Ah summer. I LOVE the long days with sunsets at 8:30pm. I used the late sunsets to my advantage the last couple weekends and did some gardening in the evening hours. May was pretty darn foggy in San Francisco though and on the chillier side. A lot of locals complain about the fog, but I kinda like it. I don’t like the arctic blast it can bring with it, but I love how the fog looks and how it rolls in over the city like a blanket.

Ah summer. I LOVE the long days with sunsets at 8:30pm. I used the late sunsets to my advantage the last couple weekends and did some gardening in the evening hours. May was pretty darn foggy in San Francisco though and on the chillier side. A lot of locals complain about the fog, but I kinda like it. I don’t like the arctic blast it can bring with it, but I love how the fog looks and how it rolls in over the city like a blanket.

I didn’t realize that the SF fog is actually nicknamed Karl the Fog until recently, which I think is awesome. He was named by an anonymous twitter account @KarlTheFog. The inspiration came from Tim Burton’s character “Karl” from the film Big Fish, a giant everyone feared because they thought he was going to attack, but he was just lonely and hungry.

In SF, “Karl is a constant character in our lives. … Some people love how he keeps the city cool, others hate that we don’t get traditional summers. They spot him from all over S.F. and many people have choice words for his arrival. Everyone knows and sees the fog,” says @KarlTheFog.

Besides hanging out with Karl in May, I took some time off to recharge from my April work overload. It was totally worth it!

New Here? Welcome! Be sure to check out my about page and read how I got paid to break free from a grueling desk job. I publish monthly income reports to track my progress and push myself forward.

2016 Goals Update

I have three main career goals for 2016 and I’m actively hustling to meet or beat them this year. In each of my income reports, I provide a quick update on my progress:

1) Goal: Invest At Least $5,000 Every Month

I continued to be uninspired by the stock market in May so I decided to forgo investing like I did in April. I paid off another $3,000 in mortgage debt instead. Technically, I was one day late because I went to the bank on June 1st instead of May 31, but I counted that as my May contribution. However, that one day difference ended up causing me undue stress.

Why? Even though the $3,000 debited my checking account on June 1st, it didn’t actually get reflected in my mortgage account until June 10th. My personal banker told me there was a system delay when I inquired around June 6th, but she wasn’t very specific.

My money basically went into a black hole until I went into a branch on June 10th and made a banker track it down. She was able to get someone to manually push it through. Basically the problem was since I went in on the 1st of the month, the bank’s computers got confused because my automatic monthly payment hadn’t come in yet (it normally processes on the 6th of every month). Long story short, if you use auto pay for your mortgage and want to pay down extra principal, wait until your auto pay clears for the current month, and then go into the branch or do the transfer online before the last day of the month. Lesson learned.

2) Goal: Grow My Net Worth By $75,000

I am on a quest to become a multi-millionaire! It’s a long journey, but an exciting and fulfilling one. If I can grow my net worth by $75,000 this year I’ll pass a net worth of $1 million and will be in good shape to hit some financial goals I want to reach before I turn 40. How do I plan to accomplish this goal? I plan to save as much as I can freelancing and hoping my investments continue to rise in value.

I continue to have suspicions about a slowing property market in San Francisco. Many real estate agents I’ve talked to say the market has softened in recent weeks, mostly for condos, which makes sense. Condo supply has been increasing so it’s natural that demand is going down, but plenty of people are still buying. Single family homes are still selling like hot cakes and I’m not worried about my property’s value dropping off a cliff or anything.

3) Goal: Grow More Traffic

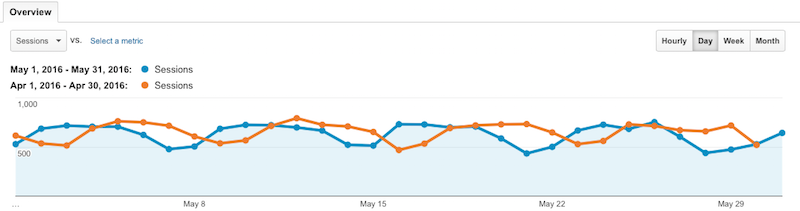

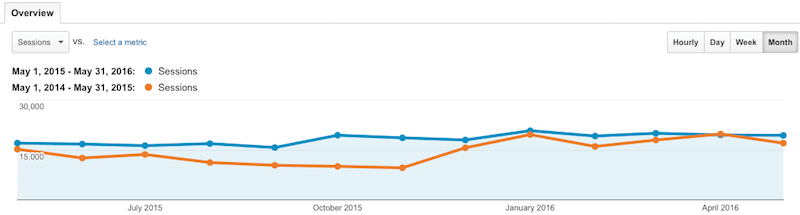

Growing traffic is easier said than done, but I keep reminding myself its possible as I’ve witnessed by many other sites. April was the first warning sign that that seasonal slowness was on its way and summer has arrived. Month over month, May was flat which is fair. I’m happy that the YoY chart shows a wider gap again with May 2016 sneaking above May 2015.

A big welcome to the new readers and another thank you to the regular readers. All of your comments are much appreciated!

