It felt great writing my recent post, How I Negotiated A Severance Package And Got Paid To Quit My Job, and I’m glad that I am able to help spread hope to more people that it is possible to negotiate a severance instead of simply handing in your two weeks notice. Shortly after I published the post, a reader asked me a great follow-up question: Is it possible to get unemployment benefits if you have a side business but lose a day job?

Never having filed for unemployment myself before, I didn’t know the answer right off the bat, but the question definitely piqued my interest. I set out to try and find out some answers, and this is what I found.

There Isn’t A Simple Yes / No Answer

It should come as no surprise that there isn’t a simple yes or no answer to qualifying for unemployment benefits if you have a side business but lose a day job.

When it comes to anything government related, things usually aren’t going to be simple, easy to understand, or black and white. Don’t even get me started on the “T” word that almost made me want to shut down my business.

Unemployment Benefit Rules Vary By State

Anyway, what I quickly found out in my research is that when it comes to unemployment benefits, there is a vast range of rules and requirements between each of the 50 states. Go figure.

Things would be much simpler if all the states had the same rules, but that’s a debate for another day.

In my quest to get some answers, I focused my research on California since that’s where I live and I’m the most familiar with CA laws in general. Plus the longer I live here, the more I think CA is one of the craziest states when it comes to business rules, regulations, taxes, legal matters, and such.

Where else can you get dinged for not using your composting bin, pay tax on any state tax refund you received the previous year, or be forced as a business owner to itemize a 10 charge to customers who need a bag to avoid a $500 penalty?

Some of the more unusual rules are specific to San Francisco and many of the rules have good intentions, but they are quirky and confusing nonetheless.

What The California EDD Wants To Know If You File For Unemployment And Have A Side Business

First of all, the names of the agencies that handle unemployment claims vary by state, so check with your employer or your state’s labor department to find out whom to contact if you want to get more information on your state’s programs.

In California, the Employment Development Department (EDD) is in charge of everything unemployment related. The EDD not only handles unemployment, they also administer disability insurance, collect payroll taxes, offer job training, and have various workforce services.

I spoke with a representative from the EDD briefly to gain some insights on how the system would handle someone who lost a job but has a side business. Since everything eligibility related depends on specific circumstances in California, I presented the below scenario in order to get more information.

Example Of Unemployment Benefits With A Side Business

Example scenario: John has worked full-time for an employer named Computers, Inc. for six years in an IT role. In his spare time, he started his own s-corp business two years ago called John’s Tees. He designs and sells fun t-shirts.

John has one employee who keeps track of inventory, handles customer service, and works on new designs. Over the last six months, John tapered off his hours working on the side business and stops collecting wages, paying his employee to do all the work instead.

He remains the 100% owner of the s-corp, however. But one day, Computers Inc. has a restructuring and John is laid off from his full-time IT job. Is he eligible to file for unemployment benefits in California since he still owns a side business?

Unemployment Claim Q&A

Based on the below Q&A, the resulting answer is yes. You can qualify to receive unemployment benefits if you have a side business and lose your day job.

Question: Was John’s last employer Computers, Inc?

Answer = Yes

Question: Is John’s primary occupation IT and selling t-shirts is just a side business?

Answer = Yes

Question: Is John actively looking for full-time work in IT?

Answer = Yes

Question: Is John able to work full-time in IT?

Answer = Yes

Question: Did John perform any work for his side business during the two weeks on his claim form?

Answer = No

Question: Did John receive any distributions from his side business or other income during the two weeks on his claim form?

Answer = No

Side Business And Unemployment Eligibility

Result: According to the EDD rep I spoke with, John is eligible for unemployment benefits in California even though he has a side business.

The key data points seem to be his primary occupation is different from his side business. In addition, he is actively looking for a full-time IT job. His side business also isn’t preventing him from finding IT work, and he’s able to work full-time hours in IT.

Whether or not he worked on his t-shirt business or received income wasn’t an end all be all, but it does affect how much he could qualify to receive in benefits week to week.

Eligibility for unemployment if you are self-employed depends on what type of business activities you’re doing on the side. Generally, if you’re selling items you already own, that doesn’t count as wages earned from work and wouldn’t need to be reported.

