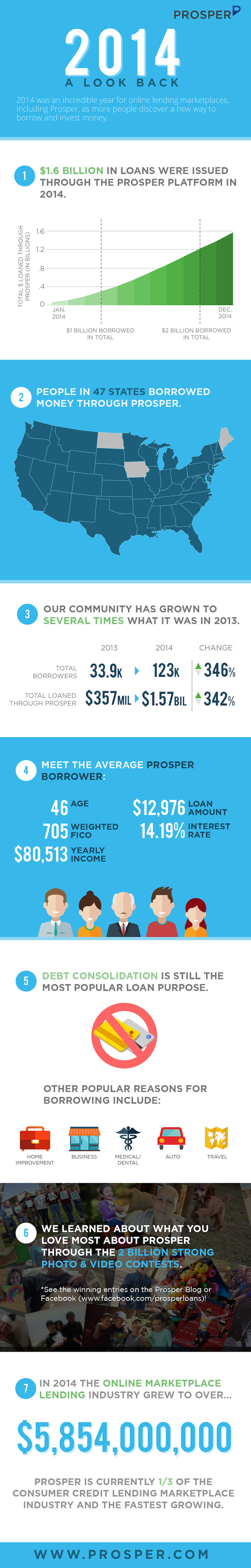

If you haven’t heard of social lending, listen up because you’ve been missing out. The industry for online marketplace lending grew to over $5.8 billion last year. Although Lending Club is the largest, Prosper was the fastest growing company and a third of that increase. Social lending is on the rise, and I’m happy to be a part of the trend. I’ve had my own Prosper P2P lending account for a couple years now and I’m loving it!

If you haven’t heard of social lending, listen up because you’ve been missing out. The industry for online marketplace lending grew to over $5.8 billion last year. Although Lending Club is the largest, Prosper was the fastest growing company and a third of that increase. Social lending is on the rise, and I’m happy to be a part of the trend. I’ve had my own Prosper P2P lending account for a couple years now and I’m loving it!

The Basics Of Social Lending

For those of you who are new to social lending, the basic way to describe it is there are online marketplaces for people just like you and me to apply for loans. Examples of loans vary, but can include things like consolidating credit card debt, paying off medical bills, getting your car fixed, starting a business, etc.

These loan applications are then reviewed and rated by the online marketplace companies, and then investors can pick and choose which loans they want to help fund. The great thing about it is you don’t need a lot of money to participate as a lender. And even if you’ve been rejected by banks as a borrower, there’s a decent chance you can get the loan you want through P2P!

Two of the well known social lending companies are Prosper and Lending Club. I started my own account with Prosper for about $1,000 a couple years ago, but you can get going with half that, or even just a couple hundred bucks. It’s really easy when everything is online and you can go at your own pace, and on your own schedule.

P2P Popularity

Interesting to note, traditional lending is comparatively still the vast majority of the $3 trillion overall consumer lending market, but social lending continues to increase it’s share.

One of the main reasons P2P lending is becoming more popular is the ease of use for both borrowers and investors. Traditional banks tend to be so slow and tedious with their application and underwriting processes, and customers are tired of it. I had an extensive, exhausting, and brutal process getting a loan last year with my bank, and don’t want to go through that again any time soon. Plus I felt I was decently qualified, so I can’t imagine how painful the process would be for those who are struggling even a tiny bit. Banks can be brutal.

While I was browsing around my Prosper account the other day, after investing in my first C-rated loans for potentially higher yield, I came across an interesting infographic they put together on how their business has grown. The most eye catching part in my opinion has to do with the demographic of the average Prosper borrower: 46 years old, 705 FICO score, $80,513 average year income, $12,976 average loan amount, paying a 14.19% interest rate.

Main Drivers For P2P Lending Growth

So why is it that social lending is on the rise? There are four main aspects that stand out in my mind. Here’s a summary based on Prosper’s P2P growth:

1) Convenience – On average it only takes four to five days for borrowers to get loans through Prosper. Old school banks, on the other hand, tend to take at least 10 days, sometimes a lot more. The online platform to submit docs on Prosper and search for loans is quite easy and feels innovative.

2) Focus on quality – Prosper has been around since late 2005 and is the first peer-to-peer lending marketplace. They validate and verify borrower information and use a clear and consistent rating system to help lenders choose the appropriate notes. First time borrowers have average FICO scores in the 700-710 range and investors have been earning roughly 7% per annum.

3) Sticky customers – The system works and customers are coming back and opening up second and third loans when their needs arise.

4) Increasing awareness of social lending – Prosper had a 346% increase in total borrowers last year alone across all 47 eligible states (Iowa, Maine, and North Dakota currently don’t allow residents to participate).

To learn more about how you can borrow or become an investor in social lending, check out this in depth Prosper review which goes into more details about how the platform works.

Untemplaters, what do you think of social lending versus traditional bank loans? There seems to be so much upside given the traditional lending market is $3 trillion. Why do you think social lending is on the rise? Do you have a P2P account?

Copyright 2015, updated 2016, Untemplater.com. Thank you for reading!

Can you write an article detailing your personal experience over the years you’ve done it? Thanks!

Nice read Sydney! While I haven’t used p2p funding I do have some money at Kiva that I use to fund a couple loans. It’s a great feeling when you can help someone who has no other means of support!

Thanks Paul! Great to hear from ya 🙂 I think Prosper is really fun. First time I’ve heard of Kiva – sounds like a really great platform!

Peer to peer social lending is definitely on the rise. I am curious, do you think this will have any disruption to the credit markets, and ultimately impact the banks? In a credit market as tight as this one, many people don’t have much other choice, but if they start seeing the upside it could be possible they don’t go back to the banks.

I haven’t used P2P yet, but the concept sounds really intriguing. It’s good to know there are other options if I ever get turned down for a loan from my bank, and the Prosper way sounds way easier.

I’m a big fan of Prosper, and I also bought Lending Tree stock (LC) in my latest motif after it corrected by 40%. Lots of opportunity in the space!