With stock market turmoil happening again thanks to Greece, Puerto Rico, China and the US expecting to raise rates soon, many people are beginning to wonder whether we’re in for a painful correction. Don’t freak out! This post will help you learn how to weather a stock market downturn and ride through a storm.

With stock market turmoil happening again thanks to Greece, Puerto Rico, China and the US expecting to raise rates soon, many people are beginning to wonder whether we’re in for a painful correction. Don’t freak out! This post will help you learn how to weather a stock market downturn and ride through a storm.

When the market was on the decline in 2009, investors panicked. Those were scary times. Instead of staying the course with their investments, a lot of investors who were in panic mode sold out of the market and were left with only 50% of what they once had. Dreams of retirement were dashed and vacation homes were sold at only a fraction of their worth. These investors clearly did not manage their money correctly during the bear market.

If only they had a better system. Instead of losing half of their investments they could have lost absolutely nothing. Or, perhaps they could have even earned money in the process. Let’s review four great ways to manage your investments in a down or volatile market so that you can protect more of your money!

Four Ways To Weather A Down Market

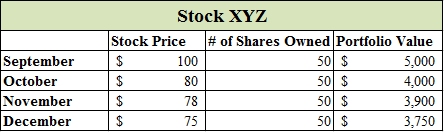

1) Buy more. When the stock market is tumbling down, the last thing your emotions are probably going to tell you to do is buy. Nobody wants to watch their hard-earned evaporate so a common reaction is to start selling and hold on to what you have left. This reaction, however, is the absolute best way to lose money and you don’t want that! If a stock’s value falls by 25% and an investor promptly sells, he/she would have just guaranteed themselves a 25% loss. As you can see below, instead of a $5,000 portfolio value, the investor would be left with just $3,750 after the sale.

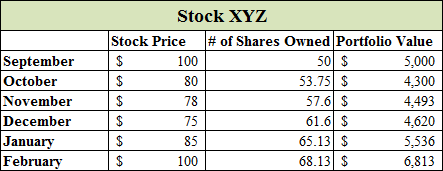

What if, instead, they decided to buy when the market was tumbling, and then the stock returned to its original share price? One might think that the difference would be insignificant, but lets take a look and see for ourselves.

The stock price fell for three straight months, but the investor continued to contribute $300 both while it was falling and during the rise back up to the $100 mark. With a portfolio value of $5,000 in the beginning, you would expect that his overall value would be $6,500 after the five months since the stock price returned to its $100 value. However, this is not the case. Thanks to dollar cost averaging, the portfolio balance is actually over $6,800! Instead of selling shares in a down market, consider those shares to be discounted and continue to buy. When the price returns, the value of your portfolio will stun you.

2) Short the market. Many have heard the term shorting the market, but few really know how to do it (and do it successfully for that matter). In its most basic form, one would borrow shares of stock and sell them with the agreement of buying them back at a later date. By selling during the peak of the market and buying after it tumbles, thousands (if not millions) of dollars can be made with this investment strategy. As a concept, the idea sounds fairly simple, but executing it at the right time is quite difficult. This is why many investors choose to leave this to the professionals.

Instead of hopping in and out of individual stocks during a bear market, wise investors simply find inverse ETFs that will short many companies at once. Examples of such ETFs are: Short Dow 30 (DOG), Short S&P 500 (SH), and Short QQQ (PSQ). By investing in funds like these in a bear market, portfolio values can soar. However, keep in mind that if one selects these funds outside of a bear market, they will likely fall in value. If this interests you, Motif Investing has a solution for shorting the markets with its professionally created and managed bearish Motifs. For only $9.95, you can buy a basket of stocks that are specifically purchased to outperform a volatile market. They do all the hard work crafting groups of stocks and ETFs and you can buy them all at once with just a couple clicks. Motif is great because they make it easy to invest in strategies, themes, and ideas and there are no management fees to worry about.

3) Buy Commodities. When the stock market is in decline, the value of commodities (ie. gold and silver) tend to rise, often because of the uncertainty in the market. Take a look at the chart below. The black line is the value of the Dow Jones Industrial Average (DJIA) from 1970 to 2012, and the yellow line is the spot value of gold during the same time period. For many years, gold sat steady below the $500/ounce mark. Then something happened the value of the overall stock market began to crumble. Suddenly the demand for shares of stocks decreased and the demand for tangible assets shot through the roof. Since there is only a finite supply of gold, the value of each ounce increased with the spike in demand. Within just three years, the value of gold increased by more than 300%. If you see a bear market coming on the horizon, be sure to consider investing some of your money in precious metals. They are a fantastic hedge against a down market.

Source: www.goldsilverworlds.com/gold-to-silver-price-ratio-dow-jones-to-gold-price-gold-vs-us-dollar-rate/

4) Maintain your asset allocation. We all know that it is wise to have a well-balanced portfolio (ie. a certain mix of stocks, bonds, cash, etc.). But did you know that keeping your balance is essential to earning your maximum amount in the market? As the market rises and falls, your desired allocation will change. As an example, the stock market may rise quickly and the value of bonds may decrease. With this simple phenomenon, your desired asset allocation will become severely out of balance, causing you to own a greater share of stocks than you desire.