But if you yourself spent time selling things you worked to create, that’s typically going to count as wages and you’ll need to report income received. You could still qualify for a partial benefit depending on your state.

Can You Collect Unemployment If You Freelance?

Let’s say John gets an opportunity to earn some money as a freelance graphic designer while he’s still trying to rejoin the workforce full-time in IT. Would he still be eligible for unemployment benefits?

It depends. Some states would outright say no. Other states actually encourage self-employment. And many, including California, need more information before they can determine eligibility.

John is required to report any freelancing and self-employment income to the EDD. That doesn’t mean he’s in trouble, he just has to report it. Partial unemployment benefits could be awarded even if he did freelancing work.

But if he earned too much money in a particular week, he wouldn’t qualify for any benefits that week. However, he could still file a claim and qualify for the following week. Everything goes week by week when it comes to unemployment in California.

How To Report Freelancing Income On The DE 4581 Form

Here are some notes about how to fill out the DE 4581 claim form if you need to report freelancing income:

Freelance Contract With Known Income

If you know how much you will earn for a freelance contract upfront, you should report the income on the day you perform the work.

For example, if John agrees with a client to design graphics for $300 and does 8 hours of work on June 1, he should report his 8 hours of work and $300 in income on his claim form for June 1.

This is regardless of when John actually receives the $300 from his client. Here’s how he would need to fill out section 6 on the DE 4581 form for the week of June 1:

Field 6 = Yes

6A = $300

6B = June 1 (Date last worked), 8 (Total hours worked), and your own name and mailing address (since you’re self-employed and working for yourself). In the “Reason no longer working” field, enter “laid off” if you completed your project.

Freelance Contract With Unknown Income

On the other hand, if John enters a different freelance contract and doesn’t know upfront how much he will be paid by his client when he’s actually doing the work, that changes when he should report it to the EDD.

Let’s say John does 8 hours of work on June 1, the client reviews it and decides on a price several weeks later, and John ends up getting paid $400 on June 18.

He should answer “no” to section 6 of the DE 4581 for the week of June 1 and not report any hours worked in that week. But for the week of June 18, he needs to report his eight hours worked and the $400 he made.

Here’s how he would need to fill out section 6 on the DE 4581 form for the week of June 18:

Field 6 = Yes

6A = $400

6B = June 18 (Date last worked), 8 (Total hours worked), and your own name and mailing address (since you’re self-employed and working for yourself). In the “Reason no longer working” field, enter “laid off” if you completed your project.

DE 4581 Can Be Confusing

I think I’m usually pretty good at following directions, but I find the language on the DE 4581 form to be confusing, especially section 6.

I don’t think I would have been able to figure out the specifics above on my own so when in doubt always check with your unemployment office if you’re not sure what to do.

Based on the form’s directions alone, I would have incorrectly put the Client’s info in the Employer box instead of “self-employment work,” and I would have probably goofed up the timing of when to report the last day worked and payments received.

What About Distributions?

One of the benefits of having an s-corp business is the owners can take distributions from the profits. The catch is the IRS requires reasonable salaries and doesn’t allow owners to take all of their profits as distributions and no wages since they want to collect payroll taxes.

But let’s say John decides to pay himself a distribution since he is a corporate officer. Is he still eligible for unemployment benefits? Again, it depends. In California, John is required to report all distributions as income. Depending on how much he received, he may still qualify for partial benefits in the week he received money.

The EDD representative mentioned to me that when John receives the distribution money, he must clarify if the money was received as wages or as an officer, because they aren’t the same thing.

Distributions earned as an employee would be treated like regular work and would count against John’s benefits eligibility. In 6b of the DE 4581 form, he would input “S-corp business.”

Distributions earned as an officer would also count against John’s eligibility. But income received in this manner would trigger an EDD phone interview.

While that might sound intimidating, phone interviews with the EDD aren’t scary or accusatory. They are simply for the EDD to collect any additional information if necessary and to confirm the money was received as an officer and not as an employee.

