If you haven’t already heard, I have officially entered the world of full time freelancing and self employment! Aaah! Yes, it’s a bit scary, but fortunately so far it’s much more exciting. I’ve been blogging and working on side jobs for the past five years, partly to make better use of my free time, and mostly to prepare for leaving a managerial career path I knew I didn’t want to pursue for the long haul.

If you haven’t already heard, I have officially entered the world of full time freelancing and self employment! Aaah! Yes, it’s a bit scary, but fortunately so far it’s much more exciting. I’ve been blogging and working on side jobs for the past five years, partly to make better use of my free time, and mostly to prepare for leaving a managerial career path I knew I didn’t want to pursue for the long haul.

My mid 30s snuck up on me, but fortunately I’ve patiently built up my savings, and feel ready to make the most of this new chapter in my life. Now more than ever I believe our 30s are even better than our 20s too. While I don’t really regret all my past years of working (it wasn’t always draining), I was in denial for a long time that things weren’t going to turn into unicorns and rainbows on the path I started after graduation.

You see I had a love hate relationship with my last day job, which turned into more of a bitter, tired, and frustrated marriage gone sour towards the end. I needed out. I had incredible benefits, worked with some incredible people I adored, but there were actually a good number of others I couldn’t stand, and I burnt out.

The slow burning fuse I thought would last me a few more years ended up burning out really fast in the last 6-8 months, and it was turning me into a different person. I had given over ten years of my life, slowly lost my confidence and pride, and shed too many tears of frustration over my time there. The stress became toxic and I stopped feeling appreciated. NOT a healthy environment even for someone as laid back, patient, and caring as myself.

I didn’t want to walk away empty handed though, so I took the sage advice of Financial Samurai and negotiated a deal to get paid to leave my job (more to come on that in an upcoming post). I took a lot of deep breaths, sat in on some tough conversations, yanked out the plug, and now here I am!

Getting Over The Awkwardness Of Publicizing My Income

I’ve had mixed feelings about publishing an income report for the longest time. I clearly remember my early years of blogging when I’d look in my Google Adsense account and get so depressed. It’s hard to get excited about 5o cents lol! But now that I have no job, I need to be disciplined and held accountable for making a living for myself.

Please know that as a very private person, it’s really WEIRD for me to expose myself financially, but I think it will be good for me. After all, in order to grow we usually have to feel uncomfortable for a while to move beyond our existing comfort zone.

I need to be more business focused now that my survival depends on it. And I think getting into the rhythm of analyzing my progress month over month is critical if I want to thrive in this exciting and dog eat dog world of self-employment.

Perhaps my income reports may inspire some of you to pursue a new career path, and start your own adventure. I never thought I could be a blogger before I started, yet I managed to fumble my way through it and learn over time. Perhaps you want to learn how to be a freelancer too. There are lots of different routes and possibilities such as being a web designer, making money as a creative, or opening an own online store to earn extra money. I’ll be talking about all of this going forward. Now onwards to goals and numbers…

Three Business And Online Goals For The Next 12 Months

1) Grow More Traffic

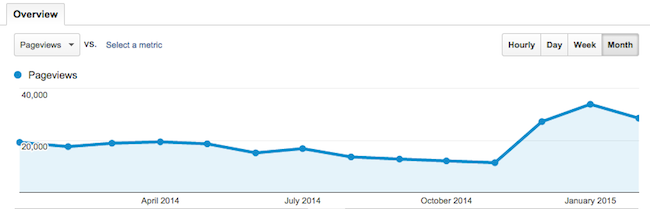

I need to start paying more attention to metrics and analytics. Untemplater’s traffic a year ago was about 17k pageviews a month, and began to fade in the Summer and Fall 2014. Fortunately, things started to uptick in November, and January 2015 traffic was my highest ever at 34k.

I had a dip in February 2015 (which was a few days shorter than January), but hopefully traffic is stabilizing and not going to drop back down significantly in the coming months. My goal over the next twelve months is to build Untemplater’s monthly pageviews by 50% to 45k. If I can manage to double it to 60k, even better. More traffic equates to more revenue.

2) Land More Freelancing Gigs

Right now I have a couple freelancing jobs that I love. I can’t get into the details because of NDAs, but they are primarily content creation, social media, and SEO related roles for various websites, large and small. I’d like to expand and explore other opportunities as well this year, perhaps outside of blogging. Although the pay is low, maybe I could teach music lessons again, or use my many years of experience in recruiting to provide resume services.