If you do nothing and the value of your stocks experience a correction and your bonds once again rise, then your net gain is essentially zero, as both investments have returned to their initial value. However, if you would have reallocated (or rebalanced) your stocks and bonds to back to your desired ratio prior to the correction, then you would have sold off those high-valued stocks to purchase more low-valued bonds (sell high, buy low). Then, once the stock values decrease and the bond values increase, your portfolio will be much larger than if you would have done nothing at all. When there is volatility in the market, be sure to rebalance your portfolio for maximum profitability.

Watch For Economic Shifts

There are always those that think the market will forever rise, and then there are others that constantly see the impending doom and gloom that they are certain will soon fall upon us. It is best to avoid both of these extreme perspectives. Instead, view the market objectively and perform research through trusted sources. The more you learn and analyze, the better prepared you’ll be to handle a stock market downturn.

If there are signs that the market may soon be falling, take a more conservative approach in your investments. If you don’t have time to manage your money, then you might want to get some professional help, especially if you’ve accumulated a large nut.

Personal Finance Recommendations For Managing Your Money

Get A Free Personalized Investment Plan – Wealthfront is an excellent choice for personal wealth management for those who want the lowest fees and can’t be bothered with actively managing their money themselves. In the long run, it is very hard to outperform any index, therefore, the key is to pay the lowest fees possible while investing your money in the market. Get a free personalized investment plan from Wealthfront in just a couple minutes by answering a free six step questionnaire. You don’t have to transfer a single penny to see Wealthfront’s recommendations for your investments, but it’s easy to fund an account if you choose to do so.

Untemplaters, how have you handled your investments during a past stock market downturn? Have your emotions gotten the better of you when markets are down? What have you been buying and selling lately?

Copyright 2015. Original content and photography authorized only to appear on Untemplater.com. Thank you for reading!

Cool blog. Point 1 in your post really resonates with me.

The last economic downturn really changed the way I perceive money and wealth. I was still in college, but was lucky enough to start investing early in high school (thanks dad). I remember the week Lehman Brothers collapsed. I was about 22 at the time and had amassed incredible gains as a very well respected company suddenly started changing the world, and how we interact with technology. Looking at my portfolio I saw I was down 30-40% and my first knee jerk reaction was, “Ok, I need to sell and stop the bleeding now.” Luckily, I had the common sense to run it past my father and get his opinion. His response was, “as of now you have lost nothing, but once you click that sell button the losses become real.”

During that time I was working at my family’s restaurant in the Upper East Side of Manhattan. Everyone was terrified that business was going to be crushed due to the inevitable depression as reported by the media. The exact opposite happened, and it was business as usual. What really stood out to me was all of our reservations that week were for parties of three: Husband, wife, financial planner. I overheard one interaction between the husband and financial planner, “You’ve had us pile up all of this cash since we started working with you, it’s time to make some real moves.”

There is no doubt in my mind that fortunes were made during that downturn.

thanks John! You were really lucky to have a great dad who taught you about investing early on. I had to teach myself and learn from friends – my parents didn’t know anything about investing. I love that quote your dad said, “as of now you have lost nothing, but once you click that sell button the losses become real.”

Great time to be planning for this Sydney, before a ‘real’ drop in asset values! Love your point about having a system – that’s really the key, being prepared before anything happens, and knowing what you’ll do in advance. It’s amazing what your mind can do when the media headlines start panic-mongering and people around you are stressing out!

Maintaining your asset allocation is probably the easiest approach to implement, and a good default if you do nothing else. I love to buy more, but generally don’t have as much cash ready as I’d like!

The media can totally freak us out and make us act irrationally – they are pros at creating pandemonium. I am wary about reading too many headlines as a result.

Everybody thinks they are a genius during a bull market. But as soon as we see a 5% dip, there is a freak out session.

It will be interesting to see how things play out once we finally do see a sustained dip. Suddenly, CDs and Treasuries will start looking sexy again.

Thank you for the article Sydney.

Sam, I just wrote an article on that topic: amoresuccessfulyou.com/personal-finance/post-rate-hike-investing/

One of the things that will really interest me going forward is where yield seekers will go. As I discuss in the post of the link above, the past 30+ years have been a bond bull market. Now with rates having only 1 direction to go, it should be interesting to see how banks and other financial institutions deal with this. While that will be interesting in itself, retail investors have big decisions to make as well.

Have a great day!

Erik

It would be nice to see banks offer 4% CD rates again. 🙂 That’s got to be quite far off though. I have one 3.5% rate CD that’s expiring in a couple years but I doubt I’ll be able to replace it with another CD anywhere close to that rate. I’ll have to start thinking about how to reinvest that cash before the expiry sneaks up.

That’s so true! This is why I try to stay diversified and am working to build more passive income streams. We’ll see another sustained dip in the markets at some point – probably several during the rest of our days – and plenty of people will panic and freak out. I don’t want to let emotions cause me to panic sell or lose the majority of my assets when the next ugly period comes around.