In 2012, I retired from my traditional job in investment banking after thirteen years. In 2013, I unretired because I was still only 35 and felt a little silly to call myself a retire. Instead of working a full-time job, I decided to consult for various fintech startups in the San Francisco Bay Area.

After two-and-a-half years of consulting, I decided to retire again in mid-2015. I had learned all I wanted to know about marketing and customer acquisition at these private firms. I tired of the corporate politics as well and wanted out.

Then in 2018, I decided to unretire again! This time it was because we had a son in 2017 and I felt it irresponsible that both my wife and me didn’t have jobs. There’s something about our DNA that makes us want to provide by taking action, even if we have enough passive income not to.

During the pandemic, plenty of folks retired because they didn’t want to deal with corporate politics and the risk of getting sick. However, now that the pandemic is over, unretirement is gaining steam once more.

Why Unretirement Is Growing In Popularity

As an early retiree since 2012, and one of the creators of the modern-day FIRE movement in 2009, I’d like to share some reasons for unretirement. I’ll discuss seven reasons why people are going back to work even if they don’t need the money.

1) Boredom: It’s hard to do nothing after a lifetime of doing something

If you’ve spent decades in a career working 40 hours a week, it’s hard to suddenly stop working. Just like how we are hardwired to wake up early or brush our teeth after a while, we will also be hardwired to work.

Many early retirees feel uncomfortable feeling unproductive. As a result, they unretire to work on something meaningful. The work doesn’t have to be full-time. But it has to be enough to keep people busy.

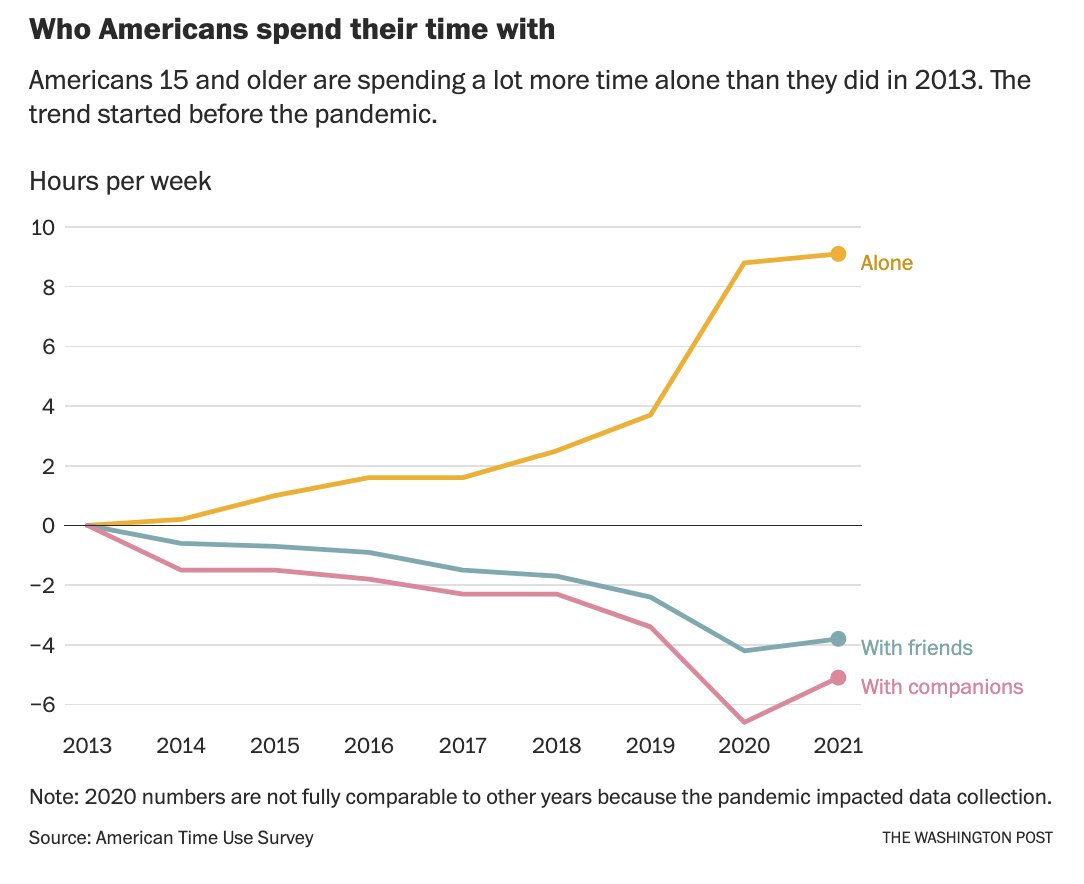

It’s easy to get bored with 40 hours of extra free time a week. If you retire early, many of your friends will be in the office during the week. If you retire later, maybe some of your friends or colleagues won’t be around!

As we age, we get lonelier. Working at a company helps keep people engaged.

2) There’s always a fear of financial loss

Historically, bear markets happen every 7-10 years. During a bear market, you could see your stock portfolio drop by30%+ and your home’s value dip by 15%+. It’s a disconcerting feeling losing money. To counteract this fear of financial loss, people will unretire to help boost their finances.