If everything checks out in the phone interview, the EDD would determine if any adjustments are necessary, and John’s benefits would continue.

Support For The Self-Employed

Unemployment benefits can be confusing because of the many different ways states handle claims and eligibility. Based on the research I’ve done, the EDD covers the basics of how eligibility works online.

But if you have any type of special circumstances like self-employment or working multiple jobs, you have to speak with someone in order to get helpful answers. Don’t just assume that you’re automatically disqualified because you have a side business or have more than one job.

If you are only self-employed without an outside employer and want to be able to collect unemployment benefits in the future, you’ll need to make contributions into your state’s unemployment insurance fund.

Be Mindful Of Unemployment Qualifications

If you only pay yourself distributions, which are not subject to payroll taxes, and only pay yourself insufficient or no W2 wages, you won’t qualify if you lose your business because you wouldn’t have contributed anything over the years.

Talk to your state’s unemployment office to get more information about your rights as only they can tell you for sure what you can qualify to receive.

What’s neat is that states such as New York, New Jersey, Delaware, Maryland, and Maine offer self-employment assistance to unemployed workers who are trying to start a business.

You may have to go in and talk to your local unemployment insurance office to apply and get information, however, as these programs are still very small and aren’t highly marketed.

They are intended to provide weekly allowances while new entrepreneurs work on getting their new business off the ground. Since these programs are different from traditional unemployment claims, they don’t pay as much, but they offer assistance just the same.

And some states even provide weekly allowances to workers who start their business while still working full-time.

They are intended to provide weekly allowances while new entrepreneurs work on getting their new business off the ground. Since these programs are different from traditional unemployment claims, they don’t pay as much, but they offer assistance just the same.

And some states even provide weekly allowances to workers who start their business while still working full-time.

How Much Can You Receive In Unemployment Benefits?

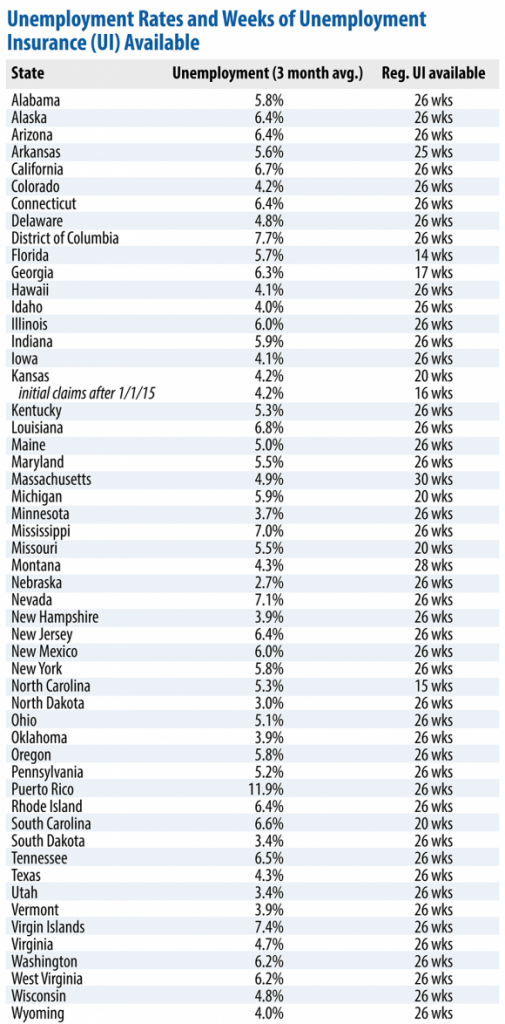

Benefits typically range between $200-600 a week and last anywhere between 14-30 weeks, depending on your state. California offers up to $450 a week for 26 weeks.

How much you are eligible to receive is based on how much you were earning in the quarters leading up to your qualifying event, the state maximum allowance, and your eligibility week to week.

Once state benefits are exhausted, you may be able to apply for a federal extension depending on the economic conditions. The global pandemic stimulus plans offered extra unemployment benefits.

