland, Norway, and Sweden.

$24,000 a year isn’t exactly a lot of money to live off, especially given employees have paid into the system for likely more than 26 weeks. $24,000 can barely get you a one bedroom apartment in San Francisco. Then you’ve got food, clothing, transportation, and other job hunting expenses to pay.

To simply shutoff all unemployment assistance come January 1, 2013 would be a travesty.

Thank you Michael, you made a great point. I was making 50k a yr and now trying to survive off my 380.00 a week.. Yeah that will really make me lazy and want to do nothing. Really! I would love a job versus being on unemployment. I hate seeing my neighbors going to work every morning while I sit here applying for jobs with no good outcome. The job market is hard out there and for those that are judging, I can only pray that you do not end up on this side of the table. Keep in mind, you are dispensible.

At a certain point when you keep a temporary measure in place for so long, it becomes permanent and therefore becomes that much harder to eventually get back to the ‘normal’ way. Along these lines, what happens with the 2% ‘holiday’ for the social security contributions? It’s been in place for two years now. If it were to be taken away, do you think most people would see it as ‘oh well that was nice to have’ or ‘oh no, they’re raising taxes’? Probably the second, which even though it isn’t true, perception becomes reality. That’s why, quite honestly, I’ve never really been in favor of these ‘temporary’ measures that have come into play over the last 4-5 years. How we get out from underneath them is going to be very interesting.

MoneyBeagle, I just mentioned the 2% in a post the other day. LOL

It’s just like taxes. If tax cuts are temporary, then businesses and people don’t spend as much as they should b/c they are buffering for future tax increases.