May vs April:

Year over Year:

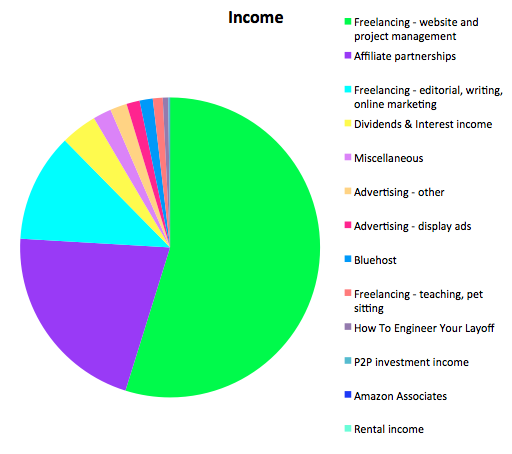

Income Report May 2016

Onwards to my May Income report…

Total Revenue Streams = $12,698

FREELANCING: $8,580

- Project consulting $6,960

- Editorial, writing, online marketing $1,485

- Teaching music, pet sitting, misc. $385

INVESTMENTS: $516

- Dividends & Interest income $495

- P2P investment income $21

- Rental income $0

ADVERTISING & AFFILIATE: $3,122

- Affiliate Partnerships: $2,682

- Contextual Advertising (Adsense): $181

- Bluehost: $180

- How To Engineer Your Layoff $75

- Amazon Associates: $4

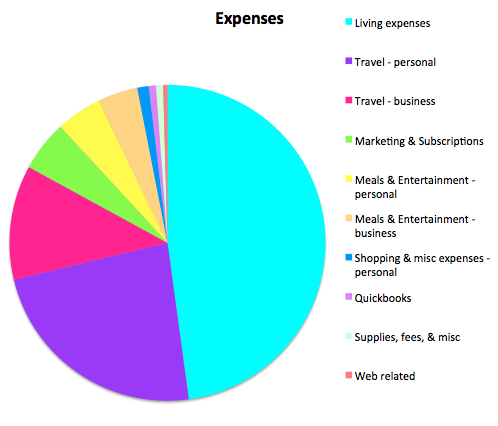

Expenses = $(6,835)

BUSINESS: $(1,565)

- Aweber, Marketing, Subscriptions, Fees: $(355)

- Meals & Entertainment – business: $(280)

- Travel – business: $(800)

- Quickbooks: $(50)

- Supplies & misc: $(50)

- Hosting, web related: $(30)

PERSONAL: $(5,270)

- Living expenses: $(3,270)

- Meals & Entertainment – personal: $(320)

- Shopping & misc expenses – personal $(80)

- Travel – personal: $(1,600)

$12,698 (Income) – $6,835 (Expenses) = $5,863 PROFITS

May Takeaways

My perfectionist and workaholic tendencies pushed me to my limits in April. May, on the other hand, was a welcome breather with a fabulous work/life balance and I had a great chance to rest and recharge. Karl the Fog hung around a lot when I was home, but that was fine with me. I welcomed hanging out on the couch watching some movies and decluttering around the house instead of being stuck in an office for 13 days straight.

Sure it would have been nice to have made as much as I did in April, but I’m glad I took my foot off the gas in May. The days are flying and it’s pretty crazy there are less than two weeks left in June already. We gotta make the most of our summer days and not lose sight of our goals in the process. Just be careful how much you spend this summer if you want to keep your financial targets on track!

Recommendations

Start Your Own Website – Want to make more money? Work on building your brand by creating your own website the easy way with Bluehost for super cheap. You can register your domain for under $20/year and get hosting for only $3.49/month. Whatever your interests are, focus on building your skills and developing your own unique niche! I’ve been blogging since 2010 and it has allowed me to break free from the corporate grind to travel, work from home, and do so many more things I’ve always wanted to do but couldn’t. There’s not a week that goes by where I’m not thankful for starting this site!

Break free! If you’re burnt out of your day job, believe that you have options and can turn your career around. I didn’t believe I could escape for the longest time, but fortunately I wised up before I destroyed my relationships with family and my health. I never would have thought I could negotiate a severance package and get paid to leave a job I grew to hate, but I did! Learn how you too can get paid to leave your job like I did and open your eyes to new opportunities.

Untemplaters, is your summer in full swing? Do you have any specific goals you want to achieve in the next few months?

Copyright 2016. Original content and photography authorized to appear solely on Untemplater.com. Thank you for reading!

Thanks for sharing your report! It’s interesting to see that you mention your living expenses as well. Most bloggers do not, so that was an interesting take.

No problem, thanks for checking it out. 🙂 Glad you enjoyed my report Anne!

Very inspirational! I look forward to seeing more of your success :o)

thanks, appreciate it!

Looks like your consulting is continuing nicely. I started picking up some more consulting work. It’s a mixed blessing. I’ve enjoyed having a break, but the income is good to have.

Time to start buying rental property. Could definitely use more passive income rather than active.

Nice job! Yeah I hear ya. It’s not easy picking up more hours when you already have a lot on your plate, but the extra income can really pay off nicely.

Love paying down chunks of principal during random periods. It adds up after a while.

I like that big purple wedge for travel. What’s the point in running an online business without the ability to travel right? Whoo hoo!

Sam

It really does add up!

It looks like you had another great month, Sydney, despite the decline in income. A little R and R never hurt anyone.

I am very glad to have read about your experience with making an extra principal payment on the mortgage. I had no idea that the timing of the additional payment could cause such major problems. Imagine if you hadn’t been persistent with following up with the bank. . .

Yes I know! It’s very likely the bank would have eaten that extra money. I’m so glad I kept my receipt and got that sorted out!