Remember, if you stop looking for work, you won’t qualify. In California, the EDD picks random weeks when you’re filing claims and requires you to report the details of the jobs you applied for in those weeks. So keep track of all of your job applications if you’re filing claims so that you’ll have everything you need when they ask.

The below table from the cbpp.org shows recent unemployment rates by state as well as the maximum number of weeks you can collect unemployment benefits.

When In Doubt, Just Ask

When it comes to collecting unemployment, it doesn’t hurt to ask your local agency to learn about the specific rules and requirements for your state. Everyone has slightly different circumstances and they want to help you out.

The people who work at these agencies are super friendly, empathetic, and are used to getting lots of questions, so don’t feel anxious about talking to them.

Free Tools To Help You Manage Your Finances

Being out of work is stressful and scary, and it’s important to carefully manage your finances. Personal Capital is a free online money management platform I use that organizes all of your money related accounts in one place.

It lets you safely and securely link your checking, savings, retirement, CD, mortgage, credit card, overdraft protection, and investment accounts together in the cloud.

They offer many different free tools to help you manage your finances such as a budgeting tool, a cash tracking tool, and a retirement fee analyzer. It’s free to sign up and can really help you take control of your finances and feel less stressed about money.

Start Your Profitable Website Today

Want to make more money and be more free? Work on building your brand by creating your own website the easy way with a WordPress site like mine through Bluehost for super cheap.

You can register your domain for under $20/year and get hosting for only $3.49/month. Whatever your interests are, focus on building your skills and developing your own unique niche.

I’ve been blogging since 2010 and it has allowed me to break free from the corporate grind to travel, work from home, consult for companies that I like, and do so many more things I’ve always wanted to do but couldn’t.

The income is relatively passive as posts I’ve written years ago are still being found through Google and generating income. What’s better than making passive income and creating a valuable asset you can one day sell for a multiple of annual income?

There’s not a week that goes by where I’m not thankful for starting this site!

Untemplaters, have you ever tried to get unemployment benefits if you have a side business? What was your experience?

Data is subject to change. Discuss and confirm requirements, eligibility, options, and other details with your local unemployment agency.

excellent info! thank you for such detail to questions i had and then some i hadnt thought of.

Let’s say John gets laid off from Computers Inc and continues generating income for his S-corp side business as its sole employee. If he holds off on paying himself wages from the S-corp, can he still qualify for full unemployment benefits?

If you are a day trader and trade as a side (extra) income and DO NOT take any money you made during the time you were drawing unemployment does that still go against you? My thought is to leave the money in my trading account and don’t take it out until my benefits end. Meanwhile, I would still be looking for work as required in California.

Thank you

I have the same question! Have you found an answer?

Investment income and passive income do not disqualify you from collecting unemployment benefits. See this article for more info: https://www.financialsamurai.com/can-i-collect-unemployment-insurance-if-i-have-passive-income/

What do you mean by 1st quarter to get potential overlap and how did you get 58 weeks?

Can you break it down a little better?

Excellent point. In ‘Engineering’ my layoff (click on my handle), instead of just quitting, I was eligible for, and received, 58 weeks of EDD unemployment compensation. Helpful hint: file the first week in the calendar quarter, and you may be eligible for an overlapping period which will give you more weeks of compensation than the normal period (26 weeks now in CA).

In CA, there is a semi-weekly form one fills out to certify eligibility, found here. http://www.edd.ca.gov/pdf_pub_ctr/de4581fo.pdf Some of the questions involve this specific issue, especially #6 which asks “Did you work OR earn any money, whether you were paid or not?” An honest answer would preclude receiving EDD benefits.

It isn’t hard to receive the maximum benefit of $450 per week. If you calculate your benefit, and subtract what your side gig pays less your expenses, then divide by hours (including commuting!), you might have to earn quite a bit of money to make it worth your while.

That’s awesome you were able to collect 58 weeks! And great tip on the potential overlap. I think a lot of people don’t realize that they are paying into the UI system while they are working and that if they start collecting benefits later on, their employer isn’t going to get a bill each month for the benefits from the EDD. Claimants are funded based on past contributions they made from their own paychecks and the employer already made into the system. So it’s kinda like getting your money back.