Does retirement seem like it’s ages away? Even if yours is several decades away, it’s never too early to start saving for it. The sooner you start, the better actually. Unfortunately, most Americans aren’t anywhere close to prepared for their retirement. The Employee Benefit Research Institute reported that 41 percent of households aged 55-64 have zero retirement savings. Zero, zilch, nada.

Does retirement seem like it’s ages away? Even if yours is several decades away, it’s never too early to start saving for it. The sooner you start, the better actually. Unfortunately, most Americans aren’t anywhere close to prepared for their retirement. The Employee Benefit Research Institute reported that 41 percent of households aged 55-64 have zero retirement savings. Zero, zilch, nada.

Think how stressful it would feel to be in your 60s and want to retire but be financially unable to, or to be basically forced into retirement by your employer or because of health issues without any financial cushion to fall back on.

Chances are high you’re not saving enough

For the minority of Americans who are actively saving for retirement, most of them aren’t saving enough. Less than 20 percent of households have saved more than four years of their annual income across all age groups. Four years of living expenses might sound like a lot if you only have a couple thousand dollars in your savings account, but the reality is that simply isn’t enough to live a long and comfortable retirement.

- The average retirement length in the U.S. is 18.8 years for men and 21.2 years for women that retire at age 65.

With life expectancies rising, more people wanting to retire well before they turn 65, and the future of Social Security up in the air, a heck of a lot of people could wind up completely broke when they should be ready to kick back and live it up.

Numbers really do matter

If you’re not that familiar with Social Security that’s okay, just be aware that it’s a broken system. The amount of benefits you could be eligible for is shrinking and you have to be older and older to get them. Age 65 used to be the magic number, but for those born in 1960 or later, full retirement age according to Social Security is delayed until age 67.

While two years of time may not be that big of a deal when you’re young and healthy, it can seem like an eternity in your 60s. Aging two years in your late 60s takes a much bigger toll on your body than it does in your 40s or 50s.

When it comes to collecting Social Security benefits, your age has a direct impact on how much you can collect. You don’t have to wait until you turn 67 to start receiving benefits, but you’ll collect a lot less if you don’t.

For example, at age 62 you’ll only receive 70% of what you could have received if you waited until age 67 to start collecting benefits. Those able to wait until age 63 would collect 75% of their benefits, which increases to 80% at age 64. The traditional retirement year of age 65 would yield 86.7% etc until reaching 100 percent at age 67.

Answer two key retirement savings questions

Two of your most important tasks in retirement planning are figuring out the answers to these two questions:

1) At what age do you hope to retire?

2) How much money do you want to have in retirement?

You should have already guessed that there are no one-size-fits-all answers to those questions because everyone has their own unique set of variables and circumstances. For example, here are several factors that can greatly impact your answers to the above two tasks:

- Where you live

- Number of dependents

- Current and expected income

- Cost of living expenses

- Healthcare costs*** (this is a big one)

- Cost of leisurely activities such as travel

- Life expectancy

Retirement Savings Goals By Age

Here are some suggestions to consider on retirement savings goals for each decade of your life until retirement.

Your 20s

- Focus on securing a job with a strong career trajectory with as many opportunities as possible for development, promotions, performance bonuses and raises.

- Be really careful that your early years of independent living are not spent piling up credit card debt.

- Start paying down your student loans.

- Open a retirement account asap. If your employer offers a 401(k) plan, take advantage of company matching.

- Try to keep your living expenses down by sharing the cost of rent with roommates. Utilize public transit whenever possible.

- Recognize that every little bit you save and contribute to a retirement account will make a big difference by your 60s. Compounding really works in your favor.

- Aim to accumulate 1-3 years worth of retirement living expenses.

Your 30s

- Put your career decisions from your 20s to good use and really maximize your 30s to bring home some extra bacon.

- Be careful not to let lifestyle inflation overtake your income growth.

- Always set a goal to pay yourself first and max out your 401(k) every year. Better yet, save even more that the annual 401(k) contribution limit in a separate investment account.

- You should already be a pro at distinguishing wants from needs. You might desire more living space to start a family, but can you really afford it? Do you really need a new car when your current one works just fine?

- Take good care of your body. Don’t let bad nutritional choices lead to a spare tire around your waist. Exercise at least a couple times a week and see your doctor for an annual physical checkup every year.

- Don’t lose sight of the long term. Aim to accumulate a total of 4-6 years worth of retirement living expenses.

Your 40s

- Take advantage of your seniority at work. By now you should have a better vision of when you plan to retire.

- Saving for retirement should be fully automatic for you at this point. You shouldn’t even have to think twice about maxing out your 401(k) and making additional contributions to your investment accounts.

- It’s time to really reassess your living expenses and compare how much they have changed since your 30s. Your ideal retirement location may have changed by this point too. Adjust your anticipated cost of living expenses in retirement accordingly.

- Update all of your income projections and look for more ways to save. Look for more ways to expand your passive income streams.

- Don’t let a mid-life crisis crush your finances. Nobody needs a shiny, new sports car or a closet full of LV handbags.

- Aim to accumulate an additional 6-7 years worth of retirement living expenses, totaling 10-13 years.

Your 50s

- It’s time to celebrate because you’re officially over the hill. You know all too well now that your body is slowing down. Regularly see your doctors for preventative care and health screenings.

