Today I interview FIRE (Financial Independence Retire Early) movement pioneer, Sam Dogen on his journey to financial independence. I’ve known Sam for decades and wanted to share his unique and fascinating story with you.

Sam attended The College of William & Mary for undergrad (1999), got his MBA from UC Berkeley (2006), and worked at Goldman Sachs and Credit Suisse from 1999 – 2012 until he retired in 2012 at age 34. Sam is one of the rare personal finance writers who actually has a relevant background and experience in finance.

Every week, Sam comes out with a free weekly newsletter to help readers achieve financial freedom sooner rather than later. Join 65,000 other readers and subscribe here.

You can also subscribe to his Apple podcast and Spotify podcast where he comes out with a new episode every one-to-two weeks. He interviews experts in their respective fields and discusses some of the most interesting personal finance topics.

Everything Sam writes on Financial Samurai is free because he believes everybody should have access to personal finance knowledge.

When did start you start writing about FIRE and when did you start thinking of retiring early?

I was an early advocate for the financial independence, retire early (FIRE) movement, writing about it on my blog Financial Samurai when I launched it in July 2009. This was during the global financial crisis, which prompted my desire to exit my investment banking career that I had pursued since 1999.

I was experiencing burnout and finding little fulfillment in the finance industry. As a result, I began documenting my journey toward achieving financial independence and early retirement.

After two and a half years of writing about FIRE on Financial Samurai, I had an epiphany while vacationing in Santorini, Greece. Why not try to negotiate a severance package to provide a financial cushion upon early retirement? I had a lot of unvested stock and cash that I would lose had I simply quit my job.

Negotiating a severance package is exactly what I did in March 2012 – I secured a severance that covered five years of normal living expenses in exchange for training a junior employee over a couple of months. I was also able to keep all my deferred cash and stock compensation, which vested over the next five years.

As an early pioneer of the FIRE movement, my primary rule is to generate enough passive investment income to cover basic living expenses. To do this, you must actively save and invest as much as possible beyond your tax-advantaged retirement accounts like IRAs and 401(k)s. In other words, you must boost your taxable investment portfolio and accumulate rental properties.

My second FIRE rule is to always negotiate a severance package if a pension is not part of your compensation. If you plan to quit your job and retire early anyway, there’s no downside to attempting to negotiate a severance to bolster your financial security post-employment.

What were some of the sacrifices you made to reach financial independence?

Achieving financial independence required significant sacrifices on my part. In my twenties, I frequently opted out of social events with friends and colleagues in order to save money. Living in expensive cities like New York and San Francisco was incredibly expensive, where each outing would cost at minimum $100.

Additionally, during my 13-year investment banking career, I consistently worked at least 60 hours per week, often including weekends. These relentless demands on my time resulted in me missing out on many fun experiences. It also limited my ability to develop deeper relationships that could have further aided my career and wealth-building.

After just my first week at Goldman Sachs, where I started at 5:30 am and worked until past 7:30 pm, I realized I couldn’t sustain such a grueling schedule for decades in finance. By my first year in 1999, I had set a goal to retire by age 40 after 18 years of service. Accomplishing this required diligent work, alongside aggressive saving and investing.

My strategy involved aiming to save and invest 50% or more of each paycheck. With this approach, I calculated that after 18 years, I would accumulate at least 18 years’ worth of living expenses. Factoring in a reasonable 5% investment return, I projected I could amass at least 25 years’ worth of expenses to bridge the gap until Social Security kicked in.

Working at a difficult job turned out to be a blessing

The irony is that starting with such a demanding job straight out of school actually fostered my tendency to save and invest more. Had my initial job offered a more relaxed 40-hour workweek with minimal pressure, I likely would have spent more on various things and experiences. However, this would have resulted in less financial security and ultimately, less freedom in my later years.

Although the social sacrifices were challenging, the ability to retire significantly earlier than most has been incredibly rewarding. The freedom and opportunities it has provided have made the tradeoffs well worth it.

When did you reach financial independence?

I achieved financial independence at the age of 34 in 2012. At that time, my net worth exceeded $3 million, and my investable assets were generating approximately $80,000 a year in passive income.

