This post was written by Derek Sall, owner of LifeAndMyFinances.com, a place where he encourages people to get out of debt, save money, and grow wealthy.

This past December I decided to make the audacious goal of paying off my mortgage by the end of 2014. When I sat down and crunched the numbers, I discovered that to even have a chance of paying off the remaining $54,000 balance to the bank, I needed to earn more money as well as dramatically cut my expenses. And this realization lead to the creation of my budget.

The First Real Budget

Since I am a single guy and don’t spend all that much money on “stuff”, I figured for the longest time that I really didn’t need a budget. However, when I finally constructed my first real budget in January 2014, I quickly realized that I should have made one a long time ago.

January Budgeting, 2014

Based on my understanding of my spending (which I never tracked until this moment in January), I figured that I could easily spend less than $2,000 in that first month, which would have allowed me to make a nice payment on my mortgage with the money that was left over. However, things didn’t really work out as I had planned. Here’s a recap of how my January went:

- My car broke down twice, which left me paying $503 to get it back on the road (vs. my planned $0.00)

- My gas and electric bills were way higher than I thought, totaling $343 for the month

- My grocery costs were almost $100 more than expected at $337

- I was apparently shelling money out to everyone and gave $814 to charity, and I only budgeted $300

- I had a surgery in November that I completely forgot about and had to pay the remaining $645 bill

All in all, I ended up shelling out $1,700 more than I expected in that first month of January. It was obvious that I needed to scale back on some of my frivolous spending. Beyond this, I started looking a little more carefully at my regular monthly costs like my phone bill, insurance, and my mortgage payment. Now that I had a budget I was becoming more aware of the actual costs for these items each month, and it just seemed like too much.

Adhering to the Budget and Cutting Down the Costs

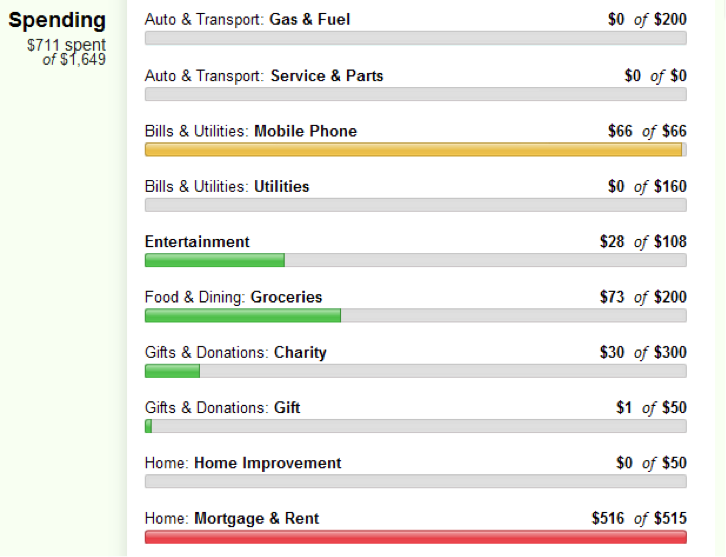

Fast forward a few months and my budget looks wildly different. Here’s a snapshot of it today.

No More Random Overspending

At first glance, you’ll notice fewer red lines than before. I am no longer overspending in any of these categories, which means that I have more money flowing toward my house mortgage, which of course means that my net worth is climbing much more rapidly than before.

Lower Phone Costs

In January, my phone bill was $85 a month. I never stopped to think about how much money this was each time I paid the bill, but suddenly when I saw that $85 in my budget it sounded like way too much to be paying each month. So, I simply called up Verizon and let them know I was considering switching providers – this 5 minute action immediately reduced my bill by $20 per month, which is now saving me more than $200 a year.

Lower Insurance Costs

Similar to my phone bill experience, I did not like the dollar amount that I was paying for my car insurance each month either. I mean, my car is a 2001 Honda Civic and I had the lowest coverage on it that I possibly could, and I was still paying nearly $80 a month. Initially, I called my insurance company, but they said they simply couldn’t do anything for me. So, I took my search somewhere else and found a company that would insure me for $49/mo. Cha-ching! That’s a $370 yearly savings.

Rework My Mortgage Payment

I already had a low interest percent on my mortgage loan, so there wasn’t any savings there, but I noticed that there was a substantial amount of money in my escrow account – even more than I would have needed for a full year of property taxes. Not only was this unnecessary, but I was paying the bank for this service and was earning no interest on this lump sum of money. So, I withdrew the lump sum, closed my escrow and am now earning $10 each month on that balance (and saving $7 a month because I’m not paying the bank to hold onto my money).

Growing My Wealth

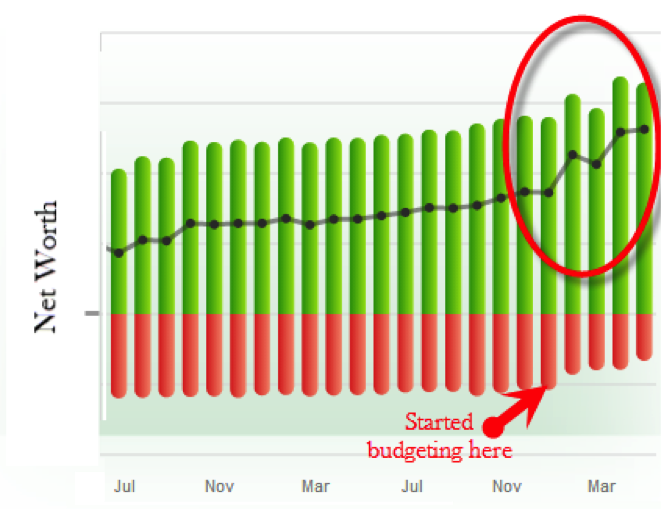

At this point I am becoming very satisfied with my spending. No longer am I spending $3,700 a month on items I didn’t even really know about. In this current month, it actually looks like I might spend less than $1,000, which will mean a huge payoff toward the mortgage (and of course, another bump in my net worth).

As I was working to pay down this debt, my overall net worth is beginning to grow at rapid rate (see the black line in the net worth chart below).

Recommendations

Utilize Free Financial Tools To Grow Your Wealth. Sign up for Personal Capital, a free online tool which helps you track all your finances, manage your cash flow, calculate your net worth, and analyze your investment portfolios for excessive fees. It’s the best free online money management tool around and they’ve got a great app for the iPhone, Androids, and tablets. You can take a look at a great Personal Capital Review by clicking the link.

Improve your finances while also supporting charity. Want to increase your financial knowledge and grow your wealth? Want to give back in the process too? Check out The Best of Financial Samurai eBook. It contains 180 pages of the best 35 articles written by Financial Samurai over the past seven years to help readers achieve financial freedom sooner. All of the book proceeds are donated to a charity that helps inner city kids stay off the streets and stay in the class rooms. You can purchase The Best Of Financial Samurai here for $9.88. Why not learn and give at the same time!

Updated 2015

When I finally sat down and created a real budget, we saw how quickly we were blowing through our cash for frivolous things. A budget really makes you look at your finances and have an open communication with those that you love.

I like how budgets force us to really see where all our money goes. A lot of times we think, hey it’s only 5 bucks or 20 bucks, but even those little amounts can add up quick.

How did you make that last chart?

You should be able to build a chart like that in Excel. The chart and graph features are pretty powerful.