If you’re thinking about retiring, have a master plan. You might surprise yourself about how much financial progress you can make. Here’s a review of my master plan to re-retire by age 45.

Starting in 2018, a year after my son was born, I decided to spend more time on entrepreneurship and less time relaxing. Once you have your first child, working harder is a natural evolutionary response for the survival of our species.

On January 6, 2020, at age 42, I wrote about a master plan to re-retire by September 1, 2022 at age 45. My daughter was born a month earlier and I needed to find a way out of the grind.

I gave three years of extra money-making effort for my son, so I figured I’d show equality by doing the same for my daughter. Raising children is expensive in San Francisco.

By working more online, it help alleviate the angst of affording massive upcoming expenses, such as $1,500,000 for four years of college for two kids. I’ve thought about gaming the college financial aid system, but I don’t think it will work given our assets.

The funny thing is, I had actually forgotten I had written my master plan to re-retire by 45 until I was going through my archives. There’s no use setting goals if you don’t revisiting them. So that’s what I’m doing right now.

Reviewing How I Planned To Re-Retire In Three Years By Age 45

I turned 46 in mid-2023. So clearly, I blew past my age target to re-retire.

So much has happened since January 6, 2020, it’s kind of nuts. At the same time, I’m also melancholy the time is over. We’ll never gain any of that time back.

In order to re-retire by September 1, 2022, my plan was to either:

- Accumulate $1,500,000 in new capital

or

- Find a way to consistently generate $5,000 a month in additional online income or semi-passive income

How Did I Come Up With These Financial Goals For Re-Retirement And Why?

Based on the median San Francisco home price of $1,600,000 at the time, the California Association of Realtors estimated that a household needed to earn at least $310,000 a year to comfortably afford a median-priced home. The calculation was based on a 20% downpayment and spending no more than 28% of monthly gross income on a mortgage.

At the time, our passive investment income was generating only about $250,000 a year. Hence, we were $60,000 short if we excluded our active online income. Living a middle-class lifestyle is good enough for us.

$1,500,000 in new invested capital could generate $60,000 gross at a 4% rate of return. Today, $1,500,000 in capital can generate $75,000 a year risk-free thanks to 5%-yielding Treasury bonds. Alternative, I needed to find a way to consistently generate $5,000 a month online would solve this shortfall.

The Potential Of Achieving Either Goal To Re-Retire

When I set the two financial goals, I remember feeling like accumulating $1,500,000 of additional capital was practically impossible. That would mean saving $500,000 after tax a year for three years. Even for someone with a $1 million a year day job, which I didn’t have, saving $500,000 with a family would be tough.

On the other hand, generating an additional $60,000 in online income or semi-passive income, seemed much more doable. The pandemic was raging and I spent more time at home. So I decided to focus more on the latter by coming up with the following plan.

Here’s what I wrote in January 2020 and a review of what happened.

1) Stay-At-Home Hustle For The First Six Months After Daughter’s Birth (written in Jan 2020)

My initial course of action is to be a stay-at-home / work-from-home dad for the first six months of my daughter’s life. This way, I’ll be able to provide the most care when my wife and daughter need it the most. Further, my wife can’t tell me years down the road when I’m bald and have a pot-belly that I was a deadbeat dad.

After six months, our daughter should be able to sleep for 5-hour stretches through the night. Further, my wife should be almost back to full physical and mental strength. Thank goodness our 2.8-year-old now sleeps through the night 80% of the time.

For six months, I will work on trying to better monetize Financial Samurai. I’ve been so lax at building business partnerships, it’s embarrassing. I’d like to partner with new financial companies who have great products that will help every type of reader. I’d also like to do more business with existing financial partners.

My goal for each company I partner with is to help readers save more money, make more money, and/or gain more financial confidence.

What happened?

I built up partnerships with at least six new businesses I found interesting. In addition, I became a brand ambassador with a one-year contract from July 2022 to July 2023. I had to forsake doing business with its competitors. However, it’s been so great to focus on one partner as it saves me business development time.

