The word accounting has a dull and even scary ring to it for a lot of people. It’s just one of those subject matters that doesn’t come naturally to a lot of us, myself included. But understanding the basics of accounting comes in very handy when you’re running a business. One of the essentials is learning how to keep proper, balanced records. By the end of this post you’ll learn how to do bookkeeping for your business in 8 simple steps.

The word accounting has a dull and even scary ring to it for a lot of people. It’s just one of those subject matters that doesn’t come naturally to a lot of us, myself included. But understanding the basics of accounting comes in very handy when you’re running a business. One of the essentials is learning how to keep proper, balanced records. By the end of this post you’ll learn how to do bookkeeping for your business in 8 simple steps.

I was quite overwhelmed with figuring out how to handle all the bookkeeping for my business in the beginning. I thought about paying my accountant to do it, but his going rate was $200/month which was out of the question. So I had to learn how to do it myself.

Fortunately it’s really not that complicated! Below are 8 basic and simple steps that explain how to do bookkeeping for your business. Even though this may be all new to you, there’s no need to feel stressed. You’ll be up and running in no time.

1. Pick A System

There’s more than one system you can use to do the bookkeeping for your business. Some people just use Excel, but I like Quickbooks Online, also commonly referred to as QBO. It’s the #1 cloud accounting solution for small business.

I’ve used QBO for many years and love it. My accountant recommended it and I had positive prior experiences with it when I worked for a family run business. Quickbooks Online is fast, easy to navigate, conveniently in the cloud, and has superb customer service.

Other benefits of using QBO are their streamlined payroll and employee tax filing features and services. Setup is easy, professional accountants recommend it, and since it’s cloud based you don’t have to worry about losing your data, installing or upgrading any software.

I also like QBO because it lets you add multiple users, so my accountant can access and view my account at any time. That has come in really handy when I have a question or when he’s preparing my tax returns. You can also create and manage invoices, bills, print checks, import data from Excel or Quickbooks Desktop, run reports, and track inventory.

2. Setup Online Banking Feeds

One of the most awesome things about Quickbooks Online is its online banking features. It lets you connect your checking, savings, and even credit card accounts directly to your QBO account. What that means is your QBO account will update all your activity automatically every day, pulling in the latest credits and debits straight from your bank accounts. It’s safe, secure, and totally beats trying to do all of that in Excel.

Quickbooks also learns which income/expense accounts are associated with your vendors, which saves you time. I’ve noticed that it doesn’t get them right 100% of time (ex. you may use multiple accounts for the same vendor) but most of the time it will.

3. Decide On A Frequency

I recommend setting a goal for how often you want to do the bookkeeping for your business. The more regularly you do it, the faster and easier it will be. I have a goal to do mine quarterly at a minimum. I prefer to do it monthly or biweekly if my schedule permits.

The more frequently you do it, the fresher things will be in your mind which makes the whole process go faster. Doing your bookkeeping regularly will also help you monitor your businesses’s growth and keep your expenses from spiraling out of control.

4. Maintain Detailed Accounts

Take time to create detailed accounts in your bookkeeping system for Income, Expense, Assets, Liability, and Equity. The more organized you are, the easier and more useful your data becomes. In Quickbooks Online its super easy to create accounts and takes just a few mouse clicks.

I like QBO because you can also easily create subaccounts. So for example, let’s say you can have an Automobile expense account. You can create separate subaccounts tied to the Automobile account for parking, tolls, and gas. When you’re reviewing or entering transactions, you simply select the account or subaccount you want each entry to be reflected in.

Then you can run reports that show you the totals in each account for a specific date range. Using detailed accounts comes in really handy when you’re trying to budget, monitor spending, and track earnings.

If you’re just not sure where to start, don’t worry. Quickbooks Online has many preloaded accounts that you can choose from and use for commonly used accounts such as Advertising, Supplies, and Rent or Lease.

5. Reimbursements

As an entrepreneur or small business employee, chances are you will find yourself paying for some expenses upfront with your own personal cash or credit cards from time to time. You will then need to be reimbursed by your company for those expenses. This is important not just because you want to get your money back, but also because your business will then be able to capture the tax benefits of deducting those expenses if applicable.

So in order to get reimbursed properly, you and your fellow employees will need to keep all of your receipts and submit them with an expense report on a weekly or month basis. These documents will need to be kept for corporate records and will be used to get you reimbursed and get the bookkeeping entries properly booked. An expense report can be as simple as a spreadsheet with your name, date and the following items for each purchase.

- Date of purchase

- Vendor Name

- Purpose

- Account Name or Number (ex. Meals)

- Total Paid

- Original receipt

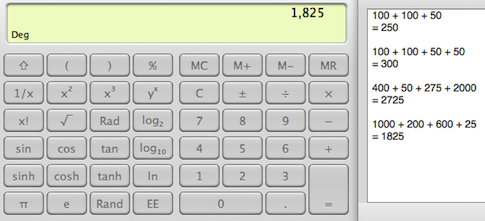

The company will then cut you a check for the total approved expenses you incurred. Next in your bookkeeping system, you will take the total amount reimbursed and separate that into the proper accounts. For ex. if the company cut a check to employee A for $250 which was comprised of $100 Meals + $100 Travel + $50 Parking, you would “split” the $250 entry into 3 accounts.

Try to process reimbursements at least once a monthly basis if possible. This will keep your employees happy getting their money back in a timely manner and will also help you stay on top of your businesses books.

6. Reconcile

Reconciliation is an important part of bookkeeping. Get copies of all of your bank statements. Compare the beginning and ending balances on the statements as well as all the individual entries to what appears in your bookkeeping system. If they don’t match, you may have double booked some entries, or left some out accidentally. QBO has easy to use reconcile features built in.

If you have stayed on top of your entries, reconciliation should be fast and easy. You will also want to double check that the accounts are correct for every entry, and that you have processed and recorded all reimbursements correctly.

7. Retain

After you’ve reconciled all of your entries for a set period, it’s time to retain the backup. Quickbooks Online backups your account data automatically, but you will also want to keep copies of your bank and credit card statements, cash receipts, expense reports, payroll forms, tax filings, invoices, and bills.

I keep both digital and hard copies of cash receipts and tax filings, and typically just digital copies of my statements, invoices, and bills. You’ll need to figure out what to retain for your business and for how long. The safest bet is to keep your records and files for 7 years but your attorney and accountant can advise you best.

8. Analyze

After you’ve gotten steps 1-7 done, it’s time to analyze your business’s data. Quickbooks Online has a great variety of charts, graphs, and reports that you can run with just a few mouse clicks.

Start by taking a look at your expenses and figure out if you need to modify your budgets and projections. Any avid entrepreneur should always know how their business is performing and actively monitor the inflows and outflows across all accounts.

Untemplaters, what do you think when you hear the word “accounting”? Do you have any tips on how to do bookkeeping? How often do you have to submit expense reports at work?

Nice tips! I get overwhelmed sometimes with all the options available on Quickbooks, thanks for this “high level” overview.

Accounts are always the scary part of having your own business if you are not sure what you are . There are plenty of resources online that can help, but I think taking a basic bookkeeping course is a good choice for any small business owner.

Accounting can be pretty intimidating indeed but it is necessary to learn how to use it and do it properly. Thanks for this!

I use Excel for any necessary accounting, budgeting, and expense reports. I also use Excel for various engineering tasks. I guess I use what I am familiar with.