Tax season is here whether we like it or not. I hate doing taxes, so I like to get it out of the way as quickly as possible. I got a jump start on compiling all my forms and receipts in January and February, and just finished filing all of my tax returns earlier this week. Fortunately I got a small refund this year unlike last year when I owed money. Filing taxes can be frustrating but it doesn’t have to be overwhelming if you take a little bit of time to understand the basics. Familiarizing yourself with the various forms and filing requirements will also help make the process less stressful. Here are some simple tax tips for entrepreneurs to get you started.

First Understand Your Tax Entity

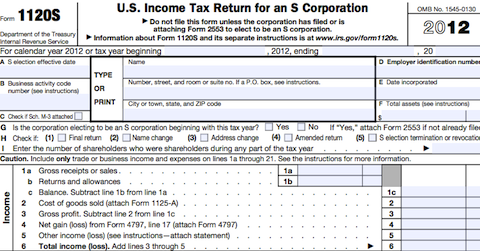

Before you formally establish a business, you need to figure out what type of business entity will work best for you. It’s important to understand what that will mean in terms of tax filings too. An S Corp for example files its own tax return, but the S Corp itself isn’t taxed because the income/losses generated are taxed at the shareholder level. For example, if you are the sole shareholder of an S Corp, you’ll be reporting and paying taxes on all of your business’s profits or losses on your individual tax return.

While you do have the option to change your business entity later on, why bother going through all that extra paper work if you don’t have to. Sole proprietorships, C Corps, S Corps, Partnerships, and LLCs are the different business entity options you have in the U.S.

Each have their own advantages and disadvantages, which can also vary based on the state you live in and your individual situation. A lot of people tend to go with sole proprietorships and S corps, but you’re best off meeting with an accountant and getting professional advice before deciding. Make sure you also understand the risks of starting a business.

Actually Set Calendar Reminders For Filing Deadlines

While this sounds rudimentary and obvious, please take my advice and spend 5-10 minutes actually putting reminders in your calendar. Don’t rely on your memory alone. Why? Even someone like me who loves being organized makes mistakes and loses track of things. For example, I had an estimated tax filing due on September 15th last year that I thought was due on the 30th, and I missed the deadline!

I was traveling and occupied with stuff, and foolishly didn’t take the time to double check the due date. Augh! Don’t let the government take advantage of your hard earned dollars because they will come after you with fees and interest if you’re late.

Utilize The Safe Harbor Rule For Your Estimated Taxes

If you’re thinking about becoming self employed, doing freelance work, or earning any type of income that isn’t subject to withholding please read my article What Are Estimated Taxes? I suggest you use the worksheet on Form 1040-ES (Form 1120-W for corporations) and utilize the safe harbor rule. The safe harbor rule for estimated taxes helps you avoid having to pay the government fees and interest if your estimated tax payments end up being less than what you actually owe when you file your returns.

For ex. Let’s say you think you’re going to make more money in 2013 vs 2012. If you paid $12,000 in taxes in 2012, you’ll be protected from fees/interest on your 2013 tax return with safe harbor if you pay $3,000 in 4 installments on 4/15/13, 6/17/13, 9/16/13, 1/15/14. If you make over $150,000 though you’ll have to tack on an extra 10%, so $3,300 in 4 installments.

Maximize Your Expenses & Donations

While I don’t recommend going crazy with expenses when you have your own business, what I do suggest is knowing what you can and can’t expense. In order to minimize the amount of taxes you have to pay, you’ll need to stay organized and keep clean books and records. Keep receipts for everything you buy, as well as all the business related services you pay for.

There are a ton of things that you can deduct from your income such as business cards, electronics, cloud storage, printer ink, tolls, gas/mileage, flights, meals and entertainment, license and registration fees, legal and accounting costs, payroll taxes, phone bills, office supplies, software, holiday parties, internet usage, etc.

Also keep track of any donations that you make, both cash and non-cash items. Always ask for a receipt anytime you make a donation. And make sure to have the thrift-shop value as well as original costs of any non-cash items in your records. Most places that accept goods have helpful guides on thrift-shop values broken out by category. Check these numbers and don’t go widely out of range. If you claim an old t-shirt you gave to Goodwill had a $250 donation value, that’s just not going to fly.

Process Your Reimbursements Regularly

It’s quite common to pay for a bunch of business related expenses with cash each month such as taxi rides, tolls, and travel meals. Don’t forget to ask for a receipt! And even though it may sound dumb, make sure you don’t lose your receipts or forget to actually process your expense report. It’s easy to do when you’re on the go and have a million things running through your mind.

Aim to reimburse yourself and log your expenses into the proper accounts on a monthly basis, or at least quarterly at a minimum. You should be monitoring the performance of your business regularly throughout the year, and keeping on top of bookkeeping is key to having reliable earnings reports.

Submit W9’s So You Can Get Paid

A lot of businesses require their clients to have W9 forms on file before they can process any payments. W9 forms are really straight forward and take less than 5 minutes to fill out. So anytime you sign up with a new business partner whom you expect to earn money from, make sure you submit a W9 if they ask for one!

And if your address or tax ID ever changes, make sure to send in an updated form so you’ll be able to receive checks at your new address and get accurate 1099 forms that you’ll need to file with your tax returns.