2) Get A Job If My Online Efforts Fail (written in Jan 2020)

If online income progress is poor after six months (<$1,000 a month in incremental new online revenue), then I will aggressively look for a job in tech, finance, or media by June 1, 2020, six months after I came up with this plan.

My preference is to work for an established company that pays a handsome salary. The company will ideally pay a total compensation of $250,000 or greater. It will offer a 401(k) match/profit sharing and provide at least 75% subsidized healthcare.

A startup would have to be extremely promising for me to want to join. Startups tend to pay below-market salaries, lack of benefits, and have much longer hours.

To be clear, income from a job does not count towards generating $6,000 a month in incremental retirement income. The purpose of the job is to earn income to build my capital account that will then produce passive retirement income.

Only semi-passive and online income counts towards the $6,000 a month incremental income for retirement.

What happened?

I did not get a job after my daughter turned six months because my online income grew. Instead, I decided to reclassify myself as a fake retiree.

3) Save And Invest 100% Of The Proceeds (written in Jan 2020)

Given our current ~$250,000 passive income currently provides for ~140% of our living expenses, we plan to save and invest 100% of all incremental income generated over the next three years. The rough breakdown of where we’ll invest our incremental revenue is as follows:

- 30% allocated towards physical real estate

- 10% allocated towards REITs

- 10% allocated towards private real estate

- 20% allocated towards the S&P 500

- 5% allocated towards individual stocks

- 20% allocated towards bonds

- 5% allocated towards venture capital

Based on my capital allocation, I’m most bullish on real estate because real estate lagged the S&P 500 in 2019. I believe real estate prices will catch up in 2020, especially as affordability has increased.

It’s hard for me to allocate more than 20% of my income towards the S&P 500 given current valuations. But I will max out my 401(k), Solo-401(k), SEP-IRA, and both 529 plans. My capital allocation will adjust over the years.

If I can lock down a good deal on a new house, I have the potential to increase instantly our net worth by $100,000 – $200,000, which would count towards the $500,000 annual net worth increase goal.

Finally, we should be able to save and reinvest roughly $50,000 a year from our existing retirement income streams. Reinvested at a 4% rate of return would generate $2,000 a year in incremental gross retirement income.

What happened?

I saved and invested aggressively and kept our expenses relatively flat. In mid-2020, I took a huge leap of faith and bought a more expensive home. Home prices did end up increasing in 2020, 2021, and the first half of 2022 before coming down.

Buying a more expensive house decreased my ability to re-retire by 45. A more expensive house means a larger mortgage and more property taxes. However, I could consider selling the house and banking the gains, which would help me re-retire.

4) Create A New Online Product (written in Jan 2020)

I haven’t created a new product like a book or a course since 2012 because it takes a tremendous amount of work, i.e, I’m lazy. But creating your online products is one of the best forms of passive income.

