Personal Finance can be daunting, it’s often associated with keeping every receipt, logging every purchase and punching numbers until your fingers are raw. I remember my eyes longing for a distraction every time my friend would start talking about it. I figured since I was not making a large salary, I could simplify by doing the counting and predictions in my head. Why complicate things, right?

Not too long after, I was hired for a new job. I needed to borrow some money in order to pay for the move, rent (deposits and agency fees) and for living expenses that would accumulate before I got my new salary. I asked the same friend if he could help me, and he agreed on the conditions that I set up an Excel table and plan all my expenses. I didn’t need to show him my finances, he just wanted to help me get started. I agreed and after putting together a simple Excel table, realized that I could move even without borrowing and increasing my debt!

Quick and Easy

I live in Europe and tools like Quicken don’t work with banks here (perhaps a legal limitation) so I have to track my expenses manually. A strong desire for simplification made me rethink the idea of keeping my receipts and tracking every cent spent, so that I now spend about ten minutes a week to keep tabs on my spending, that includes: general spending, insurance, savings and debt repayment.

Categorization of Spending

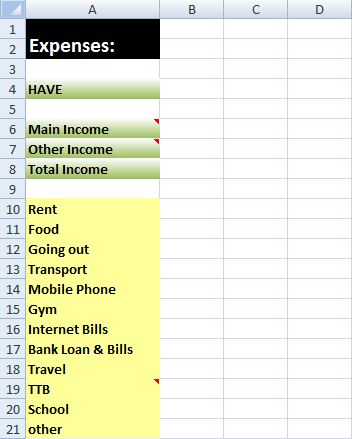

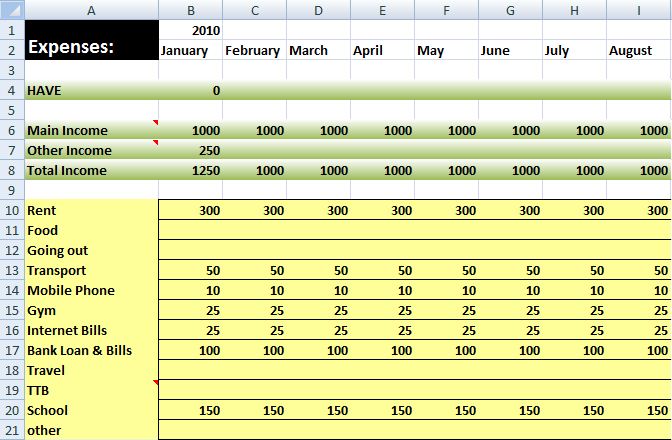

The idea is to have an Excel table where you will define the categories of where your money is coming from and where it is going, as is shown below:

Define a few more categories in the bottom for additional calculations:

It is also a good practice to highlight categories with different colors. As you can see I am using green for all income and savings, yellow for expenses and blue for general calculations and information.

Timeline

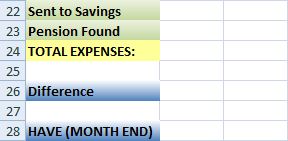

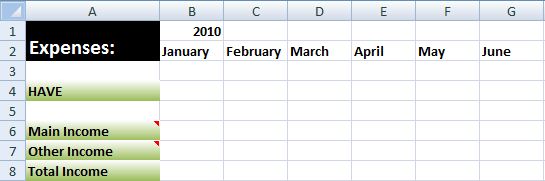

Our next step will be defining the timeline. As I am paid on a monthly basis, I track spending month to month. You can use weeks or what seems logical for you. Add the timeline to the right from the “Expenses” column as is shown below:

A timeline is one of the most important elements of Personal Finance. With the help of a timeline you will be able to track your past performance and see what to aim for in the future.

Calculations

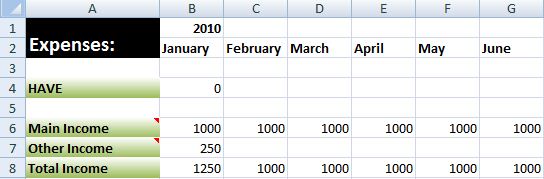

Calculations are quite basic and you should be able to perform them in any table processor. The category “Have” tells you how much money you currently can work with. I started it with zero.

“Main Income” is for your reoccurring salary after taxes. For this example I’ll put 1000.

“Other Income” is for occasional bonuses and extra earning. Just remember not to put any numbers in here before you actually get paid.

“Total Income” should be a sum of “Main Income” and “Other Income.” Use the formula to add them up automatically. Here is what it all should look like after you put all the numbers in:

Now you need to enter your categorized spending. Expenses that are steady and reoccurring like: rent, membership fees and bank payments worth putting into the chart in advance. This is what it should look like:

After accomplishing this you can already see what your allowance for things like traveling, food and going out will be.

Add two more lines that will sum up all of your expenses for each month, and show you what you’ve got left respectively.

Savings

I consider savings as a necessary expense in my table so that there is less temptation to use it. Add a line, perhaps highlighted with different color, for the amount of money you are setting aside each month. I do it separately for each savings account I have.

Tracking

Once you’re set and have everything filed, it is time to start tracking your expenses. To ease into it, I would advise using your debit card and then go through the transactions periodically using an internet banking application or a bank statement. Categorize every transaction and fill it into the table in the appropriate line, and after about three to five months you’ll see how much you generally spend for going out and food, so that you’ll be able to forecast your financial situation without having to go through bank statements all the time. Just don’t forget to perform a periodical review to do the adjustments!

In Conclusion

Using such an Excel table to track my finances allowed me to travel across Europe and the US while still saving and repaying my debt. A few times I got carried away, and tried to calculate in too many factors and over-define my expenses: don’t forget that the idea of Personal Finance is to make your life easier and not add more burden, keep it simple and workable for you.

Good to see you are treating savings as an expense as that is what it should be and many people fail to realise that. The earn, pay taxes, live and then save on whats left which is usually nothing. Great post.

I’ve tried an Excel sheet a few times, but I just couldn’t get it to do what I needed it to do. 🙂 I guess there’s a point for me where it would just be TOO simple to get any usefulness.

I also couldn’t spend 10 minutes a week on tracking our finances. The time is not such a problem (although I probably spend closer to 30-60 minutes a week), but the frequency is not enough for me. If I don’t check in every 2-3 days with my envelope balances and what’s going on, it becomes “out of sight, out of mind.”

I guess the most important thing about budgets is that they’re unique to almost every individual on the planet. Well, okay, there are like 6 “general” types, but you know what I mean. 🙂

The hardest thing in budgeting is getting started. When you have your budget plan in place all you have to do is plug in the numbers and adjust them once in a while.

Good post, this is the biggest thing I struggle with… i *MUST* get better at it 🙂 Thanks for the suggestions!

Is it so hard to spend less than you earn? That is the question. Personal finance isn’t about finance at all. It’s about psychology.

This is an excellent example of an effective and efficient tracking system. I fell into the problem of making mine too complicated. While my spreadsheet is pretty and has a lot of features, it needed a whole lot of time to set up and more than I wanted to spend to keep it running (though probably about 15 minutes a week, realistically).

I might have to go back and strip it down, following your example…