Pay Yourself A Reasonable Salary & Bonus

When you run your own business, you quickly realize how brutal taxes can be. When you are an employee of your own company you get stuck paying payroll taxes twice, once as a corporation and twice as an employee. This may tempt you to avoid payroll taxes all together. Keep in mind however that the government figured out many years ago that many S Corp owners were doing this by taking very large distributions (which aren’t taxed when taken out) and paying themselves zero to very small salaries.

Just be aware that when you file your returns, the government will look at your business classification and compare the salary you’re paying yourself to that of others in your field. They’ll also look at how much you took in distributions and if you paid a significant amount to independent contractors. The government doesn’t like it when companies avoid payroll taxes by paying people as independent contractors when they should be paid as employees. While there is no black and while rule on what is acceptable and what isn’t, you’ll want to do some research on what is common practice in your line of work. Otherwise you could find yourself having to explain yourself in an audit, and nobody wants to deal with that type of added stress!

–

Now take a deep breath and pat yourself on the back for finishing Part 1 of my Tax Tips For Entrepreneurs. Believe me, I completely understand how overwhelming taxes can be. But the more you educate yourself on the tax system, rules, and requirements, the easier it gets and the more money you can save on taxes! If you want to run a successful business, you owe it to yourself to be organized and proactive about your company’s finances.

Be Sure To Check Back In For Tax Tips For Entrepreneurs: Part 2 next week!

Untemplaters, how long have you been filing taxes? Have you ever had to pay penalties and interest for missing a tax deadline? Do you have any tax tips for entrepreneurs from your own experience?

Note I am not an accountant or tax professional. Any decisions you make are your own. Please review our disclosures for further info. Copyright 2013. Original content authorized only to appear on Untemplater.com. Thank you for reading!

You are correct that being an employee of our own company we have to pay taxes twice, both as a corporation and as a employee. I am also facing the same problem being a small business holder. I think its better to take advice of some tax consultants, they can tell us very well about our Tax rebates etc.

I know it’s such a blow to have to pay taxes on both sides!

I missed one of the estimated tax deadlines last year, too. 🙂 Now I keep the deadlines on a Google Calendar.

One caution about taking deductions for expenses — if you’re planning on applying for a mortgage, you actually want to push your AGI to be a bit higher. Mortgage underwriters base your qualification off your “bottom-line” earnings, so if you write everything off, you’ll put yourself at a disadvantage when it comes to getting a loan. Ditto for applying for long-term disability insurance. The underwriters look at your AGI, so if you write off too much, you won’t qualify for adequate insurance.

The system just isn’t well-set-up for self-employed people!

It can be so easy to forget can’t it?! Great tip on applying for a mortgage and lt disability coverage Paula. Banks and insurance companies are getting so strict these days and they definitely seem to be harder on the self-employed.

I started a computer business in college with my roommates. A three-person partnership is an expensive way to run things, and eventually one guy dropped out and became a contractor for us instead to save on filing fees. His compensation just happened to be 1/3 of our profits. 🙂

After college, I tried to go it alone for a while, but wound up giving up. Apparently I didn’t give the state division of taxation the proper form for canceling a business and 3 years later got a notice in the mail that I owed back sales taxes. Even though I didn’t actually collect any sales taxes in that period. Luckily, the state was offering an amnesty program at the time and would waive all of the late fees if I filed. So I filed 12 quarterly sales tax returns of $0 and the correct form to inform the state that I had ceased operations and was no longer collecting sales taxes.

Wow, what a perfect example of how much paperwork can be involved with running a business. What a pain to have to file 12 forms to get out of that when it could have been explained in just one. Thank goodness you were able to correct the error to get out of owing “back sales taxes” that didn’t exist!

Good tips Sydney. S-corp seems to be a little better to save on payroll taxes.

I’m curious about the safe harbor rule. Seems a little greedy and presumptuous the government expects one to pay more or at least as much as the previous year every year! Business do have down years!

The government is smart for milking people and taking care of itself first which is why I’m shocked people don’t contribute to their 401ks and do contribute to ROTH IRAs.

If a business is losing money, then you can chose not to pay the safe harbor amounts. Assuming nothing else in your tax situation changed, you wouldn’t need the safe harbor protection from underpayment penalty fees and interest because your income would be lower than the previous year. I’m certainly not a tax expert, but that’s the way I understand it. Safe harbor comes into play when your income is going up.

I usually try to get my taxes out of the way as early as possible, too. However, about halfway through filling out the forms this month, I realized I was going to have to pay in for the first time ever, and I lost my motivation . . .

That’s a bummer. I owed money last year and I was so disappointed. It happens to all of us at some point. You may want to consider raising your withholding during the year so you won’t get caught with another payment owed next year.

As someone with a regular day job who is also making a bit of money online (and hoping to become an entrepreneur eventually), what little I’ve seen about taxes leads me to believe that I would need an accountant.

Taxes are complicated enough when you just have a W-2. Add in all the business rules and I think paying an accountant will be much more worth it than spending the time and effort to figure it out myself.

Finding a trustworthy and knowledgeable accountant is worth the peace of mind and time savings when you have a complicated tax situation. There are so many tax rules that are constantly changing, so it saves a lot of confusion and stress being able to rely on someone who’s job it is to be well informed of all of those issues.