In July 2009, Financial Samurai launched with the motto, “achieving financial freedom sooner, rather than later.” As a result of his message, he helped propel the modern day FIRE movement into what it is now – an enthusiastic community of people all looking to live life on their own terms.

There are plenty of other FIRE bloggers out there, but I wanted to interview Sam given he started so long ago and still continues to write regularly about his financial journey. Jacob from Early Retirement Extreme began in 2007 and is considered the other founder of the FIRE movement, but he went back to working as a quant trader at a large money management firm in 2011 and no longer writes.

The mainstream media has picked up the FIRE movement and there are now thousands of FIRE blogs out there since 2009. Given the coverage, there are now millions of people around the world looking to break free from the corporate world drudgery as well.

Interview With FIRE Movement Founder, Financial Samurai

When did you first retire from your day job?

I first retired in 2012 after 13 years working in finance. The key catalyst for me was being able to negotiate a severance package that provided for five years worth of living expenses.

Since I left corporate America, I’ve being doing all I can to encourage other people planning to retire early to negotiate a severance as well instead of quit. You get nothing if you quit. But if you can get laid off, you might get a severance, subsidized healthcare, and be eligible for unemployment benefits.

What does your wife currently do?

In 2015, I helped guide my then 34 year old wife to also negotiate a severance package and FIRE as well. It was one of my happiest moments being able to help the one I love leave a job that no longer made her happy.

I wrote about her journey here: How A High Performing Employee Can Negotiate A Severance Package.

How do you define being financially independent?

I define being financial independent when your investment income generates enough passive income to cover your best life expenses. In other words, if your annual expenses are $100,000, you need to have over $130,000 in investment income from your existing investments. Remember, you’ve got to pay taxes on your investment income.

To generate $130,000 of investment income using a 4% return rate requires capital of $3,250,000. My definition of FIRE is more conservative because I believes it’s better to have a little too much than have a little too little.

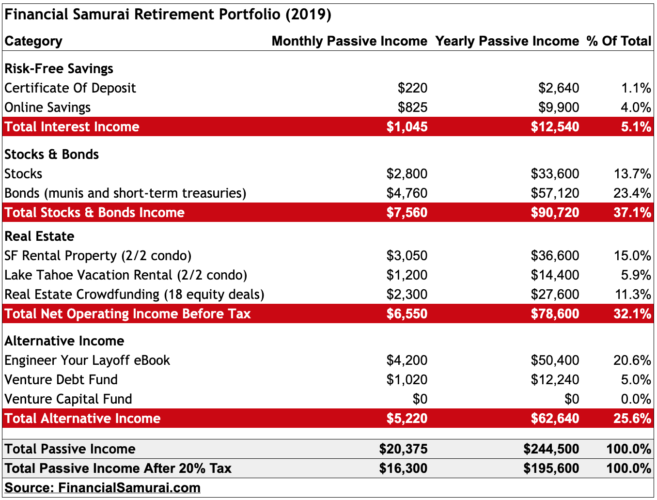

Here is my latest retirement income portfolio. We currently live off about $150,000 a year after-tax and save the rest.

What are some things keeping you busy post FIRE?

In 2016, I decided to fulfill my dream of being a teacher by coaching high school tennis for four months a year for three hours a day. The experience has been wonderful as it has given me insight in how to interact and mentor teenage boys well before my own son becomes one in 2031.

Over the three years, our school was able to win our league championship twice. We had never before won a championship before.

My wife and I also became first time parents in 2017 and are using their FIRE lifestyles to commit to being full-time parents until their little one goes to preschool at age 3 or to kindergarten at age 5. Our boy is amazing, but he keeps us so busy! We are exhausted every single day.

Finally, I continue to write 2-3X a week on Financial Samurai. Instead of just writing about FIRE, I like to write about various topics, including: real estate crowdfunding, career advice, wealth management, investing, family finances, education, relationships, travel and more.

What are some other FIRE blogs and podcasts you read and listen to?

I like reading blogs that write about a variety of experiences. Retire by 40 is one of my favorites along with ESI Money. I enjoy listening to the ChooseFI podcast as well.

What are some criticisms you or the FIRE movement have faced?

There are plenty of criticisms I’ve faced since I started writing about FIRE in 2009. As my site has grown and the FIRE message has become more widely covered, the criticism only seems to increase.

Here are some of the main criticisms:

- FIRE bloggers are simply trading their time making money from a day job to making money for themselves through blogging, podcasting, writing books, and selling e-courses

- The majority of FIRE bloggers and FIRE adherents have only invested during a bull market since 2009 and do not know what it’s like to experience a downturn. See: DIRE: Delay, Inherit, Retire, Expire

- FIRE bloggers are predominantly white males and females who lack diversity and representation of Americans today.

- FIRE bloggers and adherents are predominantly based in the Midwest and South, despite half the population of America living on the coasts.

- Many FIRE followers are not really FIRE because their investment income does not cover their best lifestyle expenses.

- Many FIRE bloggers are young and don’t have kids. Therefore, they haven’t fully calculated how much their lives will truly cost.

Many of the criticisms have merit. However, The entire goal of FIRE is to live your life on your own terms because of the financial cushion your investments provide.

I’m often my own biggest critic. With ~$250,000 a year in retirement income, I should be able to claim my family is financially independent. However, I’m still hustling to try and get to $300,000 a year in retirement income to live a middle class lifestyle in a high cost of living area like SF or Honolulu.

What are the different types of FIRE lifestyles?