- Listen to your doctors’ advice and think about how your current health conditions could impact you over the next 5, 10, 20, 30+ years. You may need to adjust your estimated healthcare costs in retirement.

- Really watch how much you’re spending each month. Start cutting back and aim to spend at least 10-20% less on average. That’ll make it easier to transition to spending 15-30% less each month once you retire.

- Review your investment portfolios and rebalance into more conservative investments.

- Look for more ways to reduce your taxable income and get a solid estate plan in place for the benefit of your heirs if you haven’t already.

- Maintaining a healthy lifestyle is more important than ever.

- Aim to accumulate an additional 8-9 years worth of retirement living expenses, totaling 18-22 years.

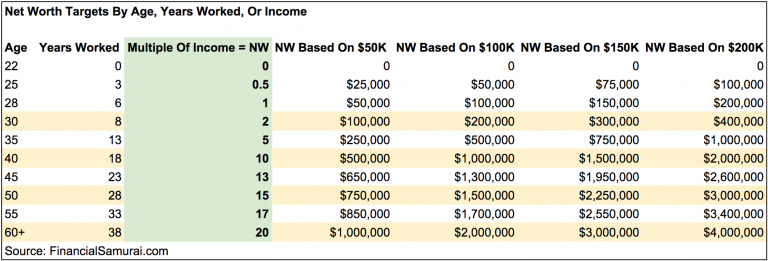

In addition, here’s a helpful chart with guidelines on how much net worth to have by income at various ages by Financial Samurai.

The more you can save over the course of your lifetime, the more options you’ll have for retirement. It’s much better to wind up with too much money versus too little, don’t you think? Life has a way of throwing unexpected curve balls at us, so the better prepared you are for retirement, the more magical it will be.

Take Control Of Your Future Now

Invest Your Money Efficiently: Betterment, the leading digital wealth advisor, is an excellent choice for those who want the lowest fees and can’t be bothered with actively managing their money themselves once they’ve gone through the discovery process. All you’ll be responsible for is methodically contributing to your investment account over time to build wealth. In the long run, it is very hard to outperform any index, therefore, the key is to pay the lowest fees possible while being invested in the market. Let Betterment build a customized portfolio for you based on your risk tolerance.

Track Your Net Worth For Free – Utilize fancy, free technology to track your own finances and net worth with Personal Capital. Quickly and securely link all of your accounts in one place so you can see where all your money is at once. The best features are their Portfolio Fee Analyzer tool and Retirement Planner. They also offer low-cost wealth management services if you want help with a passive investment strategy. Be sure to take advantage of Personal Capital’s free financial tools to maximize your net worth today.

The bottom line is the earlier you start, the better prepared you should be for the future!

Untemplaters, when did you start saving for retirement? Have you figured out when you want to retire and how much money you want to have saved by then? What are your short-term and long-term retirement savings goals?

Very good article. Lots of good points to think about outside of just finances. Taking care of your health is a big one. There are so many man created diseases now caused by poor diet that can lead to big medical expenses later on.

I think your 20s is the most important decade when it comes to saving for retirement. Time is the biggest asset we have, so it’s important not to waste it. Furthermore, digging yourself a hole by spending your money to accumulate worthless possessions can make saving for retirement much harder later on.

Sugar is one of the biggest health killers in our country. Sugar is practically in every type of processed food. Sticking to actual foods that are plants or proteins is so much better than eating processed stuff. Easier said than done, but it’s worth the effort.

Starting off on the right foot in one’s 20s definitely makes a big difference! I certainly had way more energy back then and could handle a much bigger workload. Work and save while you can is one of my mottos.

I just read an article on MSN that said less than 30% of all Americans are saving for retirement! That’s crazy. Although many of their employers don’t offer retirement plans, some of them still do, but they have an excuse for not saving. I wish people would understand that you are living longer and you owe it to yourself to prepare for your future.

Yeah I know, it’s pretty disturbing that so many people aren’t saving especially with life expectancies rising along with so many other expenses.

Some good guidelines by decade. I suggest everybody figure out a way to accumulate at least 20X of annual average gross income, or 40X annual expenses before pulling the rip chord!

Sam

Thanks! Yeah, the more savings the better. I think the world would be a much friendlier and less-stress filled place if more people took financial planning seriously!

Hey Sydney, I like the plan. Looks very doable. But is would require to be a bit more aggressive in the 40’s and 50’s (which makes perfect sense because by that time kids are leaving the house and house is paid for). As a generation we need to pay much more attention to this because chances are we have retirements that last way more than 20 years.

Thanks for the thinking on this!

Yes, I really hope more and more people start taking retirement planning seriously in their 20s and 30s. It’s shocking how so many people get into their 50s and 60s without building up their savings. Who wants to be stressed out in retirement? Certainly not me!

Great post Sidney – you have a clear writing style and hit all the major points I knew about planning for retirement!

Would you suggest opening a taxable account? I currently save 4% in my Roth 401k to get the match, planning on bumping it up to the max… I’m 24 if that helps. I also have a rental property. I’m just trying to be smart with my money but also have my money grow wisely.

Thanks Erik! Many people wind up in a lower tax bracket when they retire than while they’re working which is why they can benefit from contributing pre-tax. It all will depend on your individual situation and what you anticipate your retirement years to be like.

Ultimately though, saving in any type of retirement account is better than not saving at all. Sounds like you’re actively working on managing your finances to have a rental property and planning to max out your contributions – keep it up!