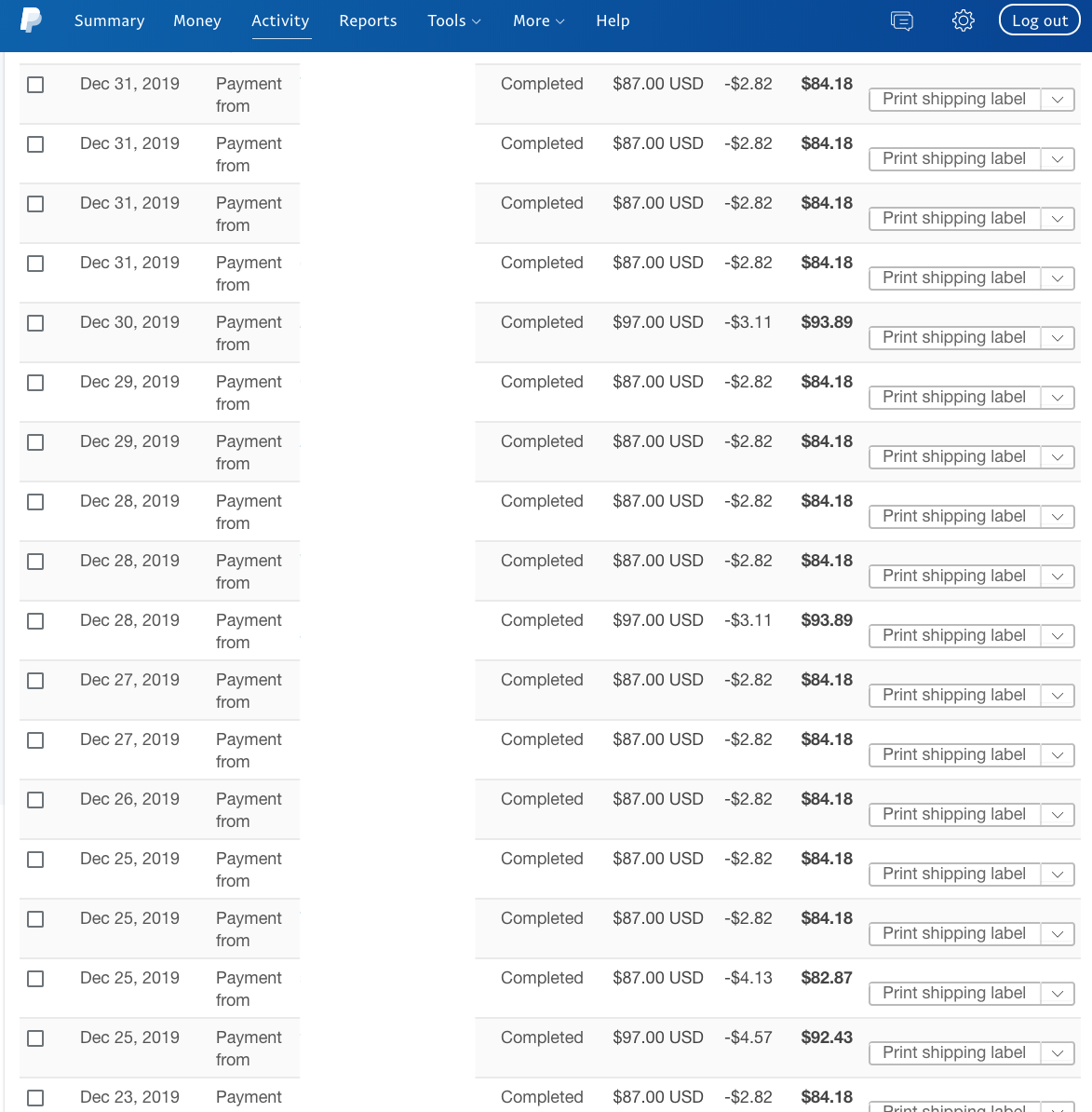

That said, I should have continued to create new products every one or two years because they can be profitable. The fifth edition of How To Engineer Your Layoff has been generating between $4,000 – $5,000 a month for the past year. Below is a snapshot with names whited out from several days in December 2019.

A product that consistently generates $50,000 a year in profits is like having $1,250,000 in capital generating a 4% return. Therefore, it would be wise of me to leverage my platform and create another premium product over the next three years. By itself, a new product could achieve our financial goals.

At the moment, I potentially have an opportunity to sign with a traditional publisher for my next book. However, I’m not sure whether it makes economic sense given my already built platform. It sure is nice to keep 100% of the spoils.

It may be easier to just start marketing the How To Engineer Your Layoff affiliate program for anybody that writes about entrepreneurship, early retirement, and career strategies. If you do, sign up as the book is a perfect fit.

What happened?

My wife and I updated How To Engineer Your Layoff for 2023 and beyond! The book is now in its 6th edition and is the only resource that teaches readers how to negotiate a severance. It regularly sells between $4,000 – $5,000 worth a month.

In addition, I wrote and published Buy This, Not That, an instant Wall Street Journal bestseller. Although the book deal was in the six-figures, I won’t receive royalties until maybe 2025. But given the success of the book, I was given a new two-book contract from Portfolio Penguin, one of the best nonfiction imprints.

