When Adaptu’s co-founder Mark Brundage left in May 2012 to become Salesforce.com’s “Director Of Customer Success,” perhaps this was the first clue that Adaptu was losing steam. It’s hard to pass up a job at San Francisco-based Salesforce.com given its record revenues and multiple six figure salary packages. Adaptu is owned by StanCorp, a $1.7 billion market cap publicly listed company trading under the ticker SFG.

When Adaptu’s co-founder Mark Brundage left in May 2012 to become Salesforce.com’s “Director Of Customer Success,” perhaps this was the first clue that Adaptu was losing steam. It’s hard to pass up a job at San Francisco-based Salesforce.com given its record revenues and multiple six figure salary packages. Adaptu is owned by StanCorp, a $1.7 billion market cap publicly listed company trading under the ticker SFG.

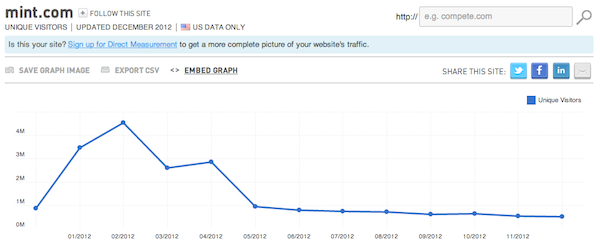

If one looks deeper into the financial account-aggregation space, there seems to be a general negative trend. According to ComScore, Adaptu received roughly 2,000 unique visitors the previous month compared to over 60,000 unique visitors this time last year. Meanwhile, Mint.com received 500,000 unique visitors down from 4.5 million in February, 2012. That’s a massive 90% decline.

As an entrepreneur, it makes me sad to see Adaptu shut down. After February 20, 2013 all user data will be deleted and users will no longer to access their accounts. I remember working with them when they first launched to help spread the word about their product. They sponsored a friend’s across the country RV tour and was also present at the Financial Blogger’s Conference. Overally, Adaptu has been a greater partner in the personal finance community.

On Adaptu’s homepage, they cited the key reason for shutting down was NOT wanting to transition away from a free model. In a world where so much is free, if one can’t get subscribers and traffic, it’s hard to survive indefinitely. Professional bloggers give away our content for free almost always. Look how many of us survive in the long run.

As many readers on Untemplater are entrepreneurs, I’d like to reflect on running a business.

LESSONS OF ENTREPRENEURSHIP

* It’s hard to make money with free. Nobody seems to pay for anything anymore. Once the first company starts offering their products and services for free, every competitor subsequently needs to follow suit. The problem with free is that there is no revenue. You’ve got to rely on massive volume to upsell a tiny percentage for paid services. If you don’t have a large customer base, there is no money to be had.

* Watch what the leaders do. Vice Presidents and C-level executives know more than you do about the state of your company. If you are an employee at a startup, it’s more important to watch what they do rather than listen to what they say. Did an exec sell her house recently? Are there more and more behind glass door meetings? Have any of your bosses or bosses in other departments jumped ship recently? Pay attention to those who have more to gain and lose than you.

* First to market is key. Mint.com dominated the financial aggregation space. At its height, the visitor traffic was 75X the peak traffic of Adaptu. Once you’ve got all your financial information uploaded to one service, it is extremely difficult to convince a user to move. The only way an upstart can win is if they provide even better tools. The problem is, there is a winner takes all affect in many cases.

* Sell your business when you can. On September 19, 2009, Intuit acquired Mint.com for $170 million. Not bad for being in business for only two years! Founder Aaron Patz was only 28 years old at the time. Perhaps Aaron could have received more if he sold a couple years after the financial recovery. But, at the end of the day, $170 million is $170 million. Sometimes you just have to take the money and run. You never know when your business might shut down.

* The market place is incredibly crowded in everything we do. There are supposedly over 500 million blogs online today. Good luck standing out, gaining traffic, and making a living online through advertisement. Take a look at the financial services industry. How many banks do we really need? Not that many, which is why banks are laying workers off by the hundreds of thousands. The same goes with the print media business. Whatever entrepreneurial endeavor we get ourselves into, we need to know the odds are strongly against us.

* Perhaps people don’t really care about their finances. Finance is boring compared to traveling the world and living a nomadic lifestyle. This is why businesses on selling you the dream of living the 4-hour work week succeed so much. Whether you succeed or fail, it doesn’t matter. Society wants instant gratification compared to years of saving in order to build a financial nut large enough to live financially free. We know we should keep track of our finances, just like we know we shouldn’t eat too much bacon, but we can’t help ourselves.

ADAPTU ALTERNATIVES

If you are one of the thousands of Adaptu clients being affected, you can take a look at Mint, LearnVest, HelloWallet, or Personal Capital. Personal Capital is a Silicon Valley start-up that launched in September, 2011 by former Intuit and PayPal CEO Bill Harris. His team’s goal is to give everyday people more control over their finances by using their technology for free while modernizing personal wealth management advice over the Internet.

Personal Capital is also a free online financial aggregator to help users growth their wealth. The company tracks your net worth, your expenses, and analyzes your investment portfolios for excessive fees and risk. The way they plan to make money is by getting a percentage of their users to sign up for financial advice based on the following fee structure below. It’s totally optional whether you choose to receive financial advice.

- First $250,000 in assets, 0.95%

- Next $250,000, 0.90%

- Next $500,000, 0.85%

- Next $4,000,000, 0.80%

- Above $5,000,000, 0.75%

Given the declining traffic figures of the financial aggregator space, I hope Personal Capital sticks around for the long term. They are based right here in the Bay Area, and I’ve been a happy user of theirs for the past several months. The biggest benefit is their free 401(k) Fee Analyzer which discovered $1,700 a year in fees I had no idea I was paying! With $28 million in VC funding and a business model that is scalable, I think they’ve got a good chance. You can sign up here. It only takes a minute.

Regards,

Sam

Copyright. Original content authorized only to appear on Untemplater.com. Thank you for reading!

When watching the show Shark Tank I always debate in my head if I would sell my business or not. On one hand I take into consideration how much time I would have sunk into the business building and developing every inch. I most definitely want to do what makes me happy, but the hard truth is the majority of all businesses fail. It can be due to management, over leveraging, or simple technological advancements that make you obsolete. So with that said I would rather sell my company for a large sum then stay on with the company as an employee if that’s what made me happy.

It’s a real bummer to see them go! I remember when they started coming around and also helped to try to spread the word a bit. I think one of the biggest hurdles to overcome is really trying to make money with free. Also it’s not that people don’t care about their finances I believe it’s the amount of options. I just did a quick search in the iOS App store and there are 100’s of trackers, budgets and calculators. Even though Mint may be a front runner the sheer quantity of options will always be another hurdle for attracting market share.

I don’t use account aggregators as a rule because my student loan company is a PITA about 3rd-party logins. But while I was doing some research on Mint for a guest post, I found this comment on the business model

However, one thing that is always a concern is that so many of these Web 2.0 business models basically boil down to giving away for free what consumers have previously been willing to pay for. It sounds like a great idea to get new users, but in the end, if you kill Quicken and MS Money, those are two less major advertisers that will no longer buy ads on Web 2.0 properties. You can only do that so long, and kill so many advertisers by giving their services away for free, before all of the Web 2.0 companies collapse under the weight of killing their own business model (advertising).

The Mint stat is curious…on the surface, they appear to be the undisputed leader in this space, probably the best-equipped, and certainly one of the few providing this kind of service. Is it just that less people are reaching out for these services over the last 12 months? Sign of economic recovery, perhaps?

It is indeed the most curious stat I’ve found about the Adaptu closing. Perhaps there was a surge in sign-ups and enthusiasm in the beginning, and once everything was all set, people lost interest. Everything is tracked for us, and I use Personal Capital mainly as a way to track my net worth and rebalance any holding if things get too out of whack.

The other thing to note is that ComScore is notoriously wrong. But, there is no denying the traffic trend.

Great insights, Sam. It’s interesting to hear how much Mint’s traffic has gone down, and I think your last point about personal finance is a big factor in that, sadly. Household debt is climbing again too. Boooo.

And for the record, there’s nothing wrong with eating too much bacon.

Bacon, bacon, bacon! I had 6 strips in the past three days… so addicting.

The good thing about an increase in household debt, and an increase in spending is that savvy investors can figure out a way to invest in the trend to make money. Gotta always look on the positive side of things!

I remember when Adaptu was ramping up huge. It’s shocking to see how drastically traffic and interest can decline. I also agree with your points about how we’ve all come to expect so many things to be free. I think businesses who offer both a free tier and a paid tier from the beginning do much better over time. Every business channel is saturated and it really takes more than one great business idea and ways to keep users coming back for more to stay in the game.

Free is an interesting phenomenon in blogging. It’s interesting when some of my readers will demand more info, more analysis, more answers. Yet when I ask them to share their info, their analysis, their answers, it’s usually silence. Not sure how much readers know how hard it is to consistently write content without expectation of anything in return.

I never jumped on the initial Adaptu bandwagon, instead I preferred to take a wait-and-see approach. I know it launched with pretty good buzz, and they actually did a fantastic job of working with the personal finance community to build a good amount of buzz. It’s too bad that it couldn’t translate to a successful model, but good ideas and strong effort aren’t always enough. I think they have a lot of good people that will hopefully find success elsewhere.