Happy Independence Day! July 4th makes me so happy to be an American and so thankful that I’m financially independent. I used to worry a lot about money when I was younger. Hearing my parents fight about money sucked. Then, living paycheck to paycheck was a grind. I had doubts if I’d ever be able to escape the rat race. But low and behold I did it! Re-reading my first net worth update from six months ago reminded me how much I’ve changed and how far I’ve come over the last two decades. Time goes so fast. If I could sum up one thing about my net worth over the years though it would be that loving money leads to financial independence!

Happy Independence Day! July 4th makes me so happy to be an American and so thankful that I’m financially independent. I used to worry a lot about money when I was younger. Hearing my parents fight about money sucked. Then, living paycheck to paycheck was a grind. I had doubts if I’d ever be able to escape the rat race. But low and behold I did it! Re-reading my first net worth update from six months ago reminded me how much I’ve changed and how far I’ve come over the last two decades. Time goes so fast. If I could sum up one thing about my net worth over the years though it would be that loving money leads to financial independence!

I used to be intimidated by money because I was scared about not having enough. While I still have fears about my income drying up someday or being faced with insurmountable expenses for my aging parents, these fears are sporadic, fairly small and thankfully don’t keep me up at night.

First came fear of money, then came love

Although I attribute my fears surrounding money as my initial motivation to work hard and build my career, I attribute my love of money as the ongoing impetus that enabled me to reach financial independence and maintain it.

Why is it that loving money leads to financial independence? For me, it stems from the sheer excitement of seeing more and more money in my accounts as each month and year passes. I love that money so much I don’t want to spend it. Of course I do spend some of it, but I take my time when I do. I never was much of an impulse shopper and the financial crisis helped eradicate any ounce of impulse shopping-itis I had in me.

My love of money has taught me the benefits of delayed gratification, waiting for sales, weighing wants versus needs and fully utilizing what I already have and donating what I don’t use. I’m sure a lot of you share these traits too.

Loving money has also taught me how great it feels to work hard and live a comfortable lifestyle that costs less than what I bring in each month. I love money so much I will do practically anything to avoid paying fees and interest. I’ve paid off my credit card bills in full every month since my early 20s and have contributed to my retirement accounts every year since my mid 20s. I also do what I can to maximize my tax deductions and minimize what owe.

Mid-year 2016 net worth update

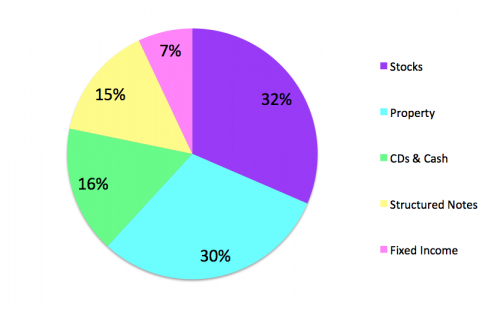

I ran my numbers over the weekend and am thrilled to announce I surpassed a $1 million net worth at roughly $1,083,700! Picking up extra work in the last six months really helped a lot along with having a diversified asset allocation and not spending that much. Here’s how my current asset allocation shakes out:

In the last six months, my portfolio allocation has changed the most in terms of fixed income (-12%), stocks (+8%) and cash (+5%). I’ve been pretty focused on buying equities this year and saving cash. I would like to increase my fixed income exposure, however, but bond prices are on the high side right right now I feel it’s best I wait a bit until I add to my positions.

Take a look at the iShares Barclays 7-10 Year Treasury Bond Fund (IEF) chart below. I don’t want to buy at the 12 month peak. If IEF drops back down in the 110 range, however, I’ll probably buy some more. But I’m just going to wait and see for now.

Beware of Brexit and its ripple effects

Hopefully all of you have been following Brexit in the news or have at least heard about it. If not, the basics that you need to know are:

- On June 23, 2016 the citizens of Great Britain voted to leave the European Union.

- “Britain” mashed with “exit” = “Brexit”

- It should take at least 2 years for Britain to officially exit the EU due to regulations and negotiations of trade agreements and policies.

- There is a lot of uncertainty around the future of both Great Britain and the other members of the EU. This not only affects their economies, it also affects non European countries including ours.

- Greater economic and political uncertainty = greater market volatility and increased risk of recessions in the coming years.

In other words, there’s a heck of a lot going on in Europe right now that isn’t helping the global economy. Based on a lot of research I’ve been doing and my own observations, I expect European and the U.S. to experience economic slowdowns. It wouldn’t surprise me if we fall into another recession in the next 1-2 years.

What does that mean for you and me? Save your money! Think back to how you felt during the financial crisis. It was a stressful and scary time for all of us. Did you wish you hadn’t spent so much in the months and years leading up to the crisis? Perhaps you wished you had more money in your emergency fund because you got laid off or had your hours cut back.

I’d rather be overly prepared than caught off guard if another recession is on the way. So I’m being conservative with my cash and taking extra work where I can find it.

Start tracking your own net worth

The more I learn about personal finance and dig into my own finances, the more I’ve come to love and appreciate money. We all come from different backgrounds, careers and locations, but we can all benefit and thrive from financial independence. Even if you still have student loans to pay off or are struggling to pay down credit card debt, don’t run away from personal finance – run towards it!

Every little bit counts when it comes to paying down debt and growing wealth. I encourage you to start tracking your net worth if you haven’t already. The more financially aware you become, the greater your chances are for becoming a hundred-thousandaire and then a millionaire.

If you want an easy way to track your own net worth for free, sign up with Personal Capital. Quickly link your checking accounts, savings accounts, investment accounts, mortgage, student loan debt, credit cards, etc. all in one place. The best Personal Capital features are their Portfolio Fee Analyzer tool and Retirement Planner. They’ve got a lot of free financial tools to help you manage debt and grow your net worth.

Untemplaters, do you think loving money leads to financial independence? Are you actively tracking your own net worth? Where do you expect the economy to go in the next couple years?

Congratulations an reaching millionaire status, Sydney! Your portfolio looks well-balanced to me, so I imagine you’ve reached this milestone to stay!

Thanks a bunch! I do like having a diversified portfolio the older I get. It was difficult when I was younger and had less money and not as much knowledge about bonds and alternative investments.

I am thinking along the same lines – conserve cash, cut expenses, find work where you can, I also reduced my international equity exposure a few months back. I don’t know what will happen with Brexit and the rest of Europe, but I would rather keep my allocation diversified. For my long-term, tax-deferred accounts, I am at about 45% US stocks /20% bonds / 20% real estate / 10% international / 5% cash.

I think 10% international sounds pretty good. I bet you were happy on June 24 that you had already reduced your intl exposure. The initial shock of Brexit pounded both domestic and international stocks, but I think it’s good to have some intl exposure when looking at the big picture. 75% of listed companies are based outside the US after all – so lots of opportunities out there.

Congratulations – becoming a millionaire in your thirties is something not many people will accomplish. Especially considering your relatively defensive portfolio. It sure is motivating for me!

I do wonder – has your M status changed your motivation already or do you still have a clear focus on those MM you wrote about earlier this year?

Thank you! I never would have thought I could have accumulated this much when I was in my teens and early 20s. I’m thankful I have a frugal gene and like to work! I think achieving millionaire status has motivated me even more to hit multi millionaire net worth in the future. Anything could happen, but I love watching how my savings continues to grow and hope the momentum keeps going.