The 2022 bear market really shook people out of their investment euphoria of 2020 and 2021. As a result, we saw a hoard of people unretire in 2022 and 2023.

We never know when the next economic downturn will be. And when downturns do happen, they could last for several years. Therefore, unretirement is a logical move to ride out the worst before the good times return.

3) Unexpected or expected financial expenses may lead to unretiring

Unexpected financial expenses happen all the time. For example, after three years of trying to have a baby, we gave up. Then soon after we gave up, my wife got pregnant. Raising a baby can be expensive, especially in a city like San Francisco. Preschool tuition alone is $2,400 – $3,200 a month. Then there is the increased cost of healthcare.

Even expected financial expenses are enough to push you to unretire and go back to work. For example, let’s say you retire with kids in the 6th grade. You may unretire once you see they got into private colleges will little tuition assistance! You always knew they would go to college. But once the bill hits you, it makes you want to earn more money.

In truth, it’s really hard to retire early with kids. You need a lot of money to take care of kids for 18 years. But if you can, retiring for the first five years of a kid’s life is wonderful. Then once they attend school full-time, you can unretire since you’ll have a lot of free time.

4) Unretiring may stem from the inability to accept loss

Let’s say your $1 million retirement portfolio declines by 20% in a bear market. Instead of just accepting the $200,000 loss, you want to unretire to make up for those losses so you can get back to even.

In a way, unretirement is a signal that you can’t sit still and accept things for the way they are. You have a restless soul where you need to always be winning. It is your competitive spirit and drive that is making you jump back into the workforce.

As untemplaters, we are always battling the status quo. So it’s natural to want to unretire and battle unacceptable financial loss. We tend to always want to keep busy.

5) People unretire because they find new purposeful work

Retiring to do nothing is not recommended. Thankfully, we all end up gravitating toward things that provide us meaning and purpose.

In my case, I found it fun to speak to authors, entrepreneurs, professional athletes, and experts in their field through the Financial Samurai podcast on Apple or Spotify. In 2022, I went on a book marketing tour for Buy This Not That where I was interviewed on at least 30 podcasts.

To return the favor, I figured out podcasting software that enabled me to interview people as well. I’ve been having a whole lot of fun, despite making no money. So in a way, I unretired to become a broke podcaster!

6) Better work flexible post pandemic is leading to unretirement

One of the best things to come out of the COVID pandemic is more work flexibility. More jobs are remote, which means workers have more flexibility to nap, play, and run errands during the day. The lack of flexibility was one of the reasons why I retired early in the first place.

Not having to sit in so many meetings or be on schedule as often is wonderful. As a result, I think FIRE is becoming obsolete. If you’re seeing all these work perks post pandemic, it’s natural to unretire and want to work again.

7) The desire for purpose may be the main reason why people unretire

One of the biggest negatives of retiring early is losing purpose. Once you lose purpose, you sort of lose your soul. Society no longer appreciates you as much and you might feel lost or depressed.

To shake the feeling of a lack of purpose, you unretire to become relevant again. Personally, I’ve gone through a number of troughs of sorrow where I’ve questioned what I’m doing with my life after I retired early. As a result, I consulted part-time, coached high school tennis, wrote a bestselling book, and became a father to fill the void.

Unretirement Is A Rational Move For A Better Life

At the end of the day, we all want to find meaning and purpose. For many, staying retired is just not fulfilling enough. So they unretire and go back to work.

But the good thing about retiring and then unretiring is that at least you know what it’s like to not work for a living. So long as you don’t stay retired for more than about three years, it’s relatively easy to find a similar-paying job again.

Personally, I’ve found it difficult to re-retire given all the things I’ve mentioned above. I want to continue staying active in the community with daily purpose and meaning. With the AI boom, especially here in San Francisco, I’d like to find away to participate in it full for the next 10 years!

So I say keep active in retirement. You never know when you’ll want to unretire!

If you’d like to know more about my FIRE journey, read my interview with Sydney about being one of the pioneers of the FIRE movement. I share how and why it all began.

Suggestions

Manage your finances better with Empower, my favorite free financial software and app. I’ve used Empower to track my net worth and calculate my retirement cash flow needs since 2012.

Join 60,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

One thing I’ve often thought about is joining a non-profit for a part-time job in my 50s/60s after retiring from my sales career. I’ve always liked what many non-profit jobs offer, but have been so focused on building and saving income that they always went on the back burner. Once I’m retired from sales, money won’t be one of my top priorities, so I will treat a lower salary like bonus money. It won’t be money I need to reach my financial goals, it’ll just be like gravy while getting to do meaningful work at a slower pace.

I think having purpose is so important in all stages of life, especially after retiring from a career of many decades. It’s a huge lifestyle shift and a huge part of one’s identity. That’s not to say people have to keep working indefinitely, but there’s something very powerful about finding ikigai in one’s life in retirement in one form or another. Waking up with purpose every day is very powerful for the soul, happiness, and longevity

I can totally relate. I quit my job during the pandemic and didn’t really plan to go back to work for the foreseeable future. But the increase in remote work (at least part-time) and a better job opportunity convinced me to take a new job this year. I work less hours than before, don’t have to commute 5 days a week (only 1-2 now) and have greater autonomy. I’m in a good spot!