Spending two years writing a new book has been one of my proudest accomplishments. It was my way to say “screw you!” to the pandemic. Putting out new products has increased my ability to retire again and just write.

5) X Factor – My Wife (written in Jan 2020)

So far, I’ve assumed my wife will continue to stay at home and take care of the household until September 1, 2022. Staying at home is her preference and I’m all for it. However, if she decides to go back to work at some point, it will make accumulating capital easier since she should be making at least 4X the cost of additional childcare expenses.

I see a 5% chance of my wife going back to work during the first year of our daughter’s life. In 2021, I see a 35% chance. And in 2022, I give it a 50% chance. But I see a 100% chance my wife spending some time helping out with the backend and maybe even front end of Financial Samurai.

What happened?

My wife did not end up going back to work. She enjoys her Fat FIRE lifestyle. But she did a tremendous job raising our children and working on a lot of the backend work for Financial Samurai. She also did all the accounting and taxes.

Although my wife doesn’t generate income, she is instrumental in running Financial Samurai. Her job taking care of our children and doing work for Financial Samurai is easily worth $200,000.

Related: How To Convince Your Spouse To Go Back To Work So You Can Retire Earlier

6) X Factor – A Booming Economy (written in Jan 2020)

I do not want to count on our existing investments to help reach our goals. One of the reasons is because our investments could easily go down in value if World War III starts. Another reason is that my investments might make me lazy.

However, if our investments do well in 2020, 2021, and 2022, it will make achieving $1,500,000 much more feasible.

What happened?

The economy boomed in 2020 and 2021, resulting in tremendous stock market, real estate, and private investment returns. Too bad 2022 wiped out all of 2021 returns. But we’re still up from January 2020.

2023 is showing signs of recovery with the S&P 500 up and inflation and interest rates coming down. Market returns have boosted my ability to re-retire.

7) X Factor – Google Algorithm Change (written in Jan 2020)

Most of the traffic that comes to Financial Samurai comes from Google. So far, Google has been kind to Financial Samurai since 2009. However, Google could easily turn on Financial Samurai, thereby hurting traffic.

In other words, it’s best not to count on Google for growth. For more defensible traffic, I need to more aggressively build my newsletter subscription, the Financial Samurai brand, and create other direct channels of traffic.

I’m hopeful that after 10+ years of writing about personal finance, Google will continue to reward a 24-year finance veteran post college who writes from firsthand experience.

However, based on what I’ve observed about websites mainly focused on making money, it seems easy to manipulate Google without any expertise or authority. Therefore, I need to deploy new strategies to get ahead.

Now there’s also the threat of Artificial Intelligence. Sigh. I just gotta keep plugging away.

What happened?

No positive or negative Google algorithm changes. Although, many of my latest articles have been featured on Google News recently. I see the consistent Google News highlights as a positive sign that Financial Samurai has the Expertise, Authority, and Trust Google and readers want.

One positive since 2019 is that my free weekly newsletter has grown about 15,000 subscribers to about 60,000 total. A newsletter is very valuable because it is unaffected by Google. Hence, this growth increases my ability to retire.

In addition, I decided to record more podcast episodes for the Financial Samurai podcast. I finally figured out how to use the podcasting interview software, which has opened up a whole new world of opportunities. It is now a top personal finance podcast today.

The podcast doesn’t make money because I don’t have advertisers. But it does help build connection with my community. Check it out on Apple or Spotify.

8) X Factor – A Big Offer For Financial Samurai (written in Jan 2020)

In 2018, I turned down an offer to sell Financial Samurai. I’m glad I did because of strong growth and a rise in valuations in 2019. I turned down an offer to sell in 2019 as well because I was emotionally not ready. I wanted to at least focus for at least a year on entrepreneurship to see what I could do.

But if there is some really attractive offer between 2020 – 2022 to sell, I must consider the option. Selling Financial Samurai would achieve our capital accumulation goal. After the non-compete period is over, I can simply start another site or sail off into the sunset, forever.

What happened?

The main way I thought I could accumulate $1,500,000 more in capital was by selling Financial Samurai. But I did not sell Financial Samurai for big bucks because money is not my main motivator for writing. It’s also too hard to sell my baby.

I plan to hold onto this site until 2043 as a teaching tool and insurance policy for my goods. I’m still enjoying writing and connecting. Running a small business is one of the best career insurance strategies to ensure my children are never unemployed.

Both Financial Achievements Reached!

Due to a bull market in 2020 and 2021, I ended up surpassing my $1,500,000 capital increase target! It was honestly a big surprise because I felt like there was less than a 20% chance it would happen. That’s what regularly investing and saving can potentially do.

I was so surprised, I even published a post called, Investment Returns vs. Active Income: When Work No Longer Matters in late October 2021. We were all making so much money, I was thinking, why bother working at all! This was a top-of-the-cycle post.

After the 2022 bear market, my overall net worth is still over $1,500,000 higher buttressed by aggressive savings. See my 2020, 2021, and 2022 reviews if curious. The rebound in the stock market in 2023 has certainly helped.

Due to increased effort, online income increased by over $60,000 in 2020, 2021, and 2022. 2021 was actually a record high. I ended up banking and investing all the excess. Online income then decreased starting in the second half of 2022 and flatlined until mid-2023.

Ultimate Re-Retirement Goal Is to Boost Passive Income

My overall passive income rose from $250,000 to $380,000 by the end of 2022, a 52% increase in three years. $380,000 is $70,000 higher than the CA Association of Realtors thinks is required to live a middle-class lifestyle.

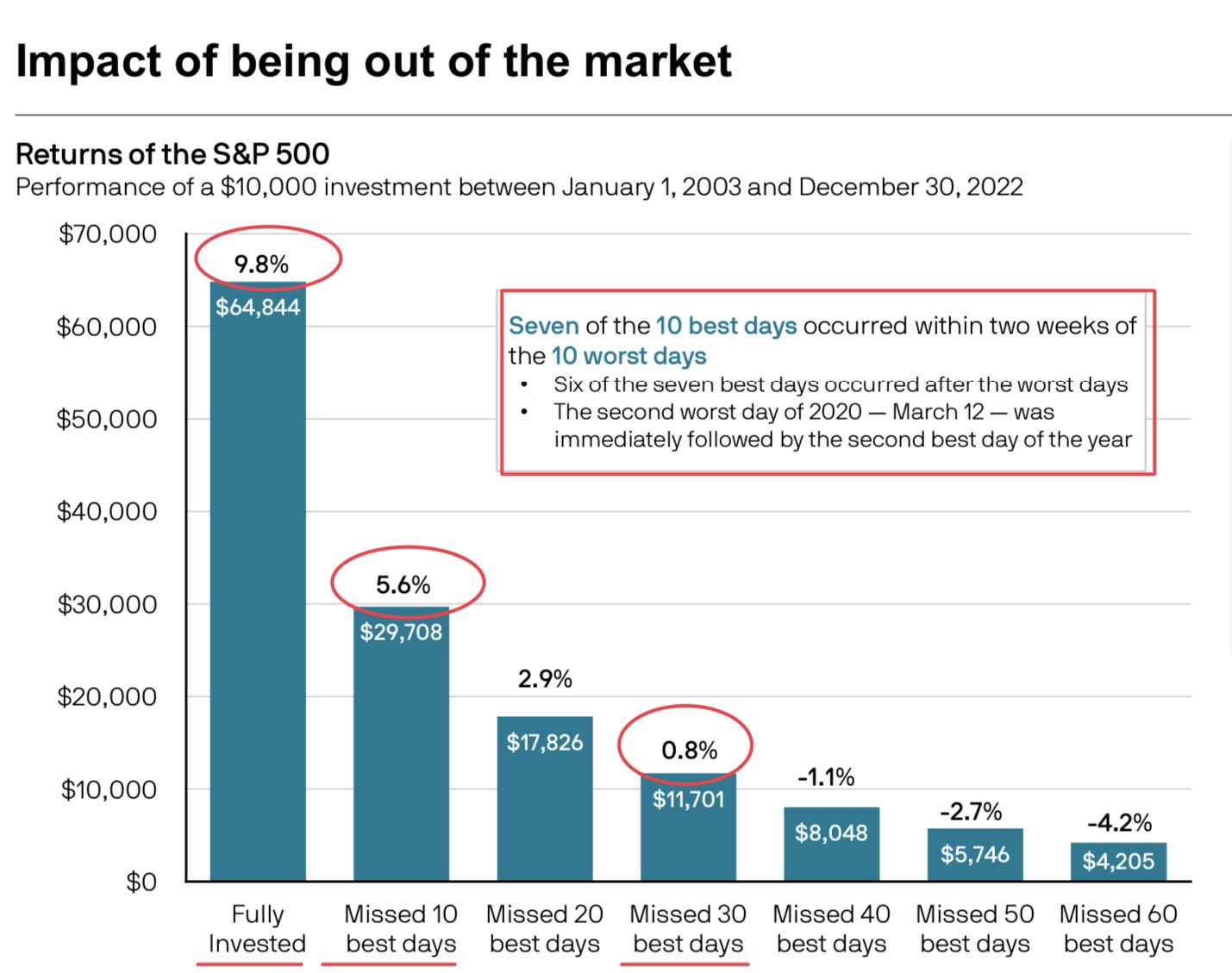

A good percentage of the net worth increase was due to luck. I did not expect a bull market in 2020 and 2021. However, I also tried my best to earn more money online and save aggressively during the pandemic. Hence, it’s important to stay invested for the long term and do what you can to actively build wealth.

In retrospect, I wish I had sold everything in 4Q 2021 when the returns felt unreal. Alas, I only trimmed a little of my exposure. That said, my public equity as a percentage of net worth is about 27%. Further, I plan to own my real estate holdings for as long as possible.

If you truly plan to retire or re-tire within three years, it’s important to lower your risk exposure to minimize sequence of returns risk. I guess I wasn’t really certain that I’d give everything up online.

Green Light To Re-Retire At 46 Or Later

Based on our current estimated passive income, I can re-retire again. I’m no longer doing many new business deals. Instead, I’m playing more pickleball and trying to persevere the capital we’ve made since 2020.

Thankfully, due to higher interest rates, it’s easier to build passive income. I’ve been “T-billing N Chilling” with the majority of my cash flow. Making a 5%+ risk-free return is just too good to pass up as we wait for the Fed to stop hiking rates. Meanwhile, my existing investments are going up.

It feels great to return to writing whatever I want online, regardless if it generates income or not. I’m also happier and less stressed being back in early retirement mode. Being able to quit the pursuit of making maximum money rocks! It’s also nice to know that if I want to make more money, I can.

What I’ve learned is that anything can happen if you write out your goals and come up with a plan. Obviously, not everything will go according to plan. However, having a master plan is so much better than winging it. Good things tend to happen when you put your intentions out to the world.

At almost 46, I firmly believe 45 is the best age to retire. 23-27 years of working and saving is long enough to burn anybody out. It is also long enough to accumulate a healthy amount of wealth.

But Maybe Going Back To Work Is In The Cards

Ironically, with the world back to normal, my itch to get a day job has returned!

Both kids will be in school full-time starting Fall 2023, which leaves me with more free time. I miss the camaraderie of working with nice people with a common mission. Further, I would like to explore completely new occupations, like working for an NBA organization! I think it would be so fun.

The freedom to explore new things is one of the best benefits of financial independence. It’s funny how our desires change over time.

Reader Questions and Suggestions

How have your finances changed since the beginning of 2020? Have you ever written out an impossible-sounding financial plan only for it to come true? Are you planning to work harder or take things easier in 2023 and beyond?

For more nuanced personal finance content, join 60,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

How fascinating it is to look back at what was happening 3.5 years ago and what you were thinking at the time compared to now! I’m so glad to have the pandemic over with and to have less fear too. You sure have accomplished quite a lot since you put down your original thoughts. Writing a WSJ bestseller during the pandemic sure is one huge accomplishment! That’s so impressive!