Those of us who purchase various forms of insurance—including business, automobile, medical, homeowners, renters, disability and life insurance—pay out thousands of dollars to our insurers every single year and rarely get to see what happens when major hiccups occur.

Those of us who purchase various forms of insurance—including business, automobile, medical, homeowners, renters, disability and life insurance—pay out thousands of dollars to our insurers every single year and rarely get to see what happens when major hiccups occur.

These unexpected accidents and emergencies are, of course, what we purchase the insurance for as an “in case of” precaution, however, not everyone fully realizes what happens when disaster strikes and we’re forced to really deal with these insurance companies.

The most important thing to keep in mind is to always deal with a reputable insurance provider. Do your due diligence and ask around for referrals. Check out various insurance company homepages and browse around to see what their services and plans are like.

Don’t Screw Up Your Application

All insurance companies are ready and willing to take your premiums, but they tend to be sticklers about paying out claims, and actively seek out ways to delay, or not pay them entirely. This is where your end of things becomes really important; the application you filed to obtain the policy, for example, must be as clean and truthful as possible—they’ll find out, if not! Why wouldn’t they? If your application proves to be invalid, the insurance company isn’t legally required to deliver a payout.

It’s important to understand that all insurance companies need to be able to generate profits through investments, much like banks, so if they’re paying out millions in claims, they have less to invest; if a large number of claims comes through during a critical investment period, their profits from investments suffer, because they don’t have the investment capital.

Due to this, an insurance company could simply drag out, or delay, fulfilling claims and save around 8%+ for the year in doing so; they’ve allowed themselves more time and money for investments, and further profits, before fulfilling claims. The 8% rises to 30% to 40% if the company engages in various forms of lowballing, or 20% to 30% saved by both confusing their policy holders into thinking they’re in the wrong, or by issuing wrongful claim denials.

With most policyholders largely uneducated in the legal matters, and fine print, of insurance companies, many just take the hit. After all, the company completely engineered the policy from conception—they wrote it, they explain it, they evaluate the claims, and they have all the money—so they are the power player here. So, what can you do to stay ahead of the game and educate yourself as a policy holder?

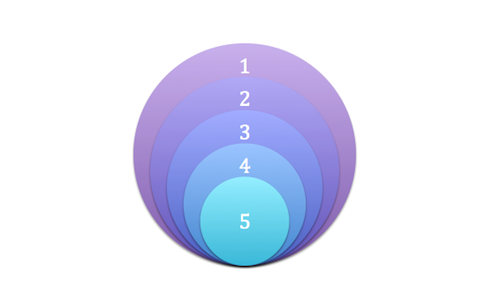

5 Surprising Things Insurance Companies Don’t Advertise To Policyholders

Below are 5 tips to help you play the insurance game as a savvy, educated, policy holder:

1. Through the interpretation of a policy and the investigation of a claim, an insurance company MUST convey their business and service in honest good faith (“Good Faith & Fair Dealing” Law).

• It is unlawful for an insurer to put their own financial interests ahead of a policyholder; this means that it is against the law for an insurance company to underpay or delay claims;

• It is against the law for an insurance company to in any way deceive or employ any kind of manipulation, or trickery tactic, when it comes to the handling of claims;

• All of the above mentioned are violations of the good faith to which they are held accountable by the law, and are prosecutable offenses.

2. If an insurance company breaches the “Good Faith and Fair Dealing” law, in any way, and the policyholder is forced to sue them in order to collect their benefits, the company is also fully responsible for all legal fees absorbed by the policyholder.

• In some cases, an insurance company that knows they acted unlawfully will attempt to under-settle, offering payment of the claim plus a certain amount extra, stating that the policyholder is receiving more from the settlement, but really, all they’re paying is what the policyholder is already owed, plus some of the legal fees that they would be responsible for, for acting unlawfully.

3. If it is discovered that your insurance agent solid you a cheaper policy that doesn’t provide enough coverage to actually cover the loss, the insurance company may have to pay for more than just what the policy benefits payout—they’ll have to pay for the entire loss, due to unlawful misrepresentation.

• In order to beat out competition, make their commission, and sell a policy, an insurance agent will sometimes underinsure whatever is being covered. For example, they’ll insure a piece of property that will cost $900,000 to replace for only $700,000, resulting in a lower premium that beats out every other insurer in town who truthfully offered premiums that would actually cover the full $900,000.

• These misrepresentations are usually discovered when a claim is filed and the “replacement guarantee” issued with the policy is rendered moot by the policyholder not wishing to rebuild the exact property, but invest the money elsewhere.

• If it comes to light that the policyholder was underinsured by the insurance agent, the policyholder is entitled to be paid for the full loss.

4. If there is any ambiguity in the fine print verbiage of your policy, all interpretations favor the policyholder.

• As mentioned previously, insurance company don’t want to pay out and they’ll make their policies an oxymoron-filled mess to do it. Some policies, when actually read, contradict what they’re covering almost completely, offering a million clauses and cases where they won’t fulfill a claim.

• If this verbiage is a loophole writer’s dream, you may have a case; in most cases it’s simple to prove that this verbiage is ambiguous and the result is a full benefit payout.

5. For all claim denials, the burden to prove the merit of the denial rests solely upon the shoulders of the insurance company, not the policyholder.

• All insurance policies have an “insuring clause” which goes into very minimal detail about what the policy is actually covering. The rest of the policy is a very long list of exceptions, exclusions, and limitations—lots of them! When you file a claim with the insurance company down the line, they want to be able to circle one of these and tell you that they can’t fulfill the claim—usually through a simple letter. Most of all, though, they want you to just accept that as fact and walk away.

• Most policyholder don’t realize that you don’t have to accept that as fact and you get more than just a letter denying the claim; they have to prove the validity of the exclusion, exception, and/or limitation as something that is clear, conspicuous, and applicable. They need to do this with their own time and educated financial experts who will sit down with an expert of your own choosing.

RECOMMENDATIONS

Looking for affordable term life insurance? Check out PolicyGenius, an independent insurance broker that is revolutionizing the way we shop for life insurance – for free! You need life insurance if you have dependents or debt. Chances are high that if you currently do have life insurance, it’s not the best policy for you. PolicyGenius provides unbiased advice on more than 25 A-rated top life insurance companies they have thoroughly researched and vetted. Because life insurance prices are regulated, you don’t have to worry about not getting the best deals. PolicyGenius helps you compare the best quotes all in one place. I’ve met the CEO, Francois de Lame in person in NYC and strongly believe in his business

Need affordable health insurance fast? Take a look at the plans offered on Agile Health Insurance. They offer term coverage for as little as $1.50/day with premiums up to 50% less than Obamacare (ACA) plans. There are no lock-out periods so you can enroll any time of year, get immediate approval and get coverage in as little as 24 hours. Agile Health Insurance also offers broader doctor networks than most Obamacare plans and has customizable options for dental and discounts on prescriptions. Find a plan that works for you today.

Need the best auto insurance? Check out eSurance online. They have the best auto insurance rates on the web. Auto insurance is the #1 expense besides your car payment which you can control reducing.

Updated for 2017 and beyond.

Very good article.

I never realized that the interpretations favor the policy holder.

I’ve been with my house and auto insurance company (State Farm) for over 20 years. They handle my claims in a professional and speedy manner, so I have never shopped around.

Thanks Terry. State Farm is great and a lot of people stay with them and AAA for many years. Having fast and reliable help when you need it most is real peace of mind.