3) Build More Affiliate Income

Affiliate income is the best way to earn revenue online if you can find the right products to highlight. The goal on Untemplater is to help promote an alternative lifestyle that’s more free, happy, and healthy. To be able to extricate ourselves away from the corporate grind, we must first build a solid financial foundation, which is why I use Personal Capital to keep track of my finances for free. Second, I’m highly in favor of finding ways to earn a livable income stream online from anywhere in the world. Finally, I’m here to share my mistakes and learnings as I take on this new and exciting adventure!

Income Report February 2015

Ok now that I’ve shared my three main goals online, here’s my February 2015 revenue!

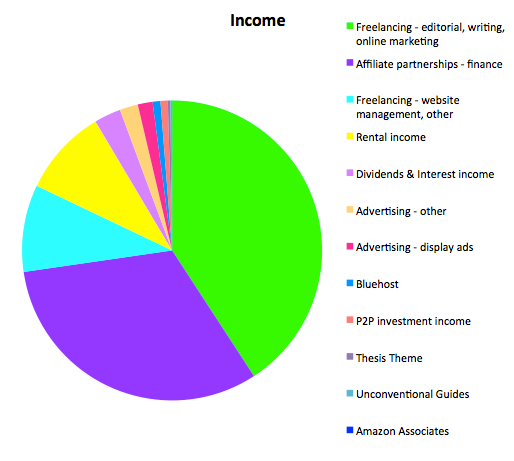

Total Revenue Streams = $10,659

FREELANCING: $5,350

Editorial, writing, online marketing $4,350

Website management $1,000

I currently have a few main clients and am looking for another to bolster my freelance income. Work for my clients can be done remotely, which is one of the great benefits of doing internet freelance work.

INVESTMENTS: $1,390

Rental income $1,000

Dividends & Interest income $307

Prosper P2P investment income $83

I’ve been investing in CDs and the stock market since 2000 and have built a multiple six figure investment portfolio. My investments are relatively conservative (60/40 equities/fixed income allocation) as I look to achieve a 5-8% return with minimum volatility. Without a full-time income stream, it’s now more important than ever to protect my principal.

I’ve also been investing in P2P with Prosper since 2013. So far, my returns are roughly 7.5%. I’m gradually adding money into my P2P account and diversifying my holdings away from just A and AA loans to try and increase my rate of return.

I also just opened a Motif Investing account, which offers the cool feature of creating custom motifs of up to 30 stocks and ETFs for only $9.95. Motif is a great platform that allows people to easily invest in their ideas at a low price. There are over 150 professionally built motifs to choose from, and over 70,000 community built motifs too.

ADVERTISING & AFFILIATE: $3,919

Affiliate Advertising: $3,400

Direct Advertising: $210

Contextual Advertising (Adsense): $170

Bluehost: $90

Thesis Theme: $29

Unconventional Guides: $20

Amazon Associates: $1

Profitable Online Store: $0

Miscellaneous: $0

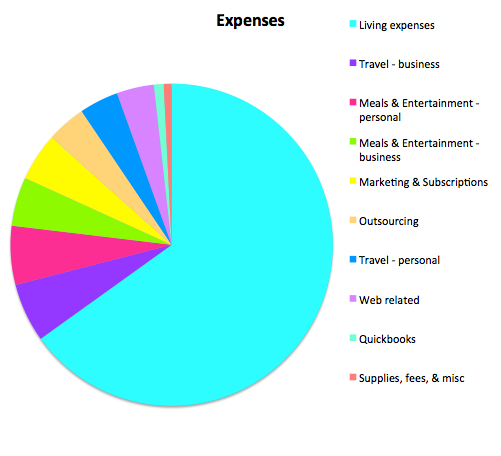

Expenses = $5,085

BUSINESS: $1,275

Travel – business: $(300)

Meals & Entertainment – business: $(250)

Aweber, Marketing, Subscriptions, Fees: $(245)

Outsourcing: $(200)

Hosting, web related: $(190)

Quickbooks: $(50)

Supplies & misc: $(40)

Beyond the fixed costs of running an online business (hosting, Quickbooks, internet access, Aweber), it doesn’t cost too much to run an online business. You can create your own website and run an online business for as cheap $3.95 a month by just opening up a Bluehost account, or you can easily spend thousands and thousands a month if you start traveling to conferences, taking out clients to dinner, paying for advertising and so forth.

When running a lifestyle business, I suggest trying to keep expenses as low as possible in the beginning, and gradually scale up to a sustainable level where you feel the returns on your expenses are at its optimal level.

PERSONAL: $3810

Living expenses: $(3,310)

Meals & Entertainment – personal: $(300)

Travel – personal: $(200)

It’s expensive living in San Francisco, but I’m not sure there’s any other place I want to live. I grew up in the East Coast, and was just back there visiting my parents, and I’ve got to say that California is the place to be. I might one day geo-arbitrage to a cheaper location to run my business. But for now, there’s so much opportunity in San Francisco due to the tech and internet boom. However, Hawaii might be an excellent place to work as well!