There are three main types of FIRE lifestyles to consider:

- Fat FIRE lifestyle. The Fat FIRE lifestyle allows FIRE adherents to live in the most expensive parts of the country or the world and really life it up in early retirement.

- Lean FIRE lifestyle. The Lean FIRE lifestyle is where some people choose to live extremely frugally to live a life of freedom. There’s absolutely nothing wrong with this lifestyle, so long as the person isn’t constantly stressed about money.

- Barista FIRE lifestyle, which is a hybrid of Fat FIRE and Lean FIRE. The Barista FIRE person choose to supplement his or her retirement income with part-time work out of necessity. But the part-time work is enjoyable.

Baristas at Starbucks famously get healthcare, which is a big cost for many FIRE strivers. Without healthcare subsidies, the average family would have to pay over $20,000 a year in healthcare premiums.

Check out my article, How To Get Healthcare Subsidies For Early Retirement, to get your healthcare costs down to a reasonable level once you leave work.

Many FIRE followers end up living the Barista FIRE lifestyle whether they need a part-time gig or not because they always want to be doing something interesting. Often times, these interesting things lead to revenue.

What are some core tenets to achieving FIRE?

I tell anybody who is willing to listen, if the amount of money you’re saving each month doesn’t hurt, you’re not saving enough.

Aggressive saving is the core tenet to achieving FIRE. Here are some more good tips.

- Spend no more than 10% of your gross household income on housing costs

- Follow the 1/10th rule for car buying

- Always max out your pre-tax retirement accounts such as your 401(k), 403(b), and IRA

- Diversify your tax-advantageous retirement accounts by contributing to a Roth IRA

- Invest in low cost index funds and ETFs

- Get neutral inflation by owning your primary residence

- Generate more than one income stream beyond your day job

- Focus on generating enough passive income to cover your best life’s living expenses

Once you’ve got your aggressive savings habits down, it’s time to build an after-tax investment portfolio large enough that generates passive income to cover your best life’s living expenses.

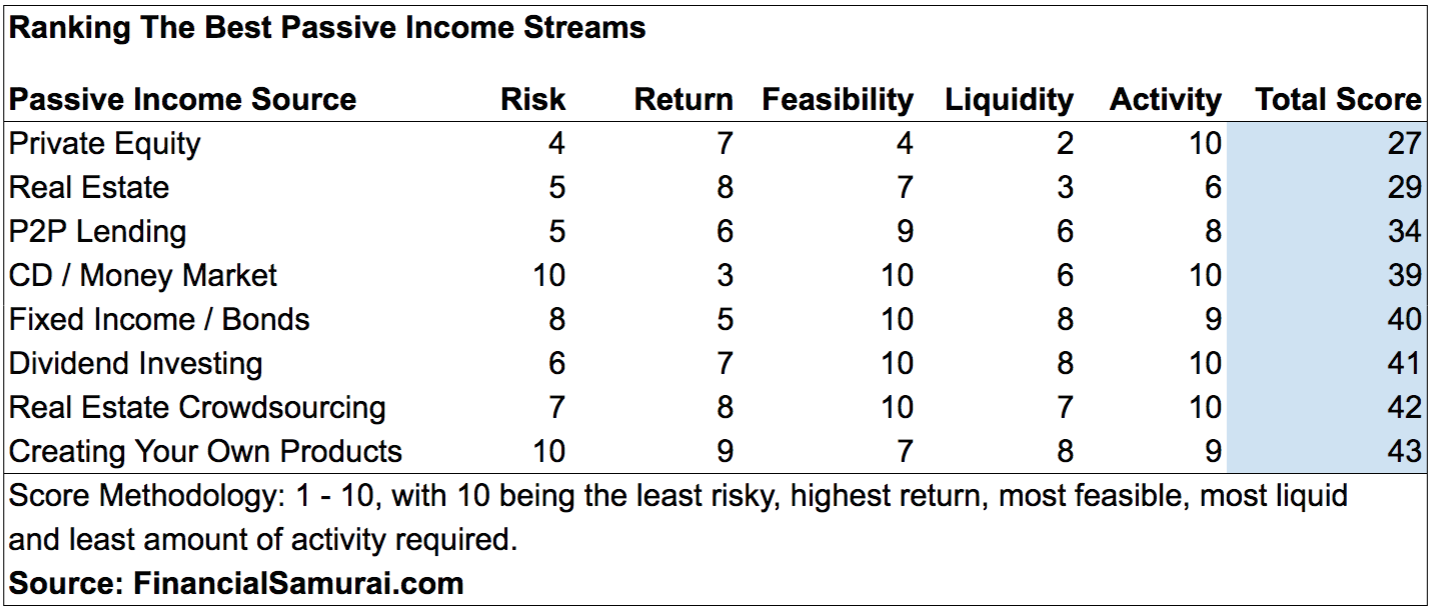

Here is a must read post called, Ranking The Best Passive Income Investments, to help FIRE followers strategically develop their FIRE portfolio. I use a five factor model to rank the eight best passive income investments.

I wish everybody well on their FIRE journey. There’s only one life to live. Better make it a good one!

Financial Samurai’s FIRE Journey

I want to thank Sam for taking the time to answer my questions. It’s been great following along on Sam’s FIRE journey because he’s so transparent and entertaining. He’s able to write about a variety of topics based on firsthand experience, while also weaving in important financial lessons as well.

Thanks for helping create a movement and inspiring others to achieve financial freedom sooner as well!

– Sydney