This passive income comfortably sustained my lifestyle in San Francisco, especially since I had already purchased a house with a fixed-rate mortgage and did not have any children.

Technically, I had reached financial independence even earlier, by age 30, as my investments were generating enough for me to live a simple life. However, I chose to work 4-5 years longer to build an even larger financial cushion.

Three years after I had retired early, my wife, who is three years younger than me, also retired. I had promised her that if my early retirement plan succeeded, she could join me by the time she turned 35. With my guidance, she was able to negotiate a severance package as a high-performing employee at her job. Her severance provided enough to cover two years of living expenses.

The combination of my passive income, our paid-off home, and my wife’s severance package gave us a robust financial foundation to pursue our early retirement goals together. We were able to maintain our desired lifestyle without the need for ongoing employment. This allowed us to enjoy more freedom, flexibility, and quality time with each other.

What was your net worth goal before retiring early?

My net worth goal for early retirement was $3 million. I estimated that with $1 million in home equity and $2 million in investable assets, I could generate approximately $80,000 a year in passive income. This amount was sufficient for a comfortable lifestyle for a single person residing in cities like San Francisco, Honolulu, or New York City.

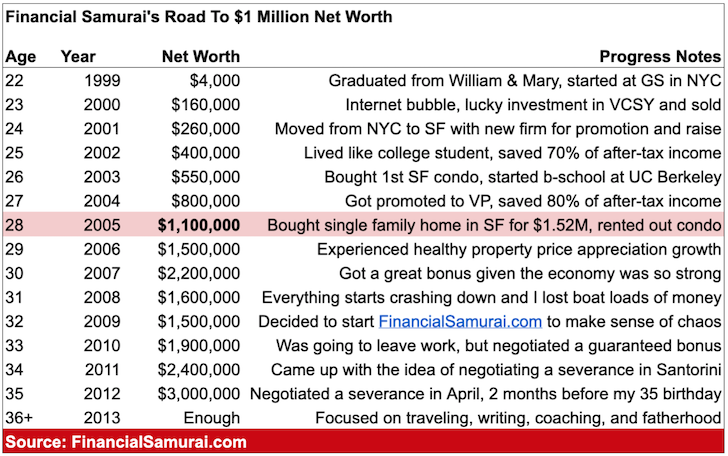

Below is a chart illustrating my net worth progression from when I graduated college in 1999 until I reached over $3 million by age 35. Upon reaching this milestone, I determined that I had accumulated enough to sustain myself for the remainder of my life.

How has your net worth goal shifted after FIRE?

I was fine with a $3 million net worth for five years after FIRE. However, the birth of my son in 2017 prompted a shift in my net worth and passive income targets.

In order to support a family of four in an expensive urban area without relying on a traditional job, I aimed to amass at least $5 million in investable assets. This $5 million would generate approximately $200,000 in passive income, providing the financial stability needed to raise a family comfortably.

The sad reality is, due to inflation, it takes closer to $300,000 to live a middle-class lifestyle for a family of four today. So shooting for $300,000+ in steady passive investment income is my goal until our kids graduate college in 2043.

How did it feel to reach financial independence?

Attaining financial independence instilled in me a profound sense of confidence to live life on my own terms. It empowered me to negotiate a severance package and regain my freedom at a young age. Although it was initially daunting to no longer receive a steady paycheck, I quickly adapted to living on a reduced income.

The freedom to pursue my desires outweighed the absence of a regular paycheck. Embarking on this new phase of life evoked a mix of excitement and apprehension, similar to the feelings of a recent high school graduate leaving home or a new college graduate moving to a start a job in a new city.

Yet, every day now feels like Christmas morning when you’re financially independent! It’s akin to winning the lottery, but far more rewarding because I achieved this financial independence through my own hard work and sacrifice. The risk-taking and discipline required to get here feels incredibly satisfying, so much more so than if I had simply been given a large sum of money.

This newfound freedom and control over my life has been truly transformative. I no longer feel beholden to a job or paycheck, freeing me to pursue my passions and desires. To me, it’s crazy to spend 40+ hours a week as a grown adult listening to another grown adult.

While the initial transition was daunting, I’ve embraced this empowering new chapter with enthusiasm and gratitude for all the effort that brought me to this point.

What do you think about the working adults who are giving advice on early retirement?

You can never truly know what early retirement life is like until you actually take the leap and retire early yourself. Therefore, it’s important to apply a healthy dose of skepticism to any advice about early retirement from researchers or individuals who have not yet retired themselves.

It’s easy for those still drawing a steady paycheck and enjoying employer-provided benefits to speculate about what retirees will or should do with their time. However, the reality of living an early retirement lifestyle can be quite different from the theoretical models or anecdotal accounts.

Only by immersing oneself in the day-to-day experience of early retirement can someone fully appreciate the nuances and adjustments required. The loss of a work identity, lack of structured schedule, and need to independently manage healthcare and finances can present unforeseen challenges.

Retirees may also discover new passions and fulfillment that weren’t evident while still in the workforce. The freedom to pursue personal interests can be incredibly rewarding, but also require adaptability as one navigates this major life transition.

In the end, every individual’s early retirement journey is unique. The only way to truly understand this experience is to embark on it yourself, rather than relying solely on the perspectives of those who have not yet taken that leap. An open, curious, and adaptable mindset is key to making the most of early retirement.

How has early retirement life compared to your expectations?

While achieving early financial independence granted me a tremendous sense of freedom, it also came with some unexpected challenges that I had not fully anticipated.

One of the most disorienting aspects was grappling with the loss of my work identity after holding that role for over 13 years. Feeling directionless and purposeless as a 35-year-old man was quite unsettling, especially during the first year of retirement.

Another unforeseen hurdle arose when our children were born during this early retirement phase. I deeply regretted not having access to employer-provided parental leave benefits. The strong desire to provide for my growing family drove me to seek ways to supplement our income.

With neither my wife nor I having steady employment, we not only lacked regular paychecks, but also faced the daunting $2,500 monthly cost of healthcare premiums without any employer subsidies. Raising children as two FIRE parents in an expensive city like San Francisco proved to be immensely difficult.

These adjustments required a significant mental and emotional shift as I transitioned from the structured work environment I had known for over a decade. While the freedom of early retirement was incredibly rewarding, navigating these unexpected challenges demanded flexibility, resilience and a willingness to adapt to my new circumstances.

Very grateful for financial independence

However, since 2012, I’ve also been profoundly grateful for the tremendous freedom early retirement has afforded us. It was fulfilling to facilitate my wife’s early retirement in 2015, particularly because I’ve witnessed many male early retirees insisting their wives continue working to support the family.

Thanks to our financial freedom, we’ve traveled to over 20 new countries, and I’ve achieved a long-held aspiration by writing a WSJ bestselling book, Buy This Not That. Moreover, I’ve had the opportunity to dedicate more time to writing on Financial Samurai, assisting others in achieving FIRE and navigating life post-FIRE.

After retiring, my chronic back pain, sciatica, and teeth grinding all disappeared. Even the gray hairs that began sprouting when I was 33 in 2011 vanished and haven’t returned over 13 years later. I didn’t realize how much stress I had internalized until I retired early. The health benefits of early retirement are priceless.

The greatest gift of financial Independence: starting a family

The most profound benefit that financial independence and early retirement has provided us is the ability to have children. While working long, grueling hours, we had struggled to conceive. However, once the immense work-related stress dissipated, our bodies seemed to respond – it was as if they had been waiting for us to prioritize our well-being over money and status before allowing us to become parents.

Being able to be stay-at-home parents until our children start full-time schooling at age five has been an invaluable gift. We’ve cherished every precious moment watching our kids grow, without the constant pressure and distractions of full-time employment. Children grow up so quickly, and achieving financial independence has allowed us to be fully present during these formative early years.

The freedom to devote ourselves to raising our family, instead of being beholden to demanding careers, has been the greatest reward of our FIRE journey.

While the journey to get here involved significant sacrifices, being able to nurture our children in a stable, attentive home environment makes it all worthwhile. This is the true purpose that our financial independence has enabled us to fulfill.

What would you do differently if you could start your FIRE journey over again?

Looking back, if I had the opportunity to redo my financial independence journey, I would likely have retired 3-5 years later than I actually did. Retiring at age 34 in 2012 now seems a bit too early in hindsight.

That year, the real estate and stock markets began recovering vigorously, which was fortunate for maintaining my retirement since 95% of my net worth was invested. However, it also meant missing out on significant career and income opportunities during those additional years of work.

If I had worked for 5 more years, I likely would have earned an additional $2-$2.5 million. Saving and investing half of that could have potentially boosted my net worth by another $1.5-$1.75 million, generating an extra $60,000+ in passive income.

Working those extra years would have also afforded me the opportunity to receive 3 months of paid parental leave for at least one of our children, if we had managed to conceive earlier. That would have been a wonderful benefit – getting paid to care for a newborn.

Additionally, delaying retirement by 3-5 years could have allowed me to explore exciting work relocation opportunities, like working in a different international office in places like Taiwan or China. That global experience could have been incredibly rewarding.

Forgot I was burned out and miserable

Despite thinking I should have worked for three-to-five years longer, I also forget about the immense misery and burnout I was experiencing during my last year on the job. The time from 2012 to now has also flown by incredibly quickly. So while the financial and career benefits of waiting seem clear in hindsight, I’m ultimately grateful for the freedom and quality of life I’ve been able to enjoy these past 10 years.

In the end, there’s no perfect playbook. FIRE is a highly personal journey, and the right timeline is the one that balances your financial needs, career goals, and overall well-being. The key is to remain adaptable and make the most of whichever path you choose.

Should have been more vocal about FIRE since I started

Due to my personal preference for privacy, other individuals who started their FIRE-focused websites later became better known within the broader FIRE community. However, when the alarming surge of anti-AAPI (Asian American and Pacific Islander) hate incidents occurred during the pandemic, I made the decision to step forward and represent the Asian American perspective.

If I had been more public about my FIRE journey earlier on, the community may not have been as racially homogeneous, which has historically skewed predominantly white and from middle America. The reality is that about half of the American population actually resides on the coasts, and the country is incredibly diverse, with people from all backgrounds aspiring to achieve financial independence at a young age.

Even though I only became more public in 2022, a full 13 years after launching my website in 2009, I believe it’s better late than never. I intend to continue writing, speaking, and sharing my insights about the FIRE movement for at least the next 20 years to come.

Remember, when it comes to saving and investing for your financial independence, if the amount you’re putting away doesn’t hurt, you’re likely not saving and investing enough. Embrace that temporary discomfort, as it will pay enormous dividends down the road.

Thank you for the opportunity to share my thoughts and experiences. I’m grateful to contribute to the important diversity of perspectives within the FIRE community.

Sam Dogen’s Books On Personal Finance And FIRE

If you would like to read Sam’s best works, pick up a copy of his instant Wall Street Journal bestseller, Buy This Not That. It will help you make more optimal decisions using his probability framework and analysis. It is the most applicable and insightful personal finance book you’ll ever read.

If you would like to learn how to negotiate a severance package and retire early, you can pick up his bestselling ebook, How To Engineer Your Layoff. It is the only book out there that gives you the confidence and strategies you need to walk away from a job with money in your pocket. It is the FIRE book to read. Use the code “saveten” at checkout to save $10.

Here’s my story on how I used Sam’s book to negotiate my own severance, despite being a high-performing employee. Before reading How to Engineer Your Layoff, I didn’t think it was possible to get paid to quit my job. But I ended up walking away with a six-figure severance package at 35 to be free.

I want to thank Sam for sharing his FIRE journey with us. The key takeaways are to plan carefully, consistently save and invest as much as possible, negotiate a severance package, and retire to something you enjoy. Best of luck everyone! -Sydney

Thanks for answering so many insightful questions Sam! I’ve really enjoyed following along your journey for so many years. It was thanks to you that I was able to negotiate a severance from my old job so I could pivot my career in a new direction. I also love how I constantly learn something new from your articles. Your house-to-car ratio post you wrote recently is one of my new favorites. Thanks for teaching us all so much and for inspiring us all to save, invest, and grow our wealth more than we ever thought possible.