PROFITS: $10,659 (Income) – $5,085 (Expenses) = $5,574

February Takeaways

I thought it’d be hard to put together this income report, but it wasn’t as difficult as I imagined. Once I got started, I actually found it quite fun and insightful. Of course I’m sure my level of enjoyment in generating these reports going forward will largely depend on how well I’m doing. But that’s how it should be. If I’m unhappy that I’m not doing well, I can only blame myself and work harder.

My profits before taxes of $5,574 represents a 52.2% operating profit margin ($5,574 / $10,659 revenue). My goal is to save 100% of my after tax profits every single month. In other words, after paying an estimated 25% effective tax rate ($1,393), I will save roughly $4,180 that will go towards my various investments. My monthly net savings rate after taxes is therefore around 40%. I may also utilize some of the earnings to promote my business at some point in the future.

Things are certainly unpredictable in the world of freelancing and blogging, so saving and working as much as possible while times are good is an important part of my business mentality. I still remember the 2008-2010 downturn very clearly. My goal is to build up my savings, investments, and online business so that even if another downturn happens again, I won’t have to find a full-time job again.

I’m determined to live the Untemplate lifestyle for the rest of my life!

Recommendations

Personal Finance – If you’re interested in tracking your own finances, sign up for a free account with Personal Capital. Link your credit cards, checking accounts, mortgage, student loan debt, savings accounts, investment accounts, etc. all in one place. Their reports and analytical tools really make it easy to monitor your financial health and helps you set goals. I’ve had an account with them for several years and love how easy and intuitive the platform is.

Be your own investment manager – I also recently opened a trading account with Motif Investing. I love their business model of buying baskets of securities, i.e. motifs, for one low rate of $9.95. They have an easy to browse product catalog of professionally created motifs that experts have crafted so you don’t have to wrack your brain figuring out what to buy/sell. It’s fun to invest in ideas to grow your wealth.

Become A Freelancer – Motivated to become a freelancer? The possibilities are endless! If you’re a creative, learn how to sell your products and create your own online store. Like to write as much as I do? Find out how to get published and earn money as a writer. Whatever your interests are, work on building up your skills and developing your own unique niche.

Are you by any chance burnt out of your job like I was? Believe in yourself that you have options and can turn your career around. I didn’t believe I could escape for the longest time and now I realize how foolish I was. Learn how to get paid to leave your job like I did and open your eyes to new opportunities.

Untemplaters, have you ever shared an income report with someone either online or in person? How did you perform in February? Do you share any of my goals and aspirations?

Congratulations on your jump to freedom. I’m transitioning from one form of self employment to another so it kind of feels like I’m making that jump again.

It can be a bit of a roller coaster ride but it’s always interesting!

Thanks Diane! Transitioning sure can feel nerve-wracking but also really exhilarating. 🙂

Best of luck with your new gig!

Wow, great diversification of income! You are definitely ready to take the next step. I’m glad you were able to arrange an amicable departure with your employer too.

Solo premeditation can be challenging, but I swear there is nothing more rewarding than creating something from nothing!

Best of luck!

Sam

Thanks Sam. Yes, leaving on good terms was really important to me and I’m glad things worked out. Thanks for the luck and support!

Wow, congrats on getting out of the rat race! I can only imagine how exciting and liberating it must be to finally be working for yourself.

I can relate to the feeling awkward disclosing income to tens of thousands of strangers, but I think that you will find this is a supportive community. I am looking forward to following along and maybe finding the motivation to quit my 9-5 and take the plunge myself. Great post!

Thanks Brian! Yeah, it’s a lot of feelings mixed into one and fortunately a lot more of the positive feelings so far. It’s been great connecting with you and thanks for your support!

Hey Sydney,

It looks like you are off to a fantastic start. I am probably a few years behind you from being in a position that would make me feel comfortable to leave the corporate world. Although my 9 to 5 is making me a really good living…I am leveraging my 5 to 9 to build my dream and lifestyle business.

Love the use of the recommendation section. I recently added this new level of demonetization to my own blog. I think its great because it gives people a way to help you out for all the great content you produce. The other thing it does is allows you to monetize the the inbox of those readers that sign up through wordpress or through an RSS feed that never actually come to the blog.

Love what you are doing.

I do have plans to reach out and do a guest post on your site in the future.

Cheers!

Max out everything you can from your 9 to 5 while you can! I used my health insurance as much as I could, maxed out my company match on 401k, used sick days, etc and it felt awesome. You’re making great headway with your blog so